- On Monday, the USD/JPY experienced its most significant daily loss since mid-July.

- Hiroshige Seko suggested that the BOJ would continue with monetary easing.

- Investor focus has shifted to US inflation data for August.

The current USD/JPY price analysis suggests a mild bullish sentiment today. On Tuesday, the yen declined after experiencing its most significant daily gain since mid-July the previous day. This movement came in response to statements from Japan’s top central banker. Notably, Ueda pointed to the potential end of the country’s negative interest rate policy.

-Are you looking for automated trading? Check our detailed guide-

In contrast, the dollar recovered after its most substantial daily decline since July 13. Bank of Japan (BOJ) Governor Kazuo Ueda suggested that the BOJ could gather sufficient data by year-end to assess the possibility of ending negative interest rates. Consequently, the yen registered its largest daily gain against the dollar since July 12.

Adam Cole from RBC Capital Markets said, “Ueda’s comments were more balanced than the market reaction implied.” Moreover, Cole noted that Japan is still far from achieving sustainable 2% inflation. Therefore, Ueda’s remarks don’t alter the situation significantly.

The yen has been under significant pressure against the dollar due to widening interest rate disparities. The Federal Reserve has implemented an assertive rate-hike policy. On the other hand, the BOJ remains dovish.

However, Hiroshige Seko, a senior official from Japan’s ruling party, interpreted Ueda’s comments differently. He suggested that the central bank would continue with monetary easing.

Investor focus now shifts to US inflation data for August. This report could provide insights into the Federal Reserve’s future rate adjustments.

USD/JPY key events today

It will be a slow day for USD/JPY as no major economic releases are coming from the US or Japan. All eyes will be on the US inflation report coming out tomorrow.

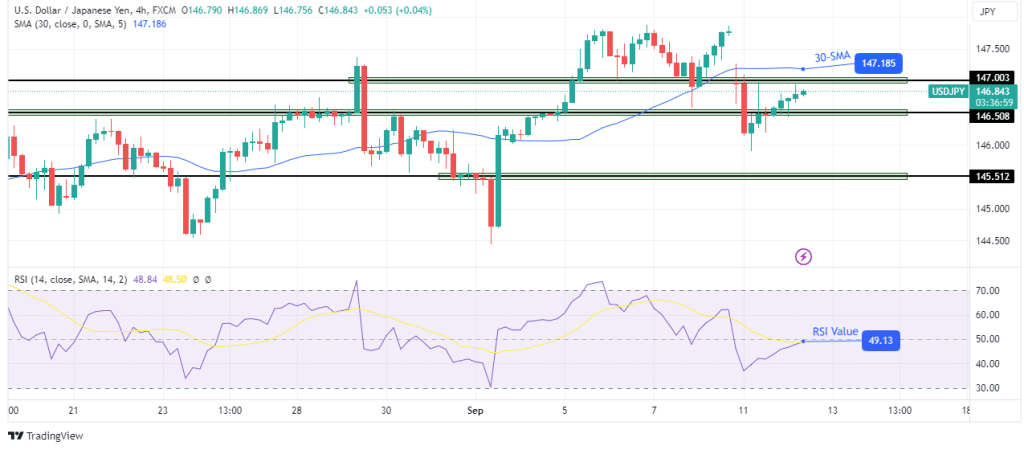

USD/JPY technical price analysis: Bulls retrace recent swing, but bearish bias holds.

Meanwhile, the 4-hour chart shows a rebound in progress. However, the bias is bearish because the rebound is a retracement of the recent bearish swing. Moreover, it takes place below the 30-SMA. Additionally, the RSI trades in bearish territory below 50, supporting bears.

-If you are interested in forex day trading then have a read of our guide to getting started-

Therefore, bears might be waiting to resume the downward move at the nearest resistance level. The nearest resistance is at the 147.00 level. After that is the 30-SMA. A bounce lower from these levels would likely see the price return below 146.50.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/usd-jpy-price-analysis-yen-stalls-after-strong-daily-gain/