- There are signs that the Fed might postpone any plans for interest rate cuts.

- Japan’s exports grew for a second consecutive month in October.

- Traders have reduced the probability of an initial Fed rate cut by March.

Thursday’s USD/JPY outlook leans towards the bullish side as the dollar firms on signs that the Federal Reserve might postpone any plans for interest rate cuts. Meanwhile, the yen was weaker after data revealed a slowdown in Japan’s economy.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

Japan’s exports grew for a second consecutive month in October. However, the growth was considerably slower, mainly due to reduced shipments of chips and steel to China. Ministry of Finance data revealed a 1.6% increase in exports from a year earlier. Although it surpassed the 1.2% forecasted by economists, it lagged behind the 4.3% rise in September.

Notably, the trade-dependent economy faces challenges from weak exports and sluggish domestic demand. Consequently, it complicates efforts to stimulate growth in the post-pandemic recovery.

Moreover, some economists caution that Japan, lacking growth momentum, could enter a technical recession, defined as two consecutive quarters of contraction.

Meanwhile, the dollar found support after retail sales exceeded expectations and producer prices fell. The data contributed to the narrative of an economic ‘soft landing.’ Furthermore, this scenario would provide the Fed additional time before implementing rate cuts.

Traders continue to be confident that interest rates will not increase. However, they have reduced the probability of an initial rate cut by March to less than 1 in 4.

USD/JPY key events today

Investors are preparing to receive reports from the US that will show the state of the economy, including

- The initial jobless claims report

- The Philadelphia Fed Manufacturing Index

USD/JPY technical outlook: Bulls eye upside potential beyond the 30-SMA

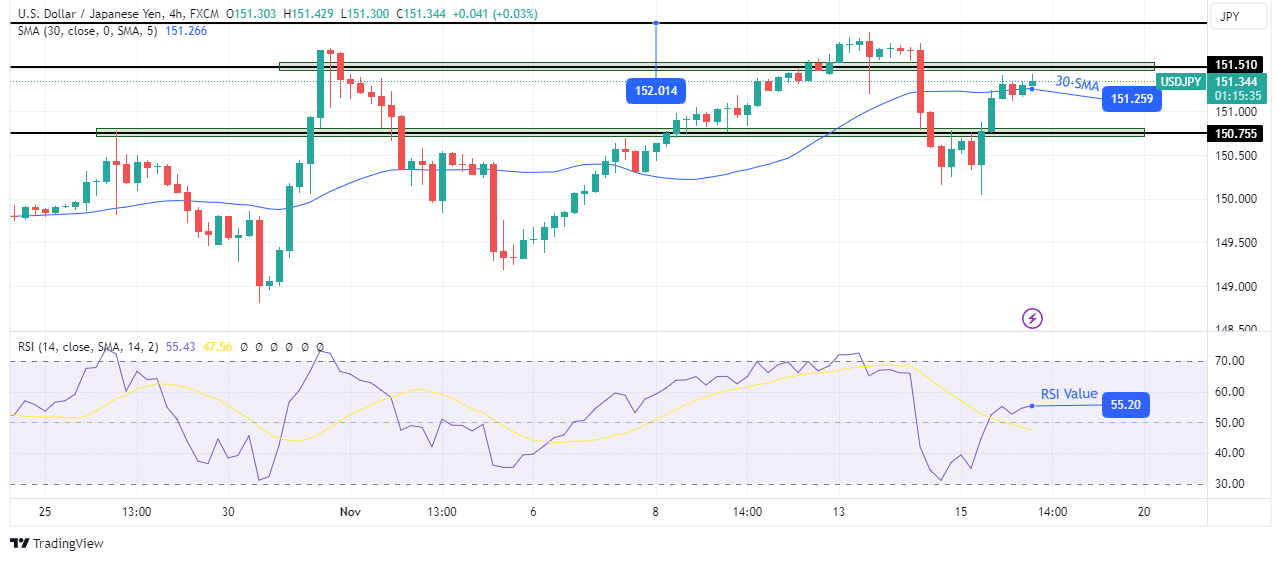

On the charts, the USD/JPY price is attempting to push above the 30-SMA as bulls struggle for control. However, they face an uphill task with resistance at the SMA and slightly above at the 151.51 key level. Still, the RSI has crossed above 50, showing bulls are gaining momentum.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

The next step for bulls will be to detach from the SMA and break above the 151.51 resistance. This would then allow the price to seek new highs. However, if bulls fail to breach the 151.51 level, the price will likely collapse to retest the 150.75 support and lower.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/usd-jpy-outlook-markets-anticipate-delay-in-fed-rate-cuts/