- Remarks from Fed officials dampened expectations of a peak in US rates.

- The dollar hovered close to a one-year high against the yen on Friday.

- The dollar is heading for a weekly gain of approximately 1.3% against the yen.

The USD/JPY outlook turned bullish as the greenback gained strength from Fed hawks and rising bond yields. This surge followed remarks from Federal Reserve Chair Jerome Powell and several other Fed officials that dampened expectations of a peak in US rates.

-Are you looking for forex robots? Check our detailed guide-

Markedly, Powell and others expressed uncertainty about whether interest rates are sufficiently high to combat inflation. As a result, the dollar hovered close to a one-year high at 151.355 yen on Friday.

Moreover, the dollar’s surge after Powell’s remarks followed a momentary upward spike due to a poor auction of 30-year Treasury bonds. This auction resulted in higher yields across various Treasury maturities.

These statements from Fed officials came a week after the US central bank left interest rates unchanged, solidifying the belief that rates might have peaked. Consequently, the dollar and Treasury yields fell in the aftermath. However, the greenback recovered this week and was poised for a weekly gain of approximately 1.3% against the yen, marking its best performance since August.

Meanwhile, traders will keep an eye on the Japanese yen, especially as it maintains a position above the 150 level against the US dollar. It raises the possibility of intervention by Japanese authorities.

USD/JPY key events today

The pair will likely end the week quietly as there are no key events from the US or Japan today.

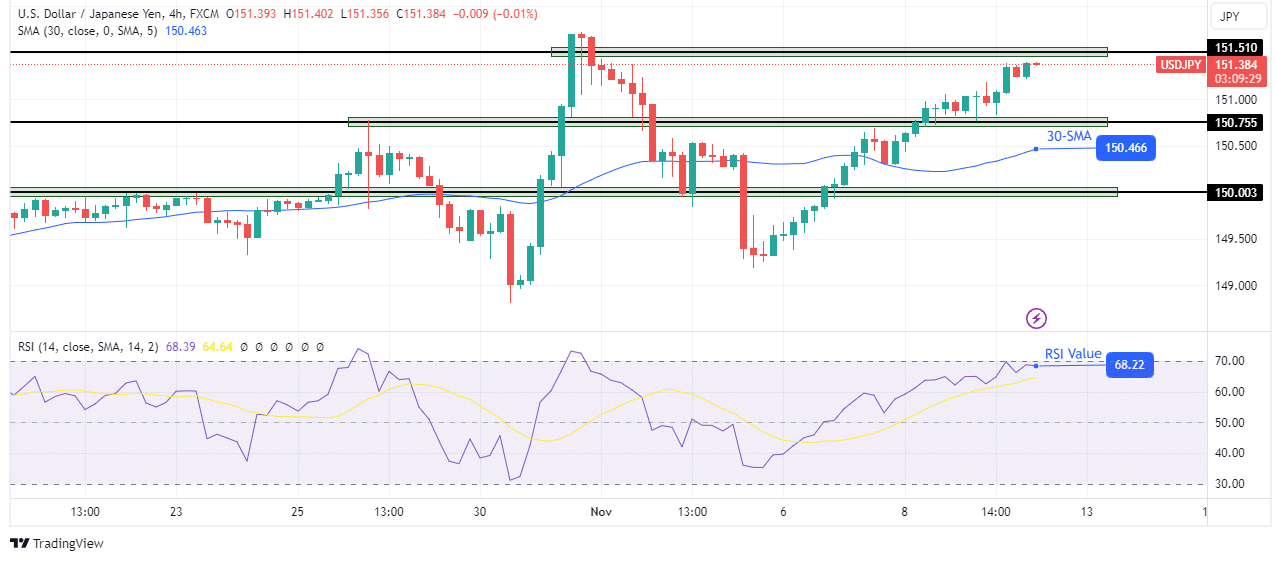

USD/JPY technical outlook: Bullish momentum approaches 151.51 resistance.

On the charts, the USD/JPY price has broken above the 150.75 resistance level. It is currently approaching the 151.51 resistance level, where it might pause. The surge has strengthened the bullish bias by pushing the price well above the 30-SMA.

-Are you looking for the best CFD broker? Check our detailed guide-

At the same time, the RSI currently trades near the overbought region, indicating solid bullish momentum. However, this might also mean that bulls need to rest before continuing higher. If the 151.51 resistance is firm, bears will likely trigger a retracement to retest the 150.75 key level. Afterwards, bulls might make a new high above 151.51.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/usd-jpy-outlook-bulls-gaining-amid-hawkish-fed/