- USD/JPY advances to fresh multi-month highs near 147.85

- US Michigan’s Consumer Sentiment came in lower than expected.

- The US DXY index reached its highest point since March 9 at 105.43 and then settled at 105.23.

- All eyes are now on the Fed’s decision next week.

Ahead of the weekend, the USD/JPY pair resumes its upward path, rising to 147.85 and on the point of recording a second consecutive week of gains. On the USD side, the Greenback trades soft and faces selling pressure after soft consumer sentiment figures from the US in September. However, the DXY index will close its eight-consecutive winning week, gaining more than 5% since July. On the other hand, the JPY has given up all gains seen by Ueda’s comments earlier this week, and the Bank of Japan’s (BoJ) dovish stance, leaves the Yen vulnerable.

Investors gear up for next week’s Fed decision

During the past week, key inflation data from the US from August measured by the Consumer Price Index (CPI) came in higher than expected. In addition, economic activity figures, including Retail Sales from the same month and Jobless Claims for the second week of September, also showed good news for the US economy.

Regarding expectations on the Federal Reserve (Fed), according to the CME FedWatch tool, the odds of one last hike slightly have declined but remain relatively high, at around 35%. That decline may be explained by the European Central Bank’s (ECB) dovish tone on Thursday after it decided to hike by 25 bps but Christine Lagarde refrained from committing to another hike. Nevertheless, the US economy looks like it is not cooling down, and Fed officials have all the reasons to hike one last time.

On the JPY front, as highlighted by the BoJ, local wage and inflation trends are key drivers in the decision-making process around monetary policy shifts. On Monday, Governor Ueda commented that the bank may gather enough data by years-end to consider a pivot, which lifted the Yen. That momentum slowly fade, however. For next week’s BoJ meeting, no changes in the ultra-loose policy are expected, but markets will monitor any changes in the economic forecast.

USD/JPY Levels to watch

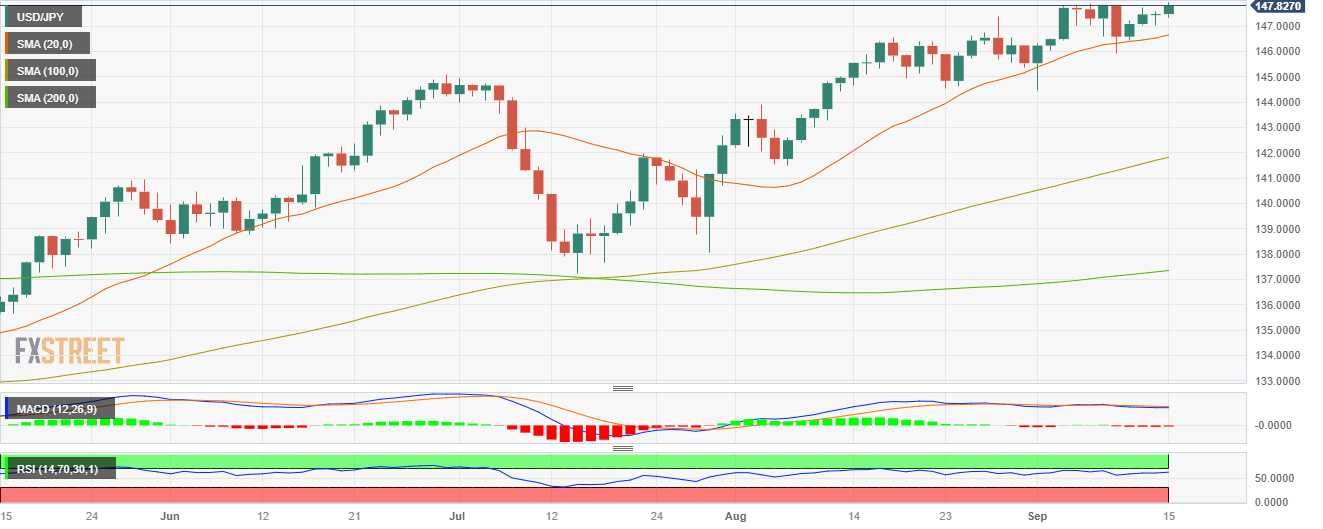

As per the daily chart analysis, the USD/JPY has a bullish technical bias for the short term.

The Relative Strength Index (RSI) also exhibits a northward slope above its midline, emphasising the presence of strong buying pressure, while the MACD, with its green bars, highlights the strengthening bullish momentum of the USD/JPY.

On the other hand, the pair is above the 20,100,200-day Simple Moving Average (SMA), indicating that the buyers are commanding the broader perspective.

Support levels: 147.00, 146.60 (20-day SMA), 146.00.

Resistance levels: 148.00, 149.00, 150.00.

USD/JPY Daily Chart

Source: https://www.fxstreet.com/news/usd-jpy-gains-ground-and-targets-15000-202309151713