- Markets are awaiting the BOJ policy meeting.

- The yen has fallen by 1.3% following Ueda’s remarks about an early move from negative rates.

- US Treasury yields have been rising due to the expectation of the Fed keeping rates high for longer.

Today’s USD/JPY forecast is flat as the yen stalled, with markets in Japan closed for a holiday. This Friday, the Bank of Japan’s policy meeting will be important after Governor Kazuo Ueda stoked speculation of a looming move away from the current ultra-loose policy.

-If you are interested in social trading apps, check our detailed guide-

That’s made the BOJ a standout in a week full of central bank meetings. The US Federal Reserve is seen implementing a hawkish pause on Wednesday, while the Bank of England could raise rates one last time on Thursday.

Notably, the yen has fallen by 1.3% following Ueda’s remarks about an early move from negative rates. Consequently, the yen has lost over 11% in 2023.

Meanwhile, Carol Kong from the Commonwealth Bank of Australia said she expects the yen to be volatile ahead of the policy meeting. Moreover, she believes investors may have misinterpreted Ueda’s remarks. Furthermore, she believes the recent weakness in Japanese wages and a possible softening of prices would push the BOJ farther from its inflation target. Therefore, the case for rate hikes in Japan is still not very strong.

Elsewhere, US Treasury yields have been rising, with the two-year above the 5% threshold and up 25 bps this month. This is due to rising government spending and the expectation of the Fed keeping rates high for longer. Moreover, last week’s US retail sales data raised these expectations and reduced the odds of recession even further.

USD/JPY key events today

With a holiday in Japan and no major releases from the US, the pair might have a quiet trading session.

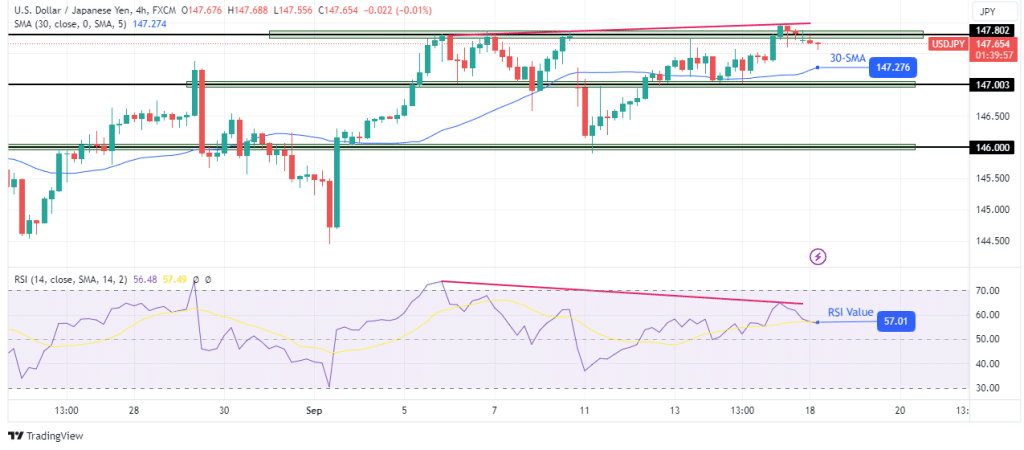

USD/JPY technical forecast: Price stalls at 147.80 resistance level.

On the charts, the USD/JPY pair has paused near the 147.80 key resistance level. Bulls have come up against this level before and failed to push above. This time, the price punctured the level but then pulled back below.

-If you are interested in brokers with Nasdaq, check our detailed guide-

Moreover, bulls have weakened at this level. This can be seen in the RSI, which has made a lower high, showing a bearish divergence. Therefore, the price will likely make a deep pullback or bearish reversal. However, there is still a chance that bulls will regain strength and break above 147.80.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/usd-jpy-forecast-yen-stalls-with-japanese-markets-on-holiday/