What is the fundamental goal of blockchain technology?

Until now, it has mainly been used to speculate on the price of crypto tokens and create decentralized finance protocols that allow other types of profit incentives, but is that really all crypto can do?

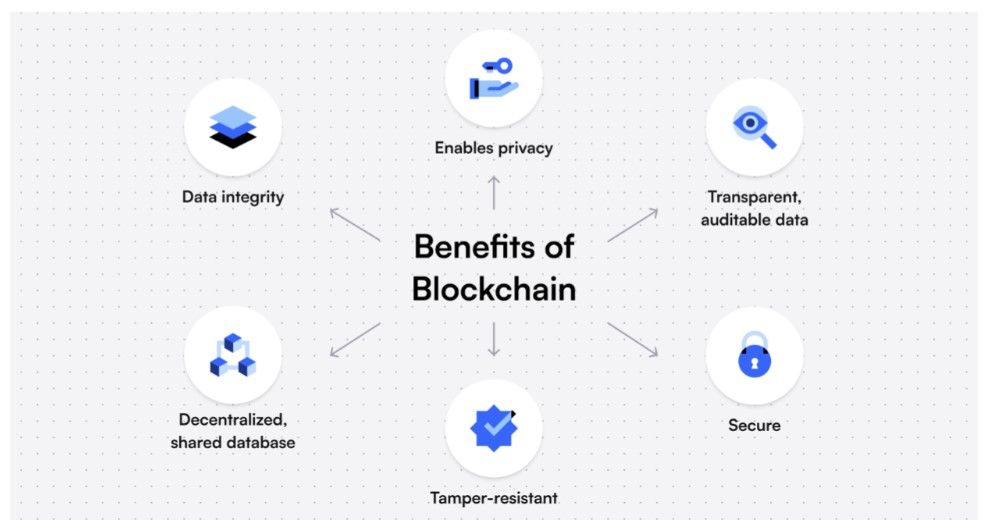

A better description of the blockchain is to create a global economy that is more transparent and efficient while also being accessible to everyone.

We’re not at that point yet, but by beginning to create more real-world use cases, we can begin unlocking the true potential blockchain has for everyone.

It’s these real-world use cases that will truly benefit the average person and speed overall adoption of blockchain technology.

To push blockchain technology into mainstream usage, we need to find effective ways to tokenize real-world assets (RWAs). This shift from physical to digital is an opportunity that could be life-changing for billions of people worldwide.

Why We Need Real-World Assets On-Chain

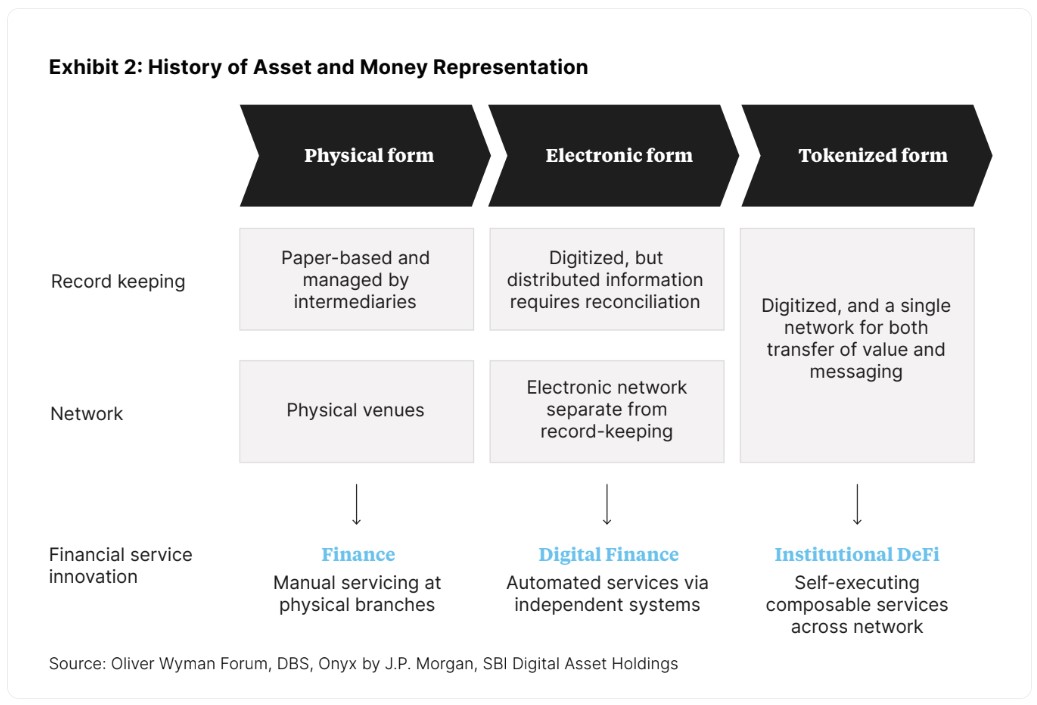

Money makes the world go round. Financial systems have a history dating back some 5,000 years to the Babylonian empire, where clay tablets were used to track debts and payments.

We’ve come a long way since then, with finance today being largely electronic. However, the current financial system is still bogged down with the need to reconcile ledgers and audit financial flows. This results in an inefficient system that adds costs and increases settlement times.

A better way is emerging through decentralized finance. The next step is to begin moving real-world assets onto these new blockchain rails. Tokenizing real-world assets will provide a number of advantages like:

Increased efficiency: The blockchain ledger is a single source of truth, which reduces the friction inherent in current financial transactions. Atomic settlement means settlement happens almost instantaneously, greatly increasing efficiency.

Reduced costs: Current systems are bloated with the need for intermediaries, which often only serve to drive up costs without providing a great deal of value. Using smart contracts for many of our financial systems eliminates the need for third parties, greatly reducing transaction costs. For example, early tests in blockchain-based bonds have shown a 90% reduction in the cost of bond issuance and a 40% reduction in fundraising costs.

Increased transparency: Public blockchains can be audited in real time, opening up the ability to verify the quality of asset collateral and systemic risk exposure. Recordkeeping disputes are easily resolved thanks to public dashboards that show all on-chain activity.

Built-in compliance: Smart contracts not only have the ability to reduce the need for intermediaries. They can also be used to ensure compliance to regulatory oversights. This can be done in such a way that personal privacy is always protected.

Liquid Markets: Many traditional financial markets are illiquid. Think art, real estate, even stocks to some extent. Tokenizing assets increases accessibility to trillions of dollars of largely inaccessible assets.

Innovation: When you put assets and application logic on a common settlement layer, you can create new financial products, from fractionalized real estate funds to liquid revenue-sharing agreements. Tokenization increases the ability to build products previously thought impractical or even impossible.

What RWAs Could Be Tokenized?

There are many real-world assets that could potentially be moved onto a blockchain for increased efficiency, transparency, and accessibility. Some of these are already being tested on-chain:

Physical gold: Blockchain technology is already being used to manage the ownership and transfer of physical gold, allowing investors to hold gold securely and transparently. There are already a number of gold-backed cryptocurrencies like Paxos Gold, but true digitization of gold has not been achieved. The London Bullion Market Association has a good analysis of the current state of gold and the blockchain for those interested in learning more.

Real estate: Land titles, deeds, and other property ownership records can be recorded on a blockchain to simplify the process of buying, selling, and transferring real estate. This is one area that’s been seeing a good deal of activity already, with projects like Lofty.ai (residential) and SliceSpace (commercial) blazing the trail towards fractionalized real estate ownership.

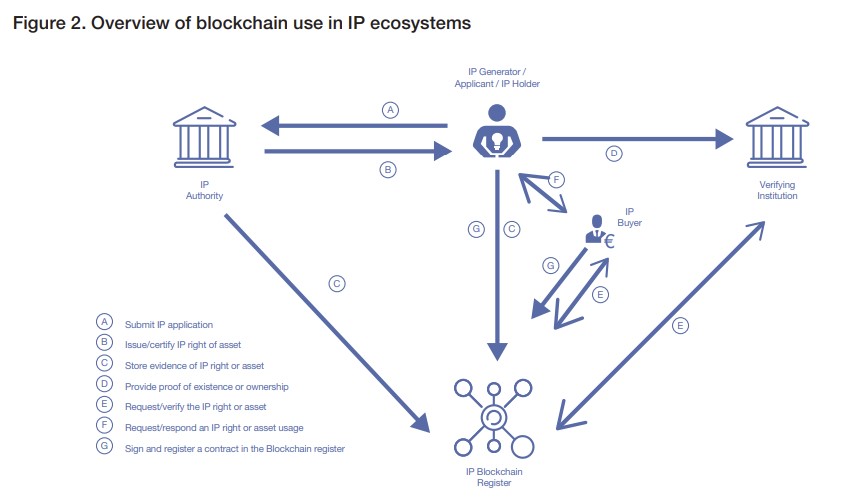

Intellectual property: Copyrights, patents, and trademarks can be recorded on a blockchain to ensure ownership and rights are properly documented and protected. Smart IP registries could track the entire lifecycle of any registered IP right. It could also resolve the practicalities of collating, storing, and providing such evidence. It would also make for smoother IP right audits. This could simplify due diligence exercises that are necessary for IP transactions, for example, in mergers and acquisitions. Blockchain could track royalties for music streaming or content downloads to ensure artists receive fair compensation for their work.

Supply chain management: Blockchain technology can be used to track the movement of goods through the supply chain, enabling better traceability and accountability for businesses and consumers.

One good example is medical products (including pharmaceuticals, medical devices, and supplies) to ensure quality and prevent counterfeiting. Another is agricultural products, where blockchain ledgers could allow farmers and consumers to track the journey of food products from farm to table.

Many major corporations already use blockchain in supply chain management including Amazon, Microsoft, IBM, Walmart, and Ford Motors. As adoption of blockchain technology increases, the number of companies using it for their supply chains can only grow.

Identity management: Personal identity information like birth certificates, passports, and social security numbers can be stored on a blockchain to reduce identity theft and streamline identity verification processes. In addition, it enhances data security, reduces costs, and creates an auditable record trail.

Blockchain identity management can be applied to a growing number of use cases across a variety of industries and sectors including healthcare, financial services, supply chain, Web3, and retail.

While China’s efforts to create a national digital ID have been closely watched, there are a number of Western companies also creating digital ID systems like IBM and Microsoft. There are also many startups working to create digital IDs.

Financial instruments: Stocks, bonds, and other financial instruments can be issued and traded on a blockchain, creating a more efficient and transparent financial system. We already see this in the derivatives markets, but tokenizing actual stocks and bonds would significantly reduce costs, improve efficiencies, and remove unnecessary third parties from financial markets.

This area could be ready to explode soon, with the very first tradeable stocks and bonds launching on the Polygon blockchain in February 2023 via the regulated European exchange Swarm. The exchange is starting out with Tesla and Apple, as well as two U.S. Treasury-based ETFs. Additional stocks and bonds will be added based on demand.

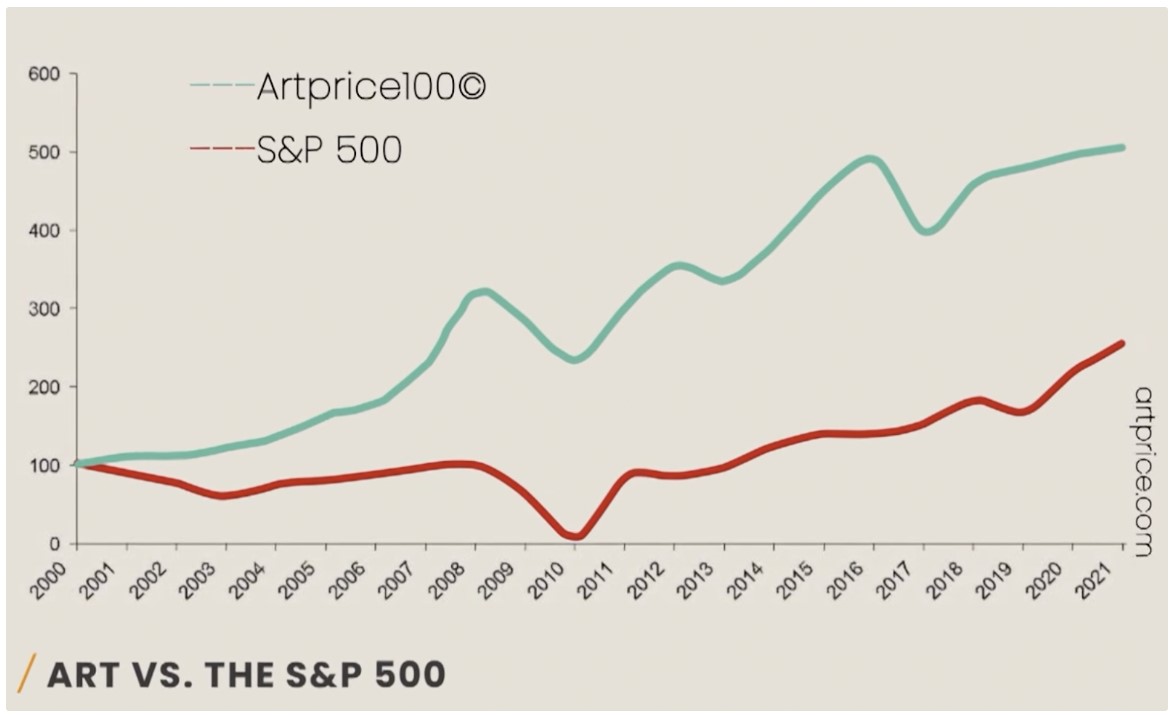

Art and collectibles: Ownership and provenance of art and collectibles can be recorded on a blockchain to prevent fraud and ensure authenticity. Note that these are not NFTs, but tokenized versions of actual physical art and collectibles.

Tokenized art and collectibles also help solve the problem of liquidity in these markets through the use of fractional ownership, which can dramatically increase the investor base in the market. The digitization of art has begun via companies such as Securitize, TokenD, and Sygnum. Access to art can help diversify any investment portfolio.

Carbon credits: Carbon credits, which are used to offset greenhouse gas emissions, can be tracked and traded on a blockchain to create a more efficient and transparent market. Under the current system, carbon credits are (for the most part) only accessible to those with access to brokers or traders and purchased by corporations. This has resulted in a fragmented, inefficient, and illiquid market.

One of the leaders in tokenized carbon credits is Toucan.earth, which has created the TCO2 token. It allows any carbon credit holder to tokenize that carbon credit. Toucan.earth connects holders to the Carbon Bridge, which allows owners of carbon credits from verified sources to link each one to a TCO2 token. These are stored in a smart contract on a blockchain database called the Open Climate Registry. Other carbon credit projects looking to tokenize include Klima DAO and SavePlanetEarth.

Insurance policies: Insurance policies can be stored on a blockchain to simplify claims processing and reduce fraud. With blockchain technology, insurance companies can create smart contracts to track insurance claims, automate outdated paperwork processes, and safeguard sensitive information.

Unlike physical contracts, smart contracts can track insurance claims and hold both parties accountable. Smart contracts can also help automate outdated processes, save billions of paperwork hours each year, and reduce human error because all forms and data are safely stored on-chain. Blockchain technologies have already been embraced by the traditional insurer Nationwide and Web3 companies like Etherisc and Lemonade.

Loyalty points: Loyalty programs for retailers and service providers can be built on a blockchain, making it easier for customers to redeem points and for businesses to manage their programs. Bitcoin Market Journal is a pioneer in this space, having recently released its own loyalty-based token for Premium subscribers. One of the leaders in the blockchain loyalty points space is Bakkt, which builds loyalty programs for its client base. Other high-profile crypto loyalty programs include those at Singapore Airlines and Venmo.

Gaming assets: Virtual items and currencies used in online games can be managed and traded on a blockchain, allowing players to truly own their in-game assets. In 2021, the Blockchain Game Association (BGA) surveyed over 200 gamers worldwide and found that most of them (85%) considered asset ownership the most significant advantage of blockchain gaming. Platform games like Axie Infinity pioneered this space, but it’s growing significantly as top gaming houses are building out games based on blockchain technology.

Then, there are platforms like Enjin.io that are providing game developers an easy way to add NFT assets to their games. Eventually, the space could see interoperability, where assets can be easily moved from one game to another. See our guide to blockchain gaming for investors to learn more about what’s happening in the space.

Some additional potential uses of blockchain technology with real-world assets include:

Energy trading: Energy providers can use blockchain technology to create a more efficient and transparent energy trading platform, allowing individuals and businesses to trade energy directly with each other.

Water rights: Blockchain technology can be used to track water rights and usage, enabling efficient allocation and distribution of water resources.

Sports contracts: Professional sports contracts can be recorded on a blockchain, ensuring athletes and teams have accurate records of their contracts and that payments are made according to agreed terms. Like other assets, these contracts can be fractionalized and sold off by players if they want immediate liquid cash.

Charity donations: Charitable donations can be tracked on a blockchain, ensuring funds are used for their intended purposes and increasing transparency for donors.

Online advertising: Blockchain technology can be used to create more transparent and efficient online advertising systems, allowing advertisers to track and verify ad impressions and clicks.

Legal contracts: Legal contracts can be stored on a blockchain, allowing parties to easily verify the terms of agreements and ensuring contracts are executed as intended.

Investor Takeaway

This list may just be scratching the surface.

In the coming decade, it’s possible nearly everything of value will be placed on-chain thanks to the trust, security, transparency, and efficiencies blockchain provides.

Tokenization of real-world assets has one massive benefit: accessibility. If you’ve been interested in investing in art, carbon credits, or even stocks, and you’ve found there are too many hurdles, tokenization of these assets can help overcome many of them via increased liquidity and simplicity.

If you’re an investor, this is an exciting time. In our view, asset tokenization will only continue to grow, and those who understand the benefits at the start are most likely to reap the rewards.

Source: https://www.bitcoinmarketjournal.com/tokenization-of-real-world-assets-the-complete-list/