In the fast-paced world of cryptocurrency trading, where fortunes can be made and lost in the blink of an eye, understanding the psychology behind market sentiment is paramount. Successful crypto trading goes beyond technical analysis and market trends; it delves into the intricate realm of human emotions and behaviors. In this article, we explore the fascinating landscape of the psychology of crypto trading and provide insights on how to master market sentiment for better decision-making.

- Emotional Rollercoaster:

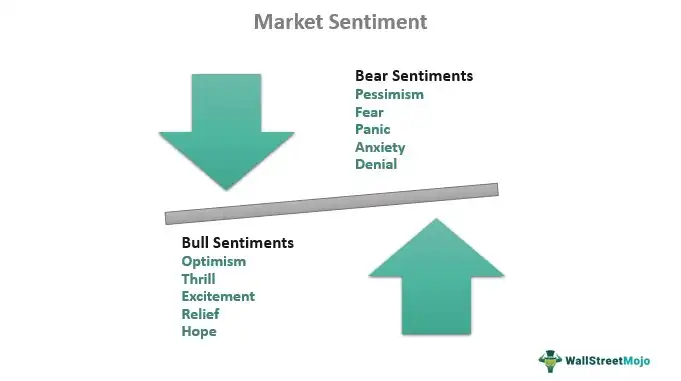

Crypto markets are notorious for their volatility, subjecting traders to a rollercoaster of emotions. Fear, greed, FOMO (Fear of Missing Out), and panic are among the powerful emotions that influence market sentiment. Recognizing and managing these emotions is crucial for making rational decisions and avoiding impulsive actions that can lead to losses.

- Market Cycles and Sentiment:

Understanding market cycles is fundamental to mastering market sentiment. Markets go through cycles of euphoria, complacency, anxiety, and despair. Recognizing these phases enables traders to anticipate shifts in sentiment and adjust their strategies accordingly. During bullish trends, optimism prevails, while bearish trends bring about skepticism and fear.

- Social Media Influence:

In the digital age, social media platforms play a significant role in shaping market sentiment. News and rumors spread rapidly, impacting the emotions of traders. Monitoring social media channels can provide valuable insights into the prevailing sentiment, but it’s essential to filter noise and distinguish between informed opinions and baseless speculation.

- Confirmation Bias:

Traders often fall victim to confirmation bias, where they seek information that aligns with their existing beliefs and ignore contradictory evidence. Recognizing and mitigating confirmation bias is crucial for making objective decisions based on a thorough analysis of all available information.

- Risk Tolerance and Patience:

Successful crypto traders understand their risk tolerance and exercise patience. Impulsive decisions driven by fear or greed can lead to significant losses. Establishing a well-defined risk management strategy and sticking to it, even in the face of market fluctuations, is a key aspect of mastering market sentiment.

- Learn from Mistakes:

Mistakes are inevitable in the world of crypto trading, but they can be valuable learning experiences. Analyzing past trades, both successes and failures, provides insights into personal trading patterns and emotional triggers. Continuous learning and adaptation are essential for mastering the ever-evolving landscape of market sentiment.

- Technological Tools and Analytics:

Utilizing technological tools and analytics can aid in mastering market sentiment. Sentiment analysis tools, machine learning algorithms, and data analytics can help traders gauge market sentiment and make informed decisions based on data-driven insights.

Conclusion:

In the dynamic and unpredictable world of crypto trading, mastering market sentiment is an ongoing process that requires self-awareness, emotional intelligence, and a deep understanding of market dynamics. By acknowledging the psychological factors influencing trading decisions, traders can develop strategies that align with their risk tolerance and investment goals. In the end, success in crypto trading is not just about predicting market trends but about mastering the psychology behind the market sentiment.