The cryptocurrency landscape is marked by innovation, volatility, and an ever-evolving regulatory environment. As governments around the world grapple with the implications of digital currencies, regulatory changes play a pivotal role in shaping the future of the crypto space. This article explores the profound impact that regulatory developments have on the cryptocurrency ecosystem, examining both challenges and opportunities.

The Regulatory Landscape: A Shifting Terrain

Cryptocurrencies emerged as a disruptive force challenging traditional financial systems, prompting regulators to respond to the new digital frontier. The regulatory landscape, however, varies significantly from one jurisdiction to another, creating a complex and fragmented environment.

- Clarity Breeds Confidence:

- Regulatory clarity is a cornerstone for fostering confidence among investors and industry participants. Clear guidelines provide a roadmap, helping businesses navigate legal complexities and encouraging responsible innovation.

- Institutional Entry and Mainstream Adoption:

- Well-defined regulations pave the way for institutional involvement. As regulatory frameworks become clearer, traditional financial institutions are more likely to engage with cryptocurrencies, leading to increased adoption and legitimacy in mainstream finance.

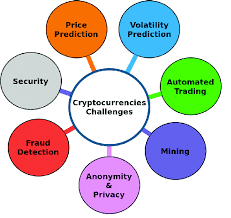

Challenges Amidst Regulatory Changes:

- Compliance Costs:

- Compliance with evolving regulations can be resource-intensive, particularly for smaller players in the crypto space. Striking a balance between regulatory adherence and the need for innovation is a significant challenge.

- Market Volatility in Response to Regulatory News:

- The crypto market is highly sensitive to regulatory news. Announcements of new regulations or legal uncertainties in major markets can lead to sharp market fluctuations. Traders and investors must adapt to this inherent volatility.

- Global Coordination:

- Given the borderless nature of cryptocurrencies, achieving global regulatory coordination is a complex task. Divergent regulatory approaches can create challenges for international businesses and hinder the development of a cohesive global crypto ecosystem.

Opportunities for Positive Impact:

- Enhanced Investor Protection:

- Robust regulations can provide a safety net for investors, fostering a sense of security in the crypto market. This can attract a broader range of participants, including those who may have been hesitant due to concerns about fraud or malfeasance.

- Innovation within Regulatory Boundaries:

- Well-thought-out regulations can serve as a framework for responsible innovation. By setting clear guidelines, regulators can encourage the development of new technologies and business models while ensuring consumer protection and market integrity.

Striking the Right Balance for the Future:

As the regulatory landscape continues to evolve, finding a balance between innovation and protection becomes paramount. Open dialogue between regulators, industry stakeholders, and the wider community is essential to developing regulations that address the unique challenges of the crypto space.

Conclusion:

The impact of regulatory changes on the crypto landscape is undeniable. Navigating this evolving terrain requires collaboration, adaptability, and a commitment to building a framework that fosters innovation while safeguarding market participants. As the crypto industry matures, the influence of regulatory developments will be a defining factor in shaping its trajectory toward mainstream acceptance and sustainable growth.