In the dynamic world of cryptocurrencies, volatility is a characteristic that often deters risk-averse users. Enter stablecoins, a revolutionary class of digital assets designed to bridge the gap between the unpredictable nature of cryptocurrencies and the stability of traditional fiat currencies. This article explores the role of stablecoins, their mechanisms, use cases, and the transformative impact they have on the broader crypto ecosystem.

Understanding Stablecoins:

- The Need for Stability:

- The inherent volatility of cryptocurrencies, exemplified by the price fluctuations of major assets like Bitcoin, can pose challenges for users seeking a more stable store of value and a reliable medium of exchange.

- What are Stablecoins?

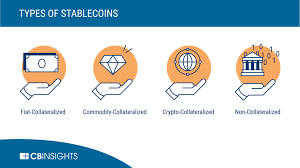

- Stablecoins are a type of cryptocurrency pegged to the value of traditional fiat currencies, commodities, or other stable assets. This pegging is achieved through collateralization, algorithmic mechanisms, or a combination of both.

Mechanisms Behind Stability:

- Fiat-Collateralized Stablecoins:

- These stablecoins are directly backed by reserves of fiat currency. For every issued stablecoin, an equivalent amount of fiat is held in reserve. Examples include USDC (USD Coin) and USDT (Tether).

- Crypto-Collateralized Stablecoins:

- Some stablecoins are collateralized by other cryptocurrencies, often held in smart contracts. The value is maintained by ensuring that the collateral is sufficient to cover the circulating supply. DAI, on the Ethereum blockchain, is a notable example.

- Algorithmic Stablecoins:

- Algorithmic stablecoins use smart contracts and algorithms to automatically adjust the supply in response to demand, aiming to keep the value stable. Ampleforth is an example of an algorithmic stablecoin.

Use Cases of Stablecoins:

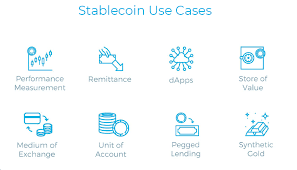

- Remittances and Cross-Border Payments:

- Stablecoins offer a faster and more cost-effective alternative for cross-border transactions compared to traditional banking systems. Users can send and receive funds with minimal volatility.

- Trading Pairs and Liquidity:

- Stablecoins serve as a reliable trading pair for cryptocurrency traders. They provide a stable reference point for valuation and are often used as a safe haven during periods of market volatility.

- Decentralized Finance (DeFi) Ecosystem:

- Stablecoins are integral to the DeFi ecosystem, providing a stable unit of account for lending, borrowing, and liquidity provision on decentralized platforms.

Benefits and Criticisms:

- Advantages:

- Stability: Stablecoins offer users a stable value, making them a more predictable and reliable medium of exchange.

- Accessibility: Stablecoins provide a bridge between the traditional financial system and the crypto space, enabling easier onboarding for newcomers.

- Concerns:

- Centralization: Fiat-collateralized stablecoins can be criticized for centralization, as they rely on custodial reserves of fiat currency.

- Regulatory Risks: Stablecoins may face regulatory challenges, especially if they are not compliant with financial regulations.

The Future of Stablecoins:

- Innovation and Evolution:

- The stablecoin space continues to evolve with ongoing innovations, including the exploration of new collateral types, improved algorithms, and advancements in blockchain technology.

- Integration into Mainstream Finance:

- As stablecoins gain wider acceptance, they have the potential to become a seamless bridge between traditional finance and the decentralized world of cryptocurrencies.

Conclusion:

Stablecoins represent a pivotal development in the cryptocurrency landscape, providing stability without sacrificing the benefits of blockchain technology. Their versatility and potential for mass adoption make them a vital component in realizing the broader vision of a decentralized and inclusive financial ecosystem. As stablecoins continue to evolve, they are poised to play a transformative role in reshaping the future of finance.