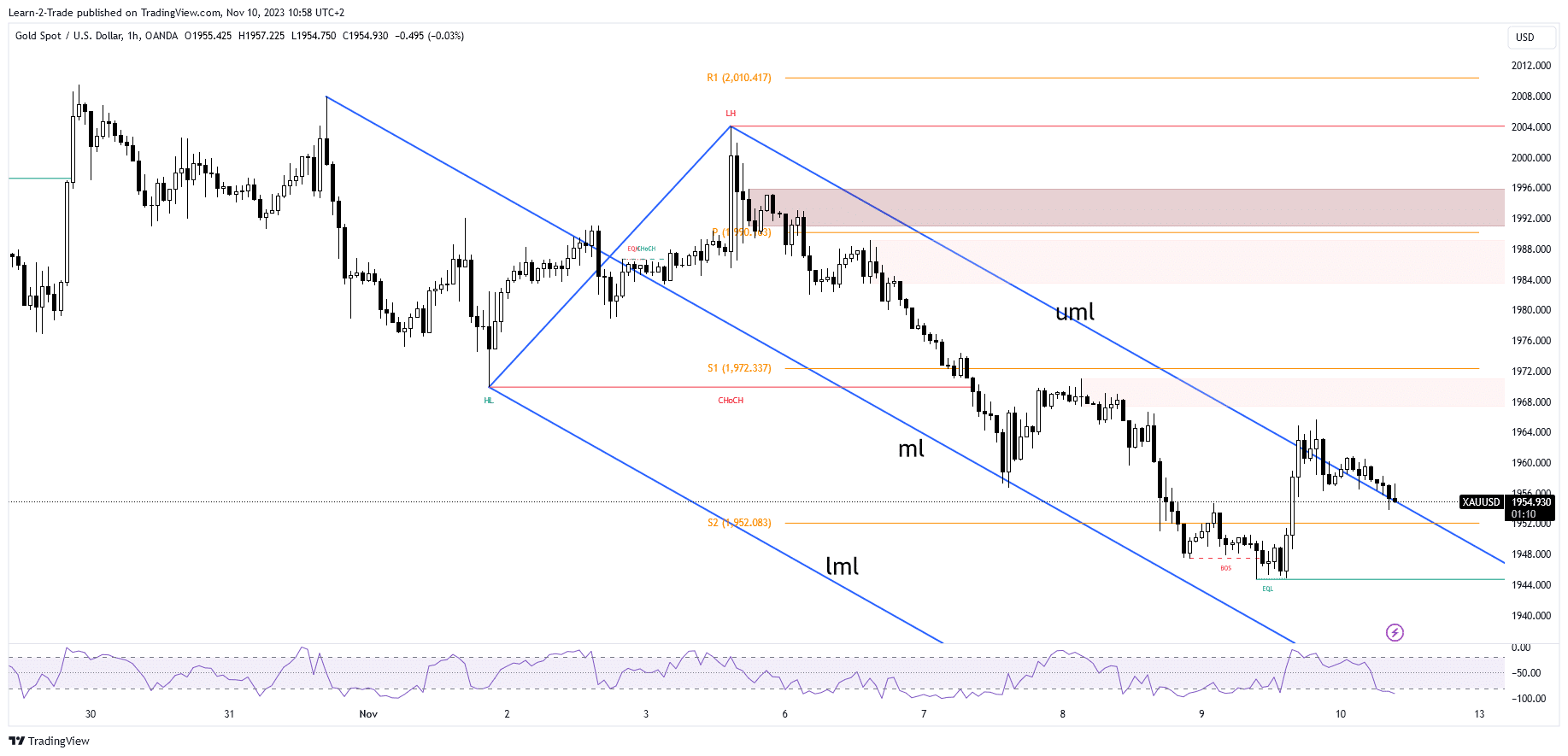

- XAU/USD retests the buyers after closing above the upper median line.

- The US data could be decisive today.

- Dropping below the S2 invalidates the upside scenario.

The gold price made waves yesterday, hitting a high of $1,965 before taking a step back to $1,954. This retreat was anticipated after the recent rally. The DXY’s rally played a role in pushing the value of gold down once again.

-Are you looking for forex robots? Check our detailed guide-

The Consumer Price Index (CPI) showed a 0.2% decrease in China, slightly more than the expected 0.1% drop. The Producer Price Index (PPI) also fell, recording a 2.6% decrease compared to the predicted 2.7%. Across the Pacific, the US Unemployment Claims exceeded expectations, boosting the dominance of the US dollar in the currency market.

Today, economic figures from the UK brought about some market volatility. Indicators such as GDP, Prelim GDP, Construction Spending, Goods Trade Balance, Index of Services, and Industrial Production surpassed expectations, adding extra excitement.

Looking ahead, the US is gearing up to release the Preliminary University of Michigan (UoM) Consumer Sentiment, expected at 63.7 points, a potential high-impact event that could lead to significant market movements. Additionally, Preliminary UoM Inflation Expectations data will be unveiled. Positive figures from the US may strengthen the US dollar and put pressure on the XAU/USD pair. Conversely, weak US data could provide support for the price of gold. Stay tuned for these developments in the financial landscape.

Gold price technical analysis: Corrective downside

Source: https://www.forexcrunch.com/gold-price-pares-gains-as-fed-hawks-roar/