- The pound surged following the Bank of England’s decision to maintain rates.

- Investors are becoming increasingly convinced that US rates have peaked.

- The pound got a boost from downbeat US employment figures.

The GBP/USD weekly forecast is riding a wave of bullish sentiment as the greenback falters after discouraging employment figures. A weaker dollar sets the stage for a potential surge in the currency pair.

Ups and downs of GBP/USD

The pound closed the week higher after monetary policy meetings by the Federal Reserve and the Bank of England. The pound surged following the Bank of England’s decision to maintain rates at a 15-year high. Moreover, the bank explicitly ruled out any imminent rate cuts.

-Are you looking for forex robots? Check our detailed guide-

Meanwhile, despite the uncertainty surrounding US interest rates, investors are increasingly convinced that the peak has been reached. Consequently, Fed funds futures indicate a less than 20% chance of rate hikes in December. This, in turn, is weighing on the dollar.

Moreover, the pound got a boost from downbeat US employment figures. The figures suggest that US rates are beginning to impact the labor market.

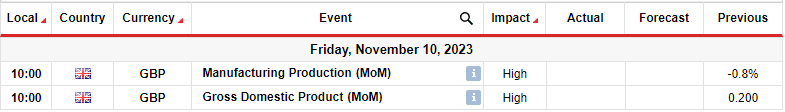

Next week’s key events for GBP/USD

In the coming week, the UK will release data on manufacturing production and gross domestic product. Notably, the UK economy has lagged due to the high interest rates meant to fight inflation.

Nevertheless, the UK steered clear of recession in the current year. However, the IMF projects it will experience the slowest economic growth among the Group of Seven nations next year.

In August, the economy showed a modest growth of 0.2%, following a surprising contraction of 0.5% in July.

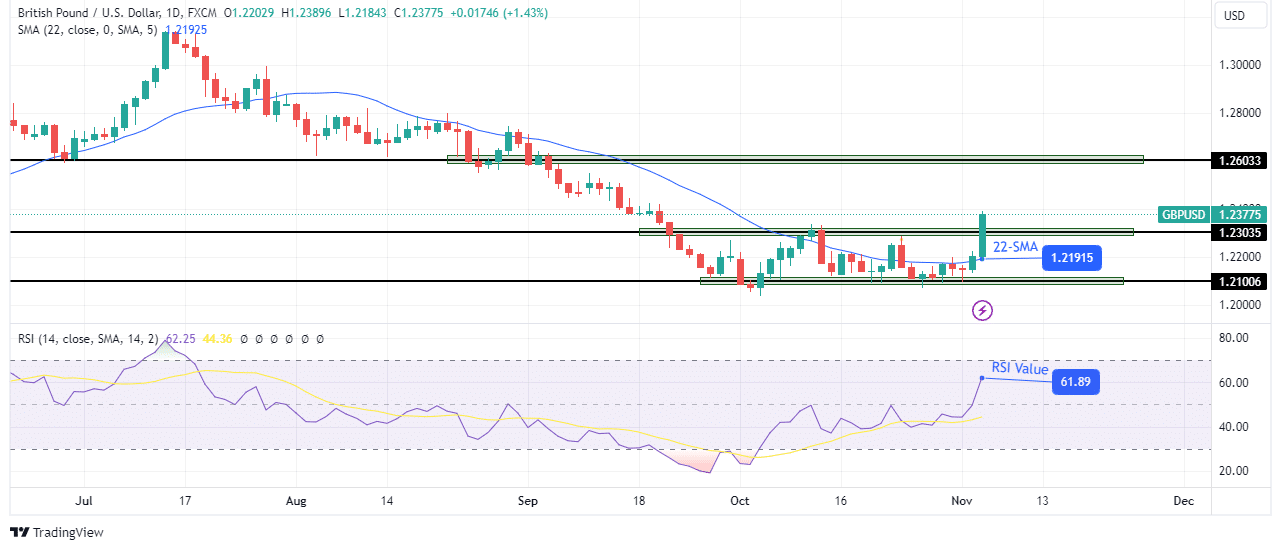

GBP/USD weekly technical forecast: Price confined by 1.2100 support and 1.2303 resistance.

The pound has been stuck in consolidation between the 1.2100 support and the 1.2303 resistance levels. It came after a steep bearish trend that paused at the 1.2100 support. Moreover, throughout the decline, the price respected the 22-SMA as resistance. At the same time, the RSI found resistance at the pivotal 50 level.

-Are you looking for the best CFD broker? Check our detailed guide-

However, when the price got to the 1.2100 support, bulls got enough strength to puncture the SMA. They have kept doing this, and finally, the price has pushed beyond the 1.2303 resistance level.

In the coming week, the price might pull back to retest the 1.2303 as support. If the level holds, the price will bounce higher and likely retest the 1.2603.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/gbp-usd-weekly-forecast-dollar-falters-amid-dismal-nfp-data/