- British inflation data came in lower than anticipated.

- Market sentiment now leans toward a 25bps increase in UK rates on August 3.

- The UK’s inflation rate remains the highest among the world’s top seven advanced economies.

Today’s GBP/USD forecast is bearish. British inflation data came in lower than anticipated, causing a pound value decline on Wednesday. Notably, the June figures revealed that British inflation had fallen more than anticipated, hitting its slowest pace in over a year at 7.9%. Consequently, the Bank of England may not need to raise interest rates to the extent previously expected.

-Are you interested in learning about forex tips? Click here for details-

Moreover, the market sentiment now leans toward a quarter-percentage point increase in rates on August 3 rather than the half-percentage increase factored in on Tuesday. The projected peak for the Bank Rate at 6% is no longer valid.

As a result, the pound experienced a decrease of up to 0.8% against the dollar, reaching $1.2931. This marks the pound’s lowest level against the dollar in a week, following its peak of $1.3144 on Thursday.

Bank of England Governor Andrew Bailey has faced criticism from investors and former Bank officials due to inflation consistently exceeding expectations. This is despite 13 consecutive rate hikes since December 2021.

Despite the decline in June, the UK’s inflation rate remains the highest among the world’s top seven advanced economies. Only Iceland, in Western Europe, had a higher inflation rate in June.

The slower decline in inflation in the UK can be attributed, in part, to how energy subsidies are adjusted every six months. The next adjustment, reflecting lower prices, is set to begin on July 1.

GBP/USD key events today

Investors will scrutinize the building permits report from the US, coming out later today. This report will give insight into the US housing market.

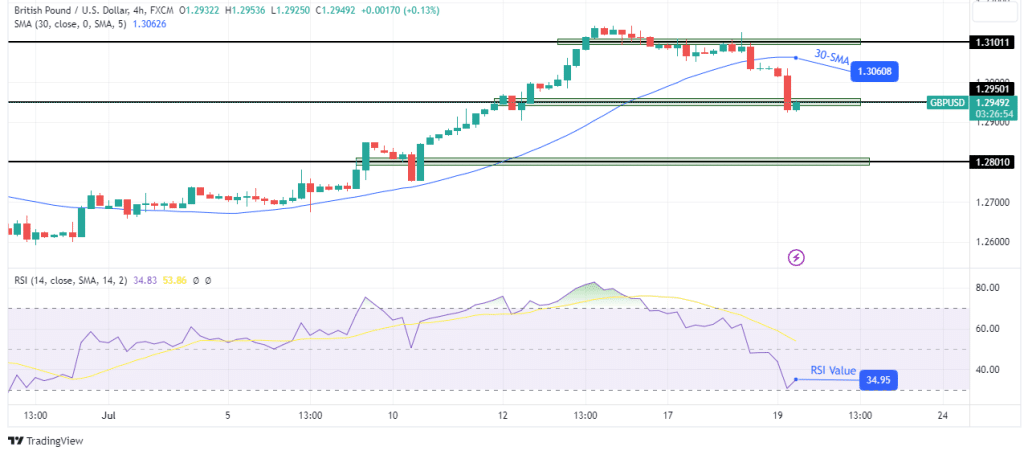

GBP/USD technical forecast: Sharp dip below 1.2950 support.

The pound has fallen sharply in the 4-hour chart after breaking below the 30-SMA. The bears managed to puncture the 1.2950 support level, showing massive strength. This strength can also be seen in the RSI, which fell toward the oversold region.

-Are you interested in learning about the forex basics? Click here for details-

The bearish bias has strengthened, with the price now well below 30-SMA. If there is no pause at the 1.2950 key level, bears will target the 1.2801. However, a pause could lead to a pullback before the bearish move continues.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Source: https://www.forexcrunch.com/gbp-usd-forecast-pound-dives-following-cooler-inflation-figures/