The world of cryptocurrency has witnessed a transformative journey in fundraising mechanisms, evolving from the era of Initial Coin Offerings (ICOs) to the rise of Initial Exchange Offerings (IEOs). This article explores the significant shift in crypto fundraising models, highlighting the strengths, challenges, and the impact of this evolution on both projects and investors.

The ICO Era: Birth of a Revolution

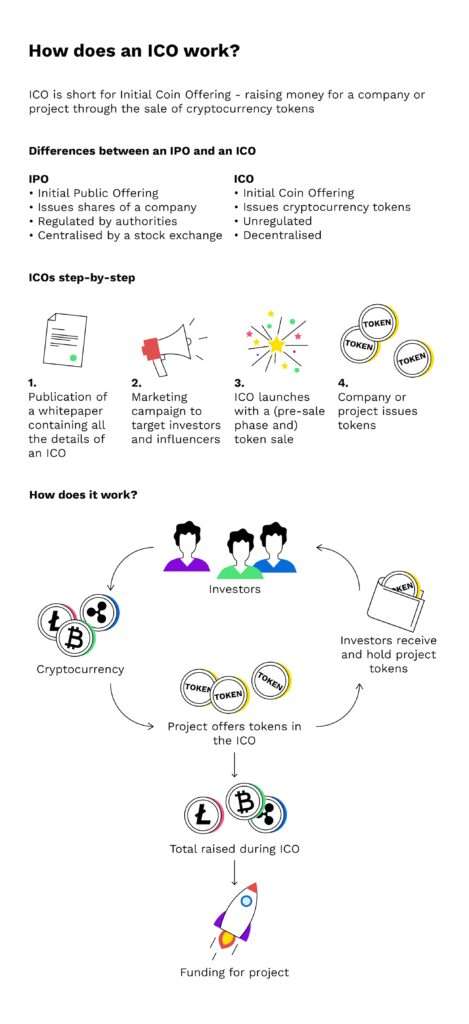

In the early days of cryptocurrency, ICOs emerged as a revolutionary fundraising method. These decentralized crowdfunding campaigns allowed projects to raise capital by issuing their own tokens directly to the public. ICOs democratized fundraising, enabling global participation and empowering retail investors to support promising blockchain projects.

- Accessibility and Global Reach:

- ICOs democratized investment, allowing anyone with an internet connection to participate. This accessibility opened up fundraising opportunities to a global audience, breaking down traditional barriers to entry.

- Token Utility and Community Building:

- ICOs not only raised capital but also created engaged communities around projects. Token holders often had a stake in the success of the project, fostering a sense of shared ownership and commitment.

Challenges and the Rise of IEOs:

Despite the successes of ICOs, they faced significant challenges, including regulatory uncertainties, scams, and a lack of investor protection. In response, a new model emerged – Initial Exchange Offerings (IEOs).

- Enhanced Credibility and Due Diligence:

- IEOs are conducted on cryptocurrency exchanges, leveraging the platform’s reputation and due diligence processes. This added layer of scrutiny enhances the credibility of projects, reducing the risk of fraudulent activities.

- Streamlined Token Sales:

- Unlike ICOs, where project teams handled token sales directly, IEOs involve exchanges facilitating the entire process. This streamlined approach simplifies token sales, making it more user-friendly for both projects and investors.

The Impact on Projects and Investors:

- Increased Investor Confidence:

- The involvement of reputable exchanges in IEOs has instilled greater confidence among investors. The endorsement by established platforms provides a level of assurance regarding the legitimacy and viability of the fundraising project.

- Liquidity and Listing Opportunities:

- IEOs often come with the promise of immediate liquidity. Projects can list their tokens on the hosting exchange shortly after the fundraising, providing investors with an early opportunity to trade their tokens on a secondary market.

Looking Ahead: The Future of Crypto Fundraising

The evolution from ICOs to IEOs represents a maturation of the crypto fundraising landscape. As the industry continues to grow, new models and methods may emerge, each refining the process and addressing the evolving needs of both projects and investors.

Conclusion:

The transition from ICOs to IEOs signifies a crucial chapter in the history of crypto fundraising. While ICOs pioneered the decentralized fundraising movement, IEOs have brought a level of credibility and structure that aligns with the maturing crypto industry. As the landscape continues to evolve, the success of future fundraising models will depend on finding the delicate balance between innovation, investor protection, and regulatory compliance. The journey from ICOs to IEOs is a testament to the adaptability and resilience of the crypto ecosystem, marking a dynamic era in the ongoing narrative of blockchain technology and decentralized finance.