- The Euro leaps to the vicinity of 1.0800 against the US Dollar.

- European stocks cling to daily gains on Tuesday.

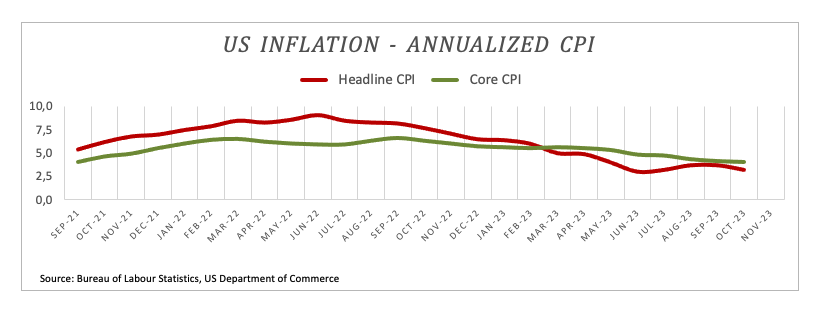

- US inflation figures surprised to the downside in October.

The Euro (EUR) gathers extra upside impulse against the US Dollar (USD), lifting EUR/USD to advance to new two-month tops near the 1.0800 barrier on Tuesday, an area also coincident with the critical 200-day SMA.

On the other hand, the Greenback sinks below the 105.00 region when measured by the USD Index (DXY), or eight-week lows, amidst the continuation of the decline from last week’s top around 106.00.

The pronounced knee-jerk in the Dollar comes amidst further weakness in US yields across different time frames, and it is particularly exacerbated after US inflation figures dropped more than expected in October. Indeed, tracked by the CPI, US consumer prices rose at an annualized 4.0% and 3.2% YoY when it comes to the Core reading (excluding food and energy costs).

Around the European Central Bank (ECB), recent views from Council members keep pointing to a prolonged pause of the current restrictive stance as inflation continues to run hot and well above the target.

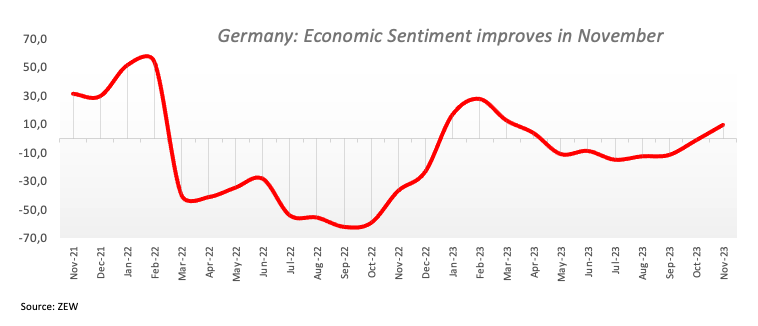

Further strength for the single currency also came after Economic Sentiment in both Germany and the broader Eurozone improved to 9.8 and 13.8, respectively, for the current month. Still around the euro bloc, another revision saw the GDP Growth Rate contract 0.1% QoQ in Q3 and expand 0.1% over the ast twelve months.

Daily digest market movers: Euro shifts its focus to 1.0800

- The EUR approaches the key barrier of 1.0800 vs. the USD.

- US and German yields accelerate their daily retracement.

- Investors anticipate that the Fed will not raise interest rates in December.

- The ECB appears to have reached a stalemate in its tightening cycle.

- Fears of FX intervention keep hovering around USD/JPY.

- US Inflation Rate came in below estimates in October.

- UK labour market report surprised to the upside.

Technical Analysis: Euro faces extra upside above 1.0800

EUR/USD maintains the constructive stance and trades at shouting distance from the key 1.0800 hurdle on Tuesday.

EUR/USD may challenge the key 200-day Simple Moving Average (SMA) at 1.0801 and the weekly top of 1.0945 (August 30) if the recovery continues. The psychological threshold of 1.1000 is followed by the August peak of 1.1064 (August 10) and another weekly high of 1.1149 (July 27), both of which precede the 2023 top of 1.1275 (July 18).

If sellers retake control, the pair may find temporary support at the 55-day SMA at 1.0637, ahead of the weekly low of 1.0495 (October 13) and the 2023 low of 1.0448. (October 15).

Additional decline in the pair is expected as long as it continues to trade below the 200-day SMA.

(This story was corrected on November 14 at 11:55 GMT to indicate that the temporary 55-day SMA is a support, not a resistance).

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.