- US inflation came in higher than expected.

- While the ECB raised rates to a record high, it also signaled the end of its rate hike campaign.

- The Federal Reserve will likely keep its key interest rate unchanged next week.

The EUR/USD weekly forecast is bearish as the ECB has signaled an end to hikes while the US economy could keep the Fed hawkish.

Ups and downs of EUR/USD

EUR/USD had a bearish week characterized by key releases from the US and the Eurozone. The week started with an inflation report from the US. US inflation came in higher than expected. However, this failed to alter expectations for a Fed pause.

-If you are interested in social trading apps, check our detailed guide-

The bigger catalyst for the pair came on Thursday after the ECB policy meeting. While the ECB raised rates to a record high on Thursday, it also signaled the end of its rate hike campaign. This saw the euro plummet against the dollar.

Moreover, more upbeat data from the US on retail sales and PPI saw the dollar end the week strong and the euro weak.

Next week’s key events for EUR/USD

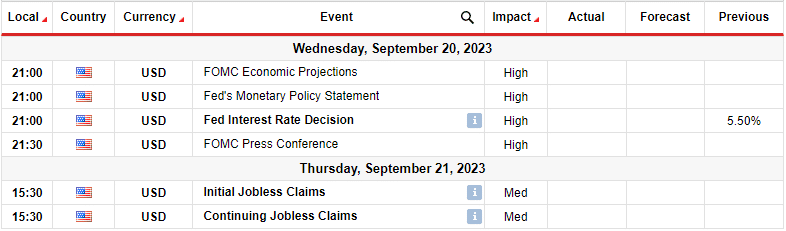

The focus for EUR/USD investors next week will be the Fed monetary policy meeting. This week’s economic indicators have solidified expectations: the Federal Reserve will likely keep its key interest rate unchanged at next week’s monetary policy meeting. This has boosted hopes that the central bank may have finished its tightening cycle.

Additionally, there is a 68.5% likelihood of the same outcome at the November meeting.

EUR/USD weekly technical forecast: Bulls could trigger a strong reversal.

The EUR/USD bears are in the lead in the daily chart. They have pushed the price down to the 1.0650 support level. The downtrend is strong as the price keeps making lower lows and highs. Moreover, the price has respected the 22-SMA as resistance more than once. This shows that bears are committed to keeping the price below the SMA.

-If you are interested in brokers with Nasdaq, check our detailed guide-

Furthermore, the RSI trades near the oversold region, showing strong bearish momentum. As such, the price will likely cross the 1.0650 support in the coming week. However, there is also the chance that bulls will return to this level for a deep reversal or a pullback. The last time the price got to this level, it reversed. If bulls return, we might see the price retest the 1.0800 resistance or a higher level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/eur-usd-weekly-forecast-ecb-fed-differential-to-grow/