- The ECB’s chief economist expressed dissatisfaction with the progress in controlling inflation.

- Eurozone inflation dropped to 2.9% last month.

- ECB’s Lane projected a steady or potentially increasing price growth next year.

Thursday’s EUR/USD outlook painted a bullish picture, with the euro making strides against the dollar. The rally was set ablaze by the hawkish remarks from European policymakers. For instance, the European Central Bank’s chief economist expressed dissatisfaction with the progress in controlling inflation.

Notably, the ECB paused rate hikes last month. Consequently, there has been growing speculation among investors that the next move could be a cut. This shift comes as consumer price growth has retreated to below 3%.

However, policymakers sought to reduce any excitement about the falling inflation, emphasizing that the overall picture was mixed. Moreover, some argued against ruling out the possibility of further rate hikes.

On Wednesday, Ireland’s central bank chief, Gabriel Makhlouf, suggested that further interest rate hikes were still possible. Meanwhile, Bundesbank President Joachim Nagel acknowledged that reaching the inflation target might be the most challenging phase.

Rabobank senior strategist Jane Foley noted a divergence between market and central bankers’ expectations of future rate cuts. There is resistance from many policymakers to such speculation.

Furthermore, Foley highlighted that policymakers are likely to maintain the possibility of additional tightening, especially if inflation remains above the target. A sharp drop in market rates could increase inflationary risks.

Inflation dropped to 2.9% last month from its previous level of over 10% a year earlier. However, ECB chief economist Philip Lane projected a steady or potentially increasing price growth next year.

EUR/USD key events today

On the calendar today are events from the US, including,

- Fed Chair Jerome Powell’s speech.

- The initial jobless claims report.

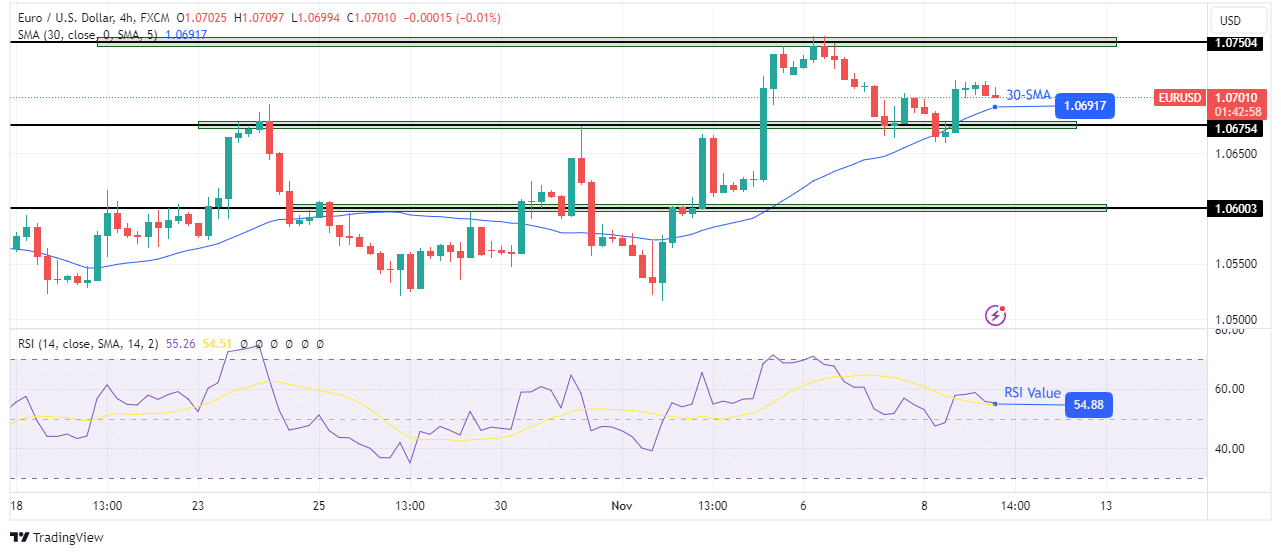

EUR/USD technical outlook: Price rebounds from 30-SMA support.

The EUR/USD price found support at the 30-SMA line and is bouncing higher. Similarly, the RSI is climbing after finding support at the 50 level. Bulls are regaining their momentum after a retracement to the 1.0675 key level.

-Are you looking for the best CFD broker? Check our detailed guide-

The next step for bulls will be to make a new high. It means retesting and breaking above the 1.0750 resistance level. However, if the 1.0750 resistance holds firm, bears will likely retest the 30-SMA support. Still, the bullish bias will stay as long as the price holds above the SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/eur-usd-outlook-euro-rises-on-wings-of-hawkish-ecb/