Decentralized Finance, or DeFi, has emerged as a groundbreaking force in the financial world, transforming traditional notions of banking and investing. This article explores the concept of DeFi, its core principles, and the revolutionary impact it has on democratizing financial services.

Decoding DeFi: A Paradigm Shift in Finance

- Democratizing Finance:

- DeFi represents a paradigm shift from centralized to decentralized financial systems. It aims to democratize access to financial services, providing anyone with an internet connection the ability to participate in a wide array of financial activities without the need for traditional intermediaries.

- Smart Contracts and Automation:

- At the heart of DeFi are smart contracts—self-executing contracts with the terms of the agreement written into code. These contracts automate various financial processes, eliminating the need for intermediaries and reducing the risk of fraud.

- Lending and Borrowing Without Banks:

- DeFi platforms enable users to lend and borrow assets directly from one another, bypassing traditional banking institutions. Smart contracts govern these transactions, ensuring transparent and efficient lending markets.

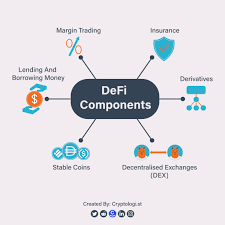

Key Components of DeFi Ecosystem:

- Decentralized Exchanges (DEX):

- DEXs facilitate the peer-to-peer trading of cryptocurrencies without the need for an intermediary. Users retain control of their private keys, enhancing security and eliminating the risks associated with centralized exchanges.

- Liquidity Pools and Yield Farming:

- Liquidity pools allow users to contribute their funds to a pool, earning fees in return. Yield farming involves optimizing returns by moving funds between different liquidity pools, creating opportunities for users to earn additional rewards.

- Decentralized Lending Protocols:

- DeFi lending platforms enable users to lend or borrow digital assets directly from one another. These platforms use smart contracts to automate loan agreements, collateralization, and interest payments.

- Decentralized Stablecoins:

- Stablecoins pegged to fiat currencies, such as USD Coin (USDC) or DAI, play a crucial role in DeFi by providing stability and a familiar unit of account within a decentralized ecosystem.

Challenges and Opportunities:

- Smart Contract Risks:

- While smart contracts automate processes, vulnerabilities in the code can pose risks. Rigorous auditing and continuous development are essential to mitigate potential vulnerabilities.

- Regulatory Uncertainties:

- DeFi operates in a relatively uncharted regulatory landscape. As the sector gains prominence, addressing regulatory concerns and establishing compliance frameworks will be crucial for its long-term success.

The Future of Decentralized Finance:

- Financial Inclusion:

- DeFi has the potential to bring financial services to the unbanked and underbanked populations globally, providing them with opportunities for savings, lending, and investment.

- Innovation and Experimentation:

- The decentralized nature of DeFi fosters innovation. Developers have the freedom to experiment with new financial products and services, pushing the boundaries of what is possible in the financial realm.

Conclusion:

Decentralized Finance is not just a technological advancement; it represents a fundamental shift in the way we think about and interact with financial systems. As the DeFi ecosystem continues to evolve, it holds the promise of creating a more inclusive, transparent, and accessible financial landscape for individuals around the world. Unlocking the power of DeFi means embracing a future where financial services are not just decentralized but are truly democratized, empowering individuals to have greater control over their financial destinies.