The gig economy, characterized by short-term and flexible employment, is experiencing a groundbreaking transformation with the integration of cryptocurrency. As digital currencies become increasingly mainstream, they are reshaping how freelancers, independent contractors, and gig workers perceive and receive their payments. This article explores the intersection of crypto and the gig economy, unveiling the ways in which this synergy is redefining the nature of work and financial transactions.

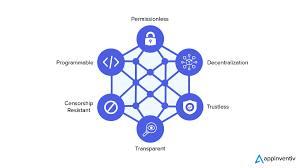

Decentralized Payments:

Cryptocurrencies, built on blockchain technology, offer a decentralized and borderless way of transacting. This eliminates the need for traditional financial intermediaries, providing gig workers with direct, peer-to-peer payment methods. This not only reduces transaction costs but also accelerates the payment process, ensuring that freelancers receive their earnings promptly.

Financial Inclusion for Gig Workers:

The gig economy is often populated by freelancers in regions with limited access to traditional banking services. Cryptocurrencies open new avenues for financial inclusion by offering a digital, accessible, and secure means of receiving and managing payments. Gig workers, regardless of their geographic location, can now participate in the global economy seamlessly.

Currency Agnosticism:

The diverse nature of the gig economy often involves international transactions, exposing workers to the challenges of currency conversions and fluctuating exchange rates. Cryptocurrencies, being currency-agnostic, enable gig workers to receive payments in a universal digital currency, mitigating the complexities associated with cross-border transactions.

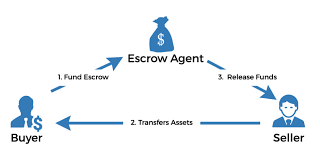

Smart Contracts and Escrow Services:

Blockchain’s smart contract capabilities have the potential to revolutionize the gig economy by automating contract execution. Smart contracts ensure that agreed-upon terms are automatically enforced when conditions are met, providing a trustless and efficient system for gig workers and employers. Escrow services powered by blockchain also enhance trust by holding funds until services are delivered as per the contract.

Reducing Payment Friction:

Traditional payment systems are often burdened by fees and delays, impacting the cash flow of gig workers. Cryptocurrencies, with low transaction fees and near-instant settlement times, reduce payment friction, empowering gig workers to better manage their finances and plan for their futures.

Volatility Concerns:

While the benefits are evident, the volatility of cryptocurrency prices poses a challenge for gig workers who prefer stability in their earnings. Stablecoins, pegged to fiat currencies, offer a potential solution by providing the advantages of cryptocurrencies without the price volatility.

Regulatory Landscape:

The integration of crypto into the gig economy is accompanied by regulatory considerations. As governments grapple with how to regulate digital currencies, gig workers and employers seek clarity on tax implications and legal frameworks to ensure compliance.

Conclusion:

The synergy between cryptocurrency and the gig economy is emblematic of a digital future where work and payments are seamlessly integrated into a decentralized, efficient, and inclusive ecosystem. As gig workers navigate this evolving landscape, the potential for financial empowerment, reduced friction in transactions, and increased autonomy over one’s earnings positions cryptocurrency as a transformative force, reshaping the very fabric of work and payments in the gig economy.