The evolution of cryptocurrency has not only disrupted traditional financial landscapes but also holds immense potential for transforming the way we conduct cross-border payments. In this article, we delve into the exciting realm of crypto and explore how it is shaping the future of cross-border transactions.

Inefficiencies in Traditional Cross-Border Payments:

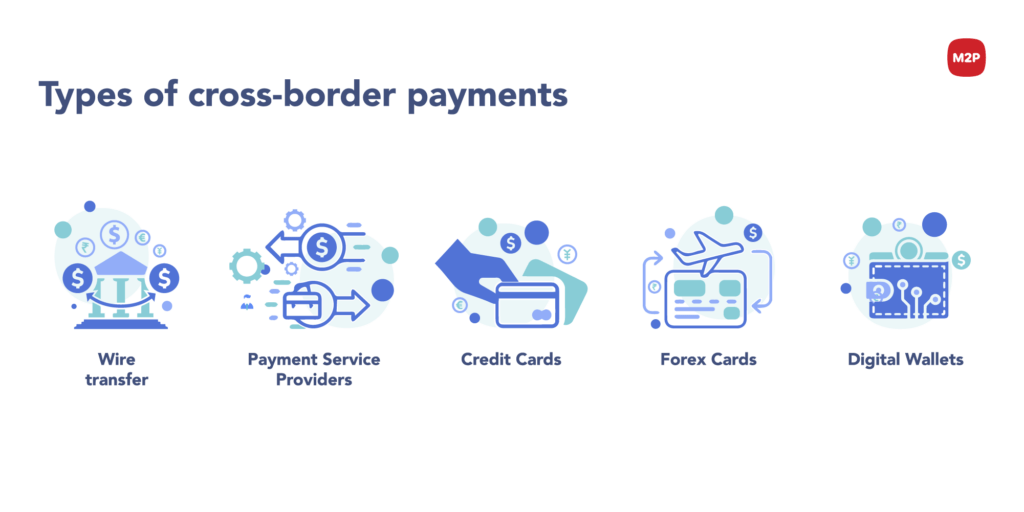

Traditional cross-border payments are often marred by inefficiencies, including high fees, lengthy processing times, and currency exchange complications. These challenges have spurred the need for innovative solutions, and cryptocurrencies have emerged as a promising alternative.

Decentralization and Peer-to-Peer Transactions:

Cryptocurrencies operate on decentralized blockchain technology, enabling peer-to-peer transactions without the need for intermediaries like banks. This decentralization eliminates the delays associated with traditional banking systems, offering a faster and more efficient way to transfer funds across borders.

Reducing Costs and Fees:

One of the most compelling aspects of using crypto for cross-border payments is the potential for substantial cost savings. Traditional financial institutions often charge hefty fees for international transfers, which can be a significant burden for businesses and individuals alike. Cryptocurrencies, with their lower transaction costs, have the potential to revolutionize the cost structure of cross-border transactions.

Borderless Nature of Cryptocurrencies:

Cryptocurrencies operate on a global scale without regard to national borders. This borderless nature makes them particularly well-suited for cross-border transactions, eliminating the need for complex and time-consuming currency conversions. Cryptocurrencies facilitate seamless international transactions, fostering financial inclusivity and accessibility.

Blockchain Security and Transparency:

The underlying blockchain technology ensures the security and transparency of crypto transactions. Each transaction is recorded on an immutable ledger, providing a tamper-resistant record of all activities. This not only reduces the risk of fraud but also enhances trust between parties involved in cross-border transactions.

Financial Inclusion:

Cryptocurrencies have the potential to bring financial services to the unbanked and underbanked populations around the world. In regions where traditional banking infrastructure is limited, cryptocurrencies offer a decentralized and accessible solution, empowering individuals with the ability to participate in the global economy.

Regulatory Landscape:

As the popularity of cryptocurrencies grows, regulatory frameworks are evolving to accommodate this emerging technology. Clarity in regulations can provide a sense of security for businesses and users involved in cross-border crypto transactions. A balanced regulatory approach is essential to foster innovation while addressing concerns related to security and compliance.

Challenges and Opportunities:

While the potential benefits of using crypto for cross-border payments are substantial, challenges such as regulatory uncertainties, market volatility, and technological scalability must be addressed. Overcoming these challenges presents opportunities for collaboration between the crypto industry, financial institutions, and regulatory bodies to create a robust and sustainable framework for the future of cross-border payments.

Conclusion:

Cryptocurrencies are ushering in a new era for cross-border payments, offering speed, efficiency, and accessibility that traditional systems struggle to match. As technology continues to advance and regulatory frameworks mature, the crypto landscape is poised to play a pivotal role in shaping the future of global transactions. Embracing this evolution presents exciting possibilities for a more connected, efficient, and inclusive global financial ecosystem.