- Australian business conditions stayed stable in October.

- Consumer confidence in Australia declined following last week’s rate hike.

- Traders are focused on US inflation figures scheduled for later on Tuesday.

A bearish sentiment took hold in the AUD/USD price analysis as the Australian economic data release could not impress the buyers. Australian business conditions stayed stable in October. Meanwhile, consumer confidence declined following last week’s rate hike by the Reserve Bank of Australia.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

The National Australia Bank (NAB) survey indicated a 1-point business condition index increase to +13 in October. On the other hand, confidence dropped by 2 points to -2. Although the survey revealed a slight drop in cost pressures in October, the levels remained high.

Labor cost growth and purchase costs eased to a quarterly rate of 1.8%, while retail price growth maintained a quarterly pace of 1.9%. However, overall price growth decreased to its lowest since mid-2020 at 1.0%.

At the same time, traders were focused on US inflation figures scheduled for later on Tuesday. Recent statements from Fed policymakers contradicted market expectations that the Fed had concluded its aggressive rate-hike cycle.

NAB’s Catril commented, “Overall, the market is also worn out by all messages coming from central banks. Moreover, the higher-for-longer and wait-and-see mode is keeping volatility low.” Furthermore, Catril highlighted the importance of the upcoming CPI number. “We need to wait for that CPI number tonight, which could be a bit of a shaker. If it’s strong, then obviously it brings in the idea that another rate hike from the Fed is possible.”

AUD/USD key events today

It will be a volatile day for the pair as the US will release a major economic report:

- The US CPI report.

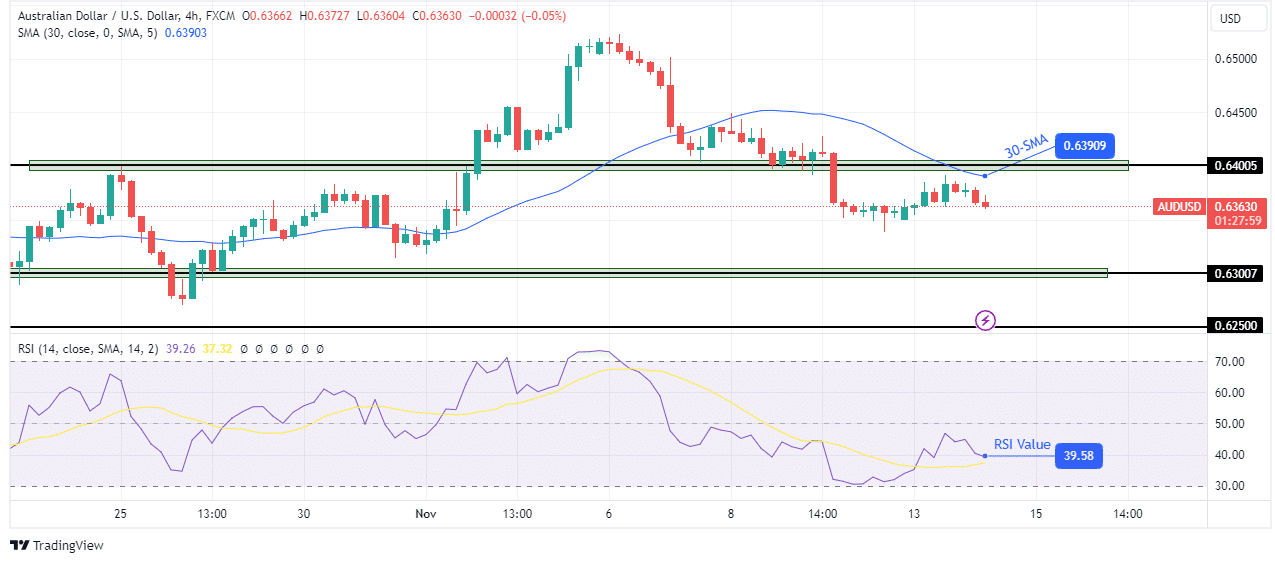

AUD/USD technical price analysis: Bears set sights on the 0.6300 support.

The bias for AUD/USD is bearish as the price descends below the 30-SMA. The change from bullish to bearish came when the price broke below the 30-SMA. Furthermore, it strengthened after bears breached the 0.6400 key level to make new lows.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

Looking at the RSI, there is solid bearish momentum as it sits below the 50 level. The price recently pulled back toward the 30-SMA resistance. However, the rebound was weak, and bears seem ready to resume the downtrend. Moving forward, bears will target the 0.6300 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/aud-usd-price-analysis-aussie-slides-after-mixed-data/