- Last quarter’s inflation beat expectations, prompting financial markets to anticipate one more rate RBA hike.

- Major Australian banks anticipate a 25 basis point rate increase from the RBA.

- There was a resurgence in house prices in Australia.

The AUD/USD outlook shines bright as a recent Reuters poll illuminated anticipation of a 25 basis point RBA rate rise to 4.35% this Tuesday. Consequently, the bulls are charging confidently ahead. This move is due to unexpectedly strong inflation.

-If you are interested in automated forex trading, check our detailed guide-

Notably, last quarter’s inflation surpassed expectations. Consequently, it surprised policymakers and prompted financial markets to anticipate one more rate hike from the Reserve Bank of Australia.

Furthermore, if this materializes, it will mark the first rate hike under the leadership of Michele Bullock, the governor of the RBA. She has stated that the central bank will raise rates further in the event of a significant upward revision to the inflation outlook.

Moreover, major Australian banks anticipate a 25 basis point rate increase from the RBA in the upcoming week. Madeline Dunk, an economist at ANZ, believes that the potential for additional RBA moves is higher. If a hike occurs in November, it is more likely that there will be another rate increase rather than cuts in the near future.

Additionally, there was a resurgence of house prices in Australia, approaching previous peaks. It suggests that the RBA’s 400 basis point policy tightening has had a limited impact on the robust property market.

However, the expected RBA rate hike contrasts with the wait-and-see approach taken by most of its global counterparts.

AUD/USD key events today

Investors will keep an eye on key events from the US, including:

- The nonfarm payrolls report.

- The US unemployment report.

- The S&P Global services PMI

- The ISM non-manufacturing PMI.

AUD/USD technical outlook: Market dynamics shift as AUD/USD bulls dominate

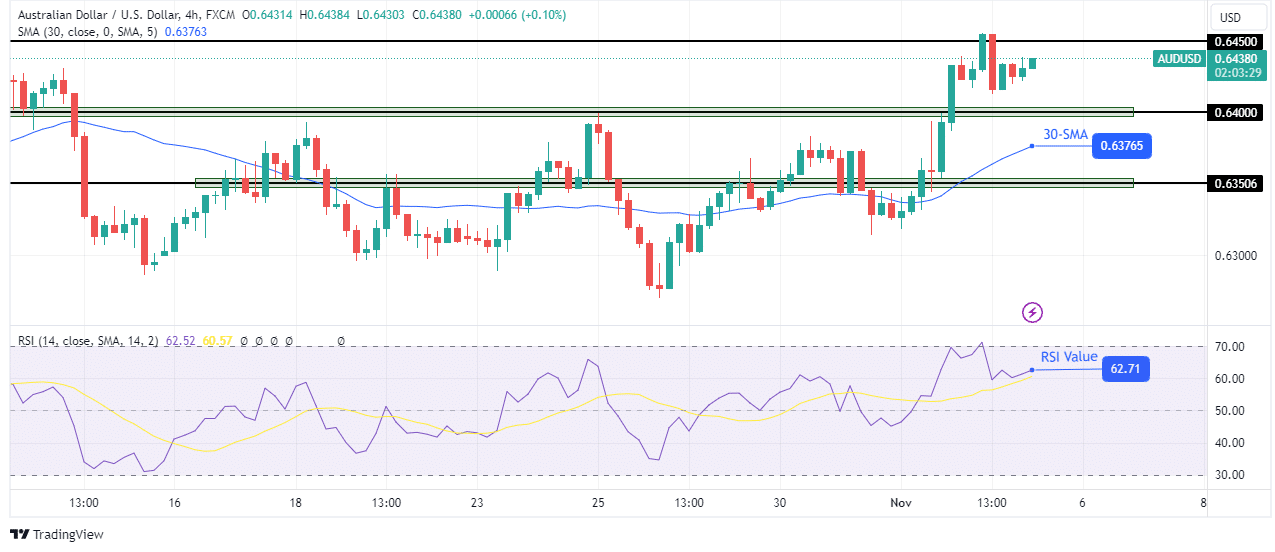

After moving sideways for a long time, AUD/USD bulls finally took charge. As such, the bias for the pair is now bullish, with the price well above 30-SMA and the RSI above 50. Bulls took control with strong bullish candles that pushed the price above the 0.6400 resistance level.

If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

However, this new bullish move has paused at the 0.6450 resistance level, where bears have shown some strength. Bears might push for a retest of the 0.6400 level as support. Nevertheless, a bullish bias will remain if the price stays above the 30-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/aud-usd-outlook-australias-key-policy-rate-set-to-rise/