- The US dollar index has increased for three weeks in a row.

- There is a 16% possibility of a 50bps Fed rate hike in March.

- BOJ’s Kuroda believes that wage growth will pick up amid high costs of living.

Today’s USD/JPY price analysis is bullish. Haruhiko Kuroda, governor of the Bank of Japan, said on Tuesday that wage growth will likely pick up speed as businesses raised wages to help households make up for rising living expenses and address a growing labor shortage.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Addressing lawmakers, Kuroda added that the central bank’s monetary policy will continue to be guided by a close examination of currency market movements and their effects on the Japanese economy.

On Tuesday, the dollar was trading below recent highs as a three-week rally fizzled and traders sat on the sidelines awaiting economic data to determine whether further dollar gains were justified.

The dollar’s gain so far this month has been propelled by strong US labor market figures and persistent inflation; the next move will be determined by Tuesday’s US manufacturing data and Friday’s core PCE price index.

The US dollar index has been on the rise for three weeks in a row, increasing by nearly 1.7% so far in February, but it has since stabilized at 103.86, going down from a six-week high of 104.67 reached on Friday.

Kit Juckes, a strategist at Societe Generale, said that more dollar strength will need the Fed Funds futures market to start pricing in a 50 bps rate hike in March. Currently, the Fed funds futures indicate a 16% possibility of that.

USD/JPY key events today

Investors are expecting the existing home sales index which keeps track of the annualized number of existing residential buildings sold in the previous month.

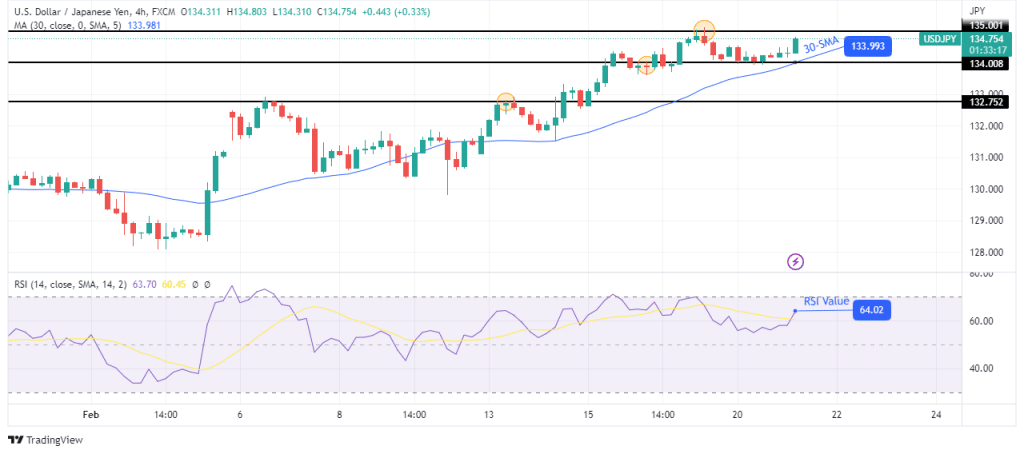

USD/JPY technical price analysis: Bulls are gearing up to take out the 135.00 resistance

The 4-hour chart shows USD/JPY bouncing off a strong support zone consisting of the 134.00 key level and the 30-SMA. The current trend is bullish as the price is trading above the 30-SMA and the RSI above 50. Bulls have consistently made higher highs and higher lows, a sign that the trend is strong.

–Are you interested in learning more about making money with forex? Check our detailed guide-

If bulls keep control, the price will take out the 135.00 resistance and make a new high. However, if bears get stronger at the 135.00 level, the price will break below the 30-SMA and head for the 132.75 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Source: https://www.forexcrunch.com/usd-jpy-price-analysis-rally-pauses-as-investors-await-data/