- Chinese consumer inflation remained almost unchanged last month.

- The annual increase in US consumer prices in April dipped below 5%.

- Investors expect the Fed to pause before cutting interest rates in September.

Today’s USD/JPY outlook is slightly bullish. The dollar increased on Thursday after more evidence of a weak post-COVID recovery in China, which clouded the global economic outlook.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

Based on recent data, Chinese consumer inflation remained almost unchanged last month. This data indicates that the post-COVID economic recovery in China is slower than anticipated and may require additional stimulus measures. This follows earlier reports this week that showed a surprising drop in imports.

The dollar fell against the yen on Wednesday as inflation slowed more than expected last month. According to the US Labor Department, the annual increase in consumer prices in April fell under 5% for the first time in two years. This drop could incentivize the Federal Reserve to pause interest rate hikes next month.

However, rates may need to stay high to tame inflation, which remains above the Fed’s 2% target.

Traders in Fed funds futures markets expect the Fed to pause before cutting interest rates in September. However, Amo Sahota, the director at Klarity FX in San Francisco, thinks the markets’ forecast of an almost 80-basis-point cut by the end of 2023 seems overly optimistic.

On Thursday, the US will release data on initial jobless claims and producer prices, which could confirm the recent signs of a slowing labor market and decreasing inflationary pressures from wages.

USD/JPY key events today

Investors will get more clarity on the state of the US labor market and inflation when the US releases the initial jobless claims and the producer price index reports.

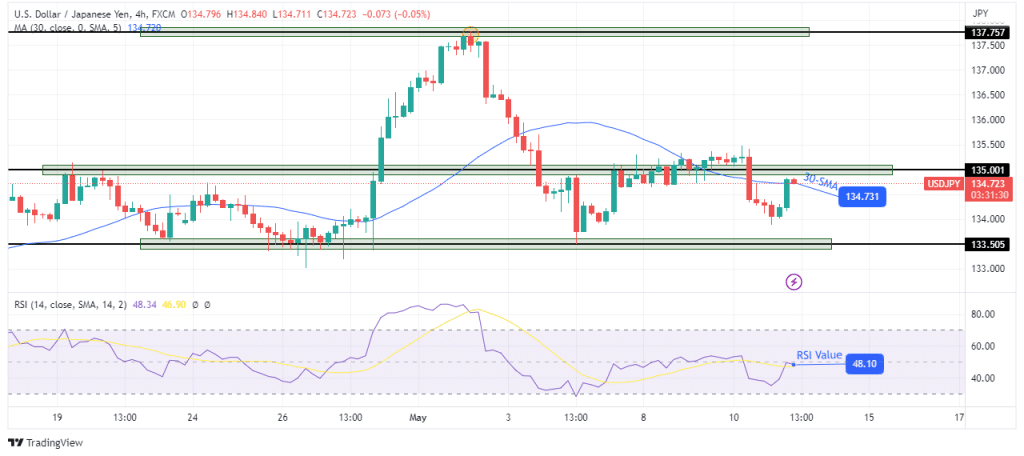

USD/JPY technical outlook: Bulls looking for 135.0 breakout

USD/JPY is trading near the 30-SMA after a strong bullish candle. However, the bias in the 4-hour chart is still bearish. The price has not yet broken above the SMA, and the RSI is still below 50. At the same time, the price has failed to trade above the 135.00 key resistance level.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

Bulls are currently challenging bears at the 30-SMA resistance. They can only take over control if the price breaks above the SMA and the 135.00 level. Otherwise, the price will soon fall to retest the 133.50 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Source: https://www.forexcrunch.com/usd-jpy-outlook-dollar-shines-on-clouded-global-outlook/