- Inflation increased in the US, but retail sales decreased.

- First Republic Bank announced that it would suspend dividend payments.

- Investors expect the Federal Reserve will likely restrict its aggressive rate hike trajectory.

The USD/CAD weekly forecast is slightly bearish as a dovish Fed will likely hurt the dollar. Meanwhile, the banking crisis may further weigh on the USD.

Ups and downs of USD/CAD

-If you are interested in forex day trading then have a read of our guide to getting started-

According to figures released last week, inflation increased in the US, but retail sales decreased. Initial unemployment claims in the US decreased, indicating a tight work market.

Nonetheless, the news releases overshadowed a rising banking crisis and a looming recession.

SVB Financial Group announced that it would seek Chapter 11 bankruptcy protection is the most recent development. The banking crisis started with the fall of Silicon Valley Bank and Signature Bank.

Due to liquidity worries, Europe has also been dragged into the crisis after Credit Suisse shares dropped. In the US, First Republic Bank saw its share price fall by 32.8% after it announced that it would suspend dividend payments.

All these contributed to the volatility in the pair last week.

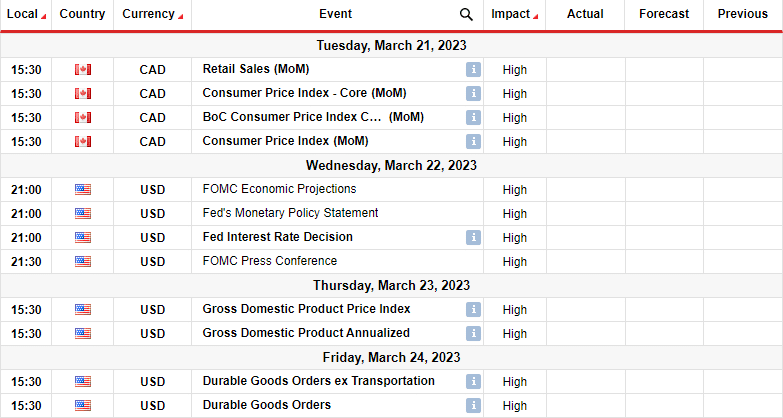

Next week’s key events for USD/CAD

Following Silicon Valley Bank’s and Signature Bank’s failures, investors expect the Federal Reserve will likely restrict its aggressive rate hike trajectory to prevent aggravating financial system stress.

The dollar could fall if there are indications that the central bank will prioritize financial stability and postpone or pause its rate increases.

In contrast to the hawkish forecasts that prevailed earlier this month, futures markets currently show investors assigning a 60% likelihood of a 25 basis point rate hike at the Fed’s March 21–22 meeting.

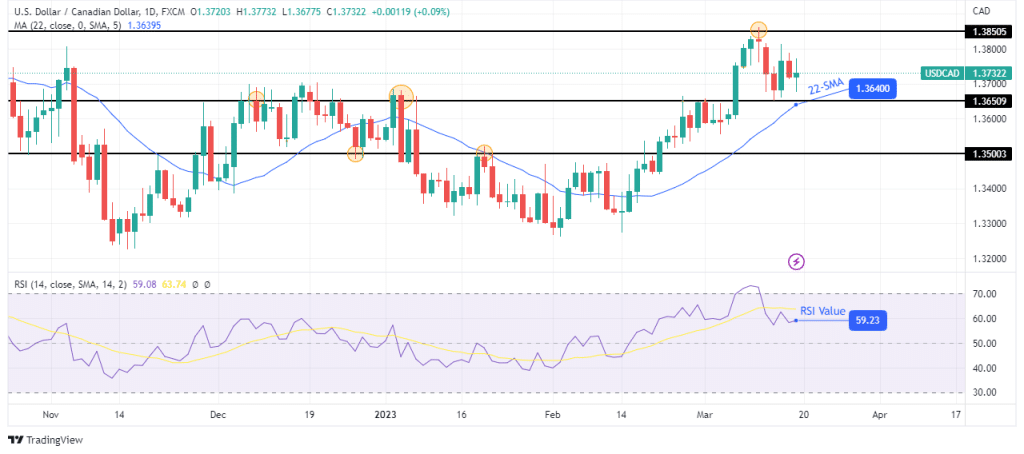

USD/CAD weekly technical forecast: Price is trading near the pivotal 1.3650 support

The daily chart shows USD/CAD in an uptrend, with the price making higher highs and higher lows. The price also trades above the 22-SMA, with the RSI staying above 50, a sign that bulls are in charge and have strong momentum.

-Are you looking for automated trading? Check our detailed guide-

The price is pulling back from the recent high at 1.3850 and has retested the 1.3650 support. It also trades near the 22-SMA, which offers strong support. The bulls might get back in and take out the 1.3850 resistance.

However, if bears break below the strong support zone in the coming week, we might see a shift in sentiment. The price will likely fall to the 1.3500 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/usd-cad-weekly-forecast-less-aggressive-fed-to-hurt-the-dollar/