- The Federal Reserve is getting close to pausing its tightening program.

- The Fed increased rates by a quarter of a percentage point.

- The sharp rise in mortgage rates hurt Canada’s housing market.

Today’s USD/CAD outlook is bearish. On Wednesday, investors applauded the Federal Reserve’s indication that it is getting close to pausing its tightening program. This helped the Canadian currency gain strength against its American counterpart.

-If you are interested in forex day trading then have a read of our guide to getting started-

The Fed announced it was about to halt additional increases in borrowing prices due to recent instability in the financial markets. It, however, increased interest rates by a quarter of a percentage point.

At a policy meeting earlier this month, the Bank of Canada decided to take a step back. The meeting’s minutes revealed that the central bank was concerned that inflation would continue to stay above its 2% objective. Additional tightening of monetary policy might be necessary.

Since then, the money markets have changed their expectations from future rate increases to rate decreases.

According to the CME FedWatch tool, markets are currently pricing in a 35% chance of a 25-bps rise and a 65% chance of the Fed halting at its upcoming meeting in May.

It is less likely that markets will return to fearing that upbeat economic data will push rates higher due to the Fed’s change in stance.

According to domestic data, Canada’s housing market was hurt by the sharp rise in mortgage rates during the previous year. New home prices fell 0.2% month over month in February after falling similarly in January.

One of Canada’s main exports, oil, saw a 1.8% increase in price to $70.90 a barrel, supported by a falling US currency.

USD/CAD key events today

There will be housing and employment data from the US. Investors will receive the building permits, new home sales, and initial jobless claims reports.

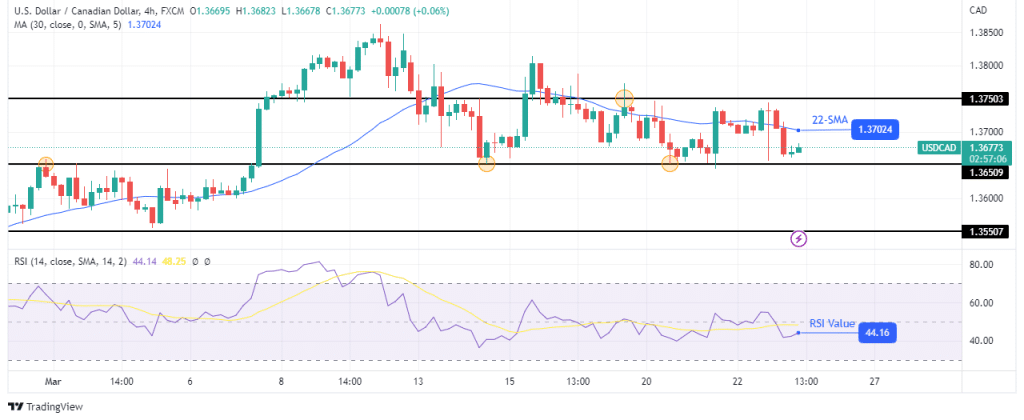

USD/CAD technical outlook: Approaching the 1.3650 support

The 4-hour chart shows USD/CAD trading below the 30-SMA with the RSI below 50, indicating that bears are in control. The price has been moving sideways, although staying mostly below the 30-SMA. It oscillates with resistance at 1.3750 and support at 1.3650.

-Are you looking for automated trading? Check our detailed guide-

The price is currently approaching the 1.3650 support level. The price will break below or bounce higher at this level and continue the sideways move. A break below would likely lead to a retest of the 1.3550 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/usd-cad-outlook-fed-raises-rates-but-signals-looming-pause/