On 12th April 2023, the Ethereum network underwent a major upgrade with the Shanghai/Capella hardfork, which enabled the withdrawal of ETH funds staked for the Proof-of-Stake consensus mechanism. After more than two years, stakers are finally able to receive accumulated rewards, exit their staked positions, or initiate changes to their staking setup.

Contrary to popular belief, the Ethereum market did not appear shaken by these fund becoming liquid after the upgrade. Instead, prices climbed to $2,110 in the week afterwards, before reverting back to $1,920, likely driven by the general decline across the digital asset market.

In this week’s edition, we will follow up on our pre-Shanghai report where we attempted to gauge the degree of true sell-side pressure expected, which we estimated to be around 170k ETH. In this report, we will assess what has actually happened since the upgrade, with a focus on the balance of withdrawals, deposits, and the entities initiating them.

Reassessing Our Predictions

In our last report, we came up with three possible scenarios of what may happen post-Shanghai, based on our assessment of the technical characteristics of Proof-of-Stake, as well as the history of development in the staking industry.

The final amount of unstaked ETH is not only determined by the demand for exits, but furthermore by two technical mechanisms, the withdrawal types, and the Churn Limit. In this report, we will briefly recap how both work, for a more detailed explanation please consult the previous (WoC 15).

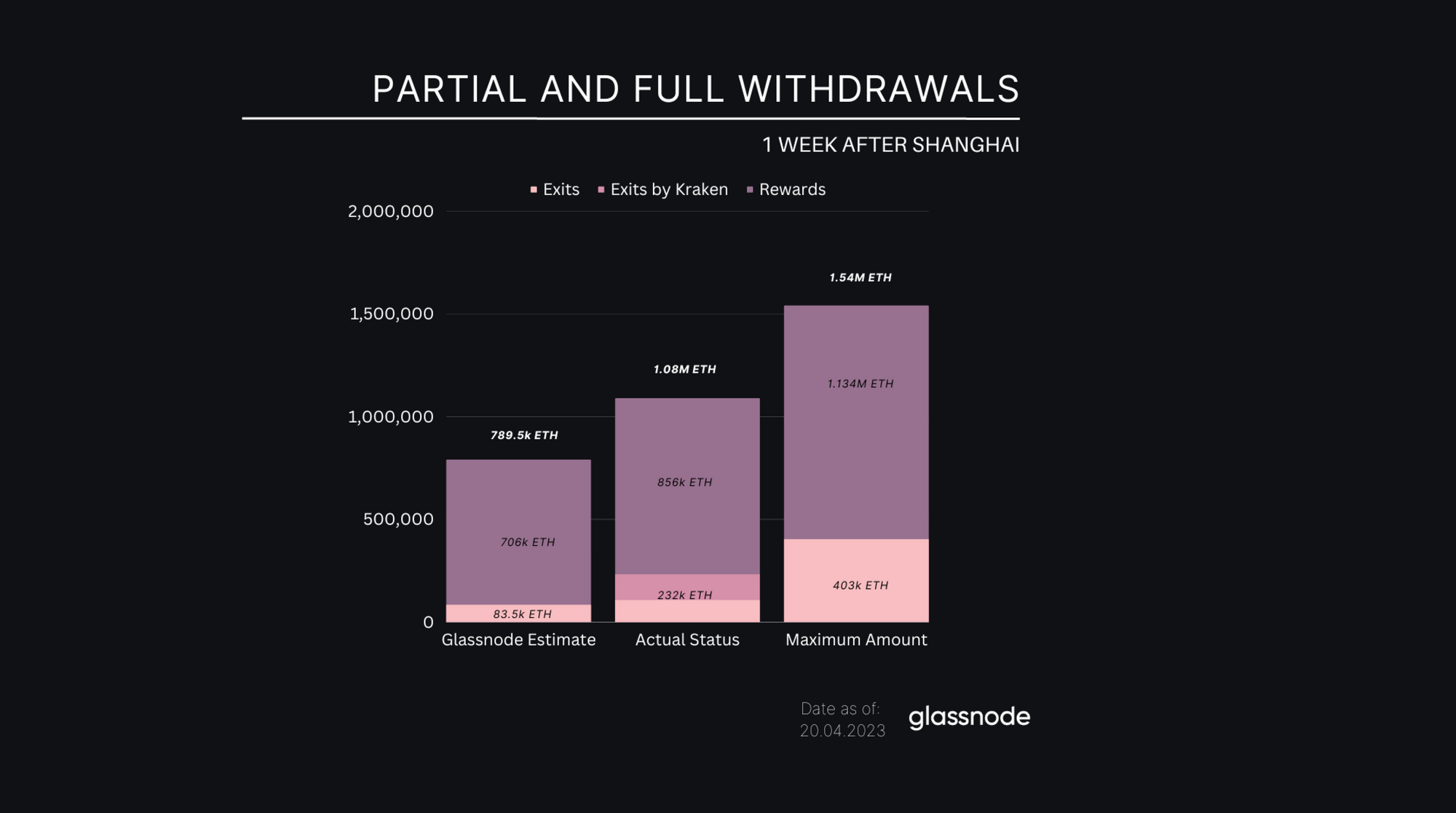

We estimated both how much stake would be withdrawn (789.5k ETH) during the week following the Shanghai/Capella update, and the volume likely to be sold (170k ETH). Our total withdrawal estimate turned out to be too conservative, as we did not expect the exchange Kraken to exit 125,088 ETH within the first week, amidst pressure from the SEC to close down its US-based staking service.

The actual numbers are between our estimate and the maximum possible amount. During the first week, 856k ETH rewards and a total of 232k ETH have been unstaked. Partial withdrawals accounted for 80% of the total amount of released ETH.

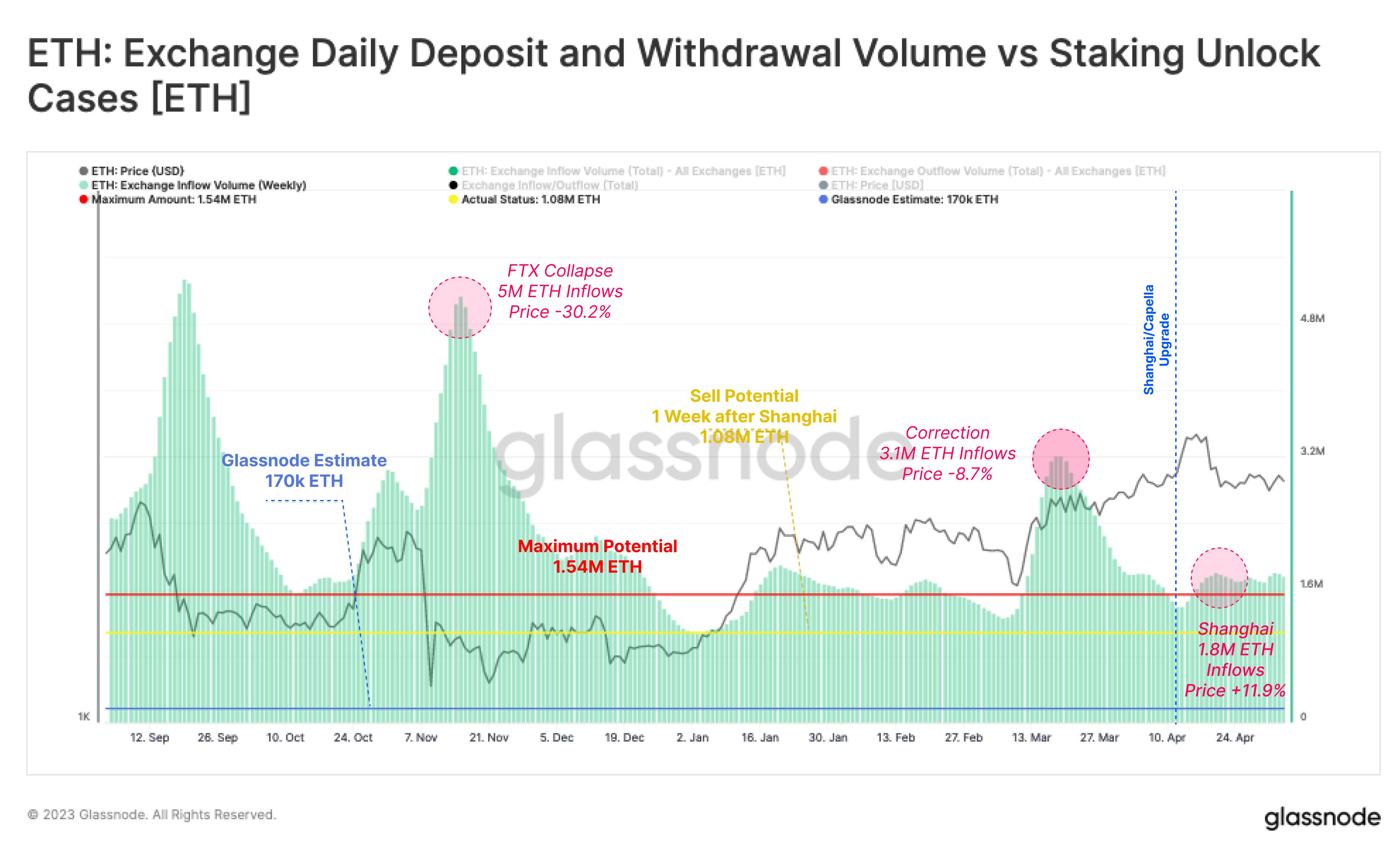

When examining how much of this withdrawn stake that was actually sold, we can consult the average weekly exchange inflows over the same period. We can see that there was no appreciabe increase in inflow volume, with up to 1.8M ETH of exchange inflows in the first seven days after the upgrade. These numbers are much smaller compared to other major ‘sell-side’ events in the past, and very much in line with typical inflow patterns.

Based on this, we can confidently say that our expectations were accurate, in that the Shanghai sell-side pressure did not lead to an appreciable increase in day-to-day trade volumes.

Exited Stake to Exceed Rewards

The upgrade introduced two types of withdrawals: partial and full withdrawals. In partial withdrawals, the rewards of each validator are automatically withdrawn and transferred to the owner’s account on the Ethereum mainnet every 4.5 days. Full withdrawals occur when a staker decides to shut down their validator(s) and retrieve their staked ETH capital.

To initiate a full withdrawal, the staker must manually sign an exit message, enter an exit queue, and wait for around 1 day before the unstaked ETH is withdrawn via the same automatic skimming process that takes up to 4.5 days. In addition to voluntary exits, there are also forced exits called slashing.

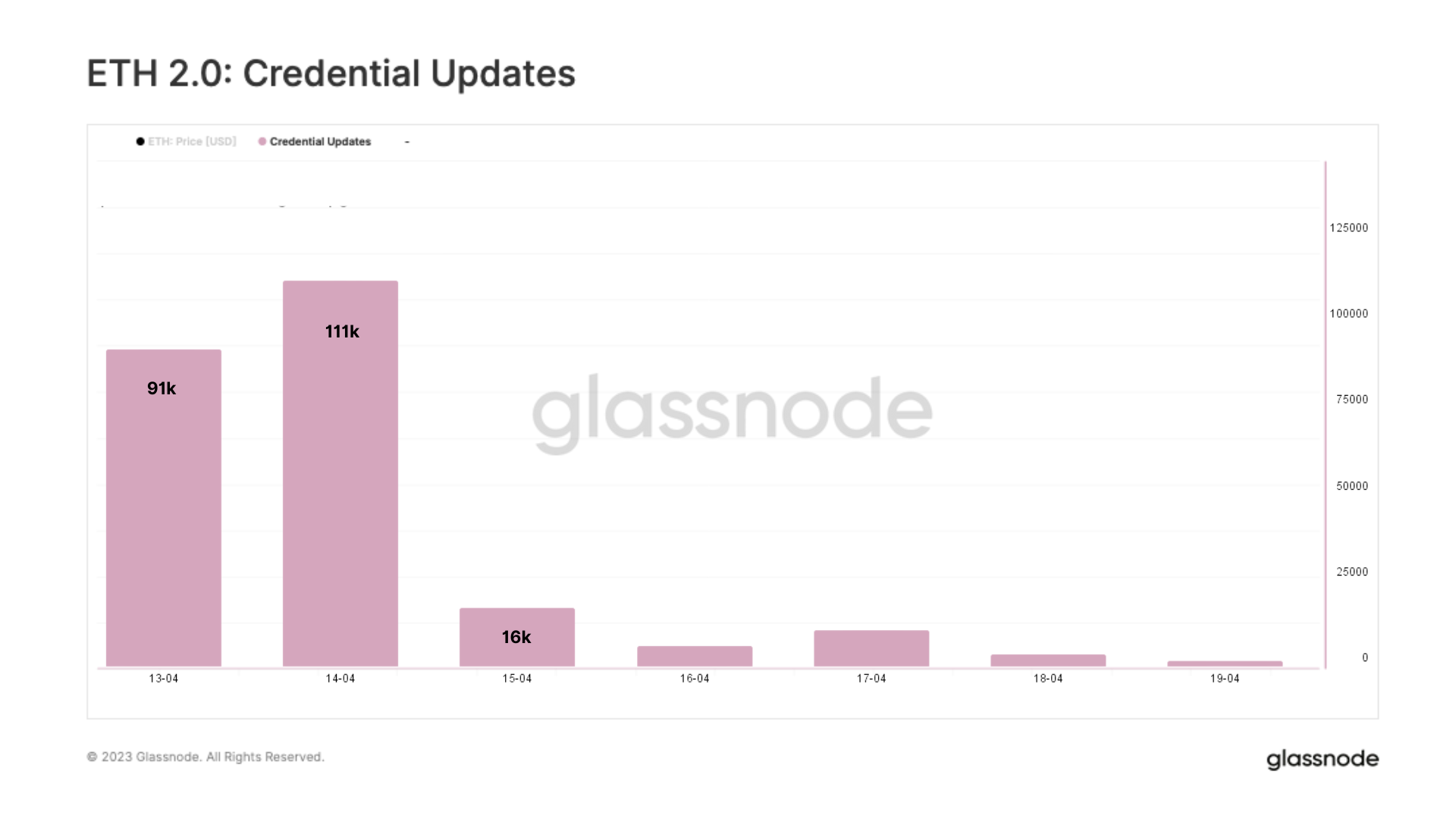

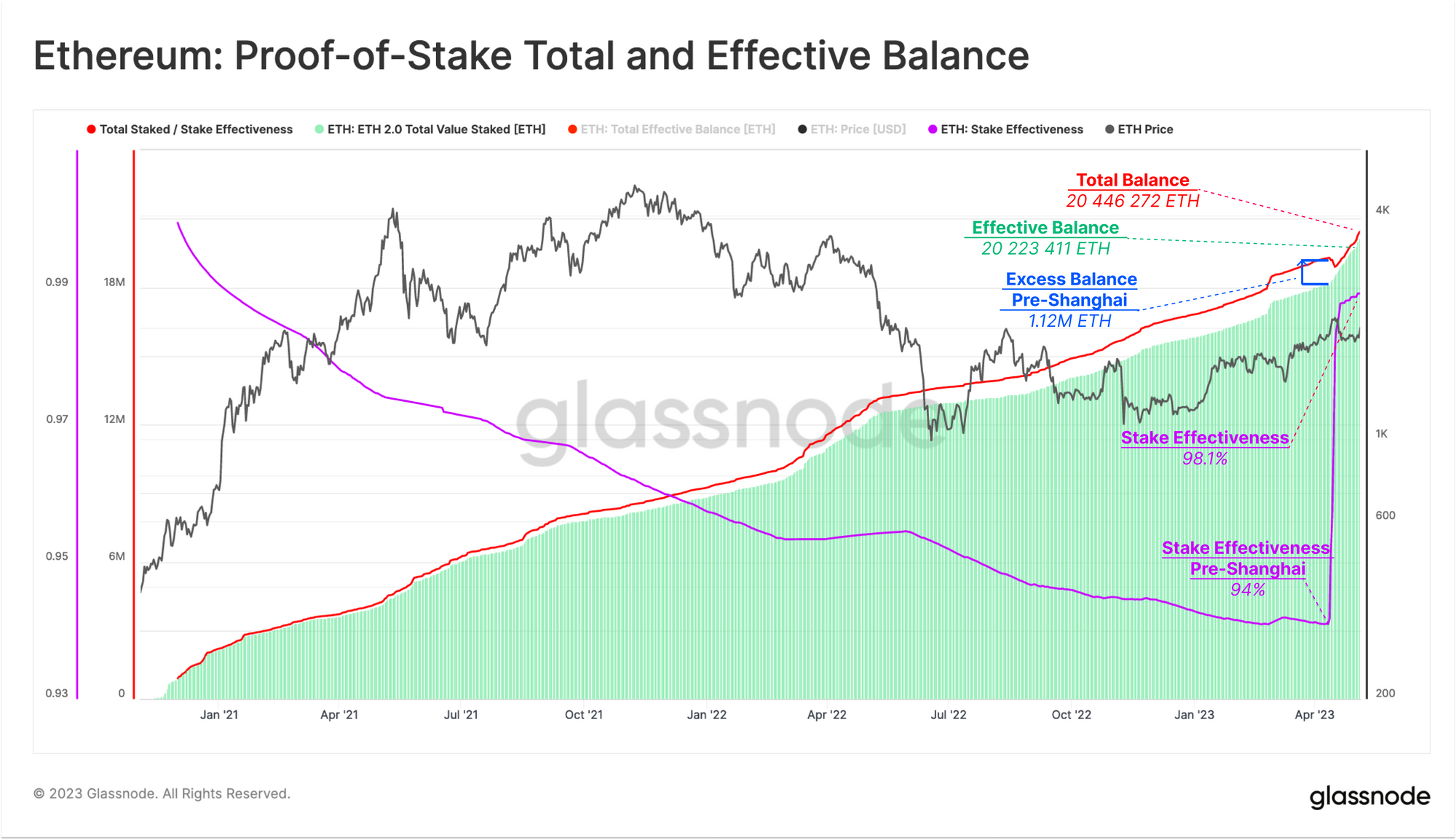

To receive rewards from the staking pool, around 300k of the stakers were required to update their withdrawal credentials. In the first week, 85% of the missing credentials were updated, with more than 200k credential updates during the first two days. Currently, we are closer to the maximum amount, with 98% of credentials updated.

As a result, the withdrawal process for both partial and full withdrawals is now taking closer to 4.5 days, which was the intended timeframe according to the protocol design. For a more detailed explanation on this, please refer to our previous report.

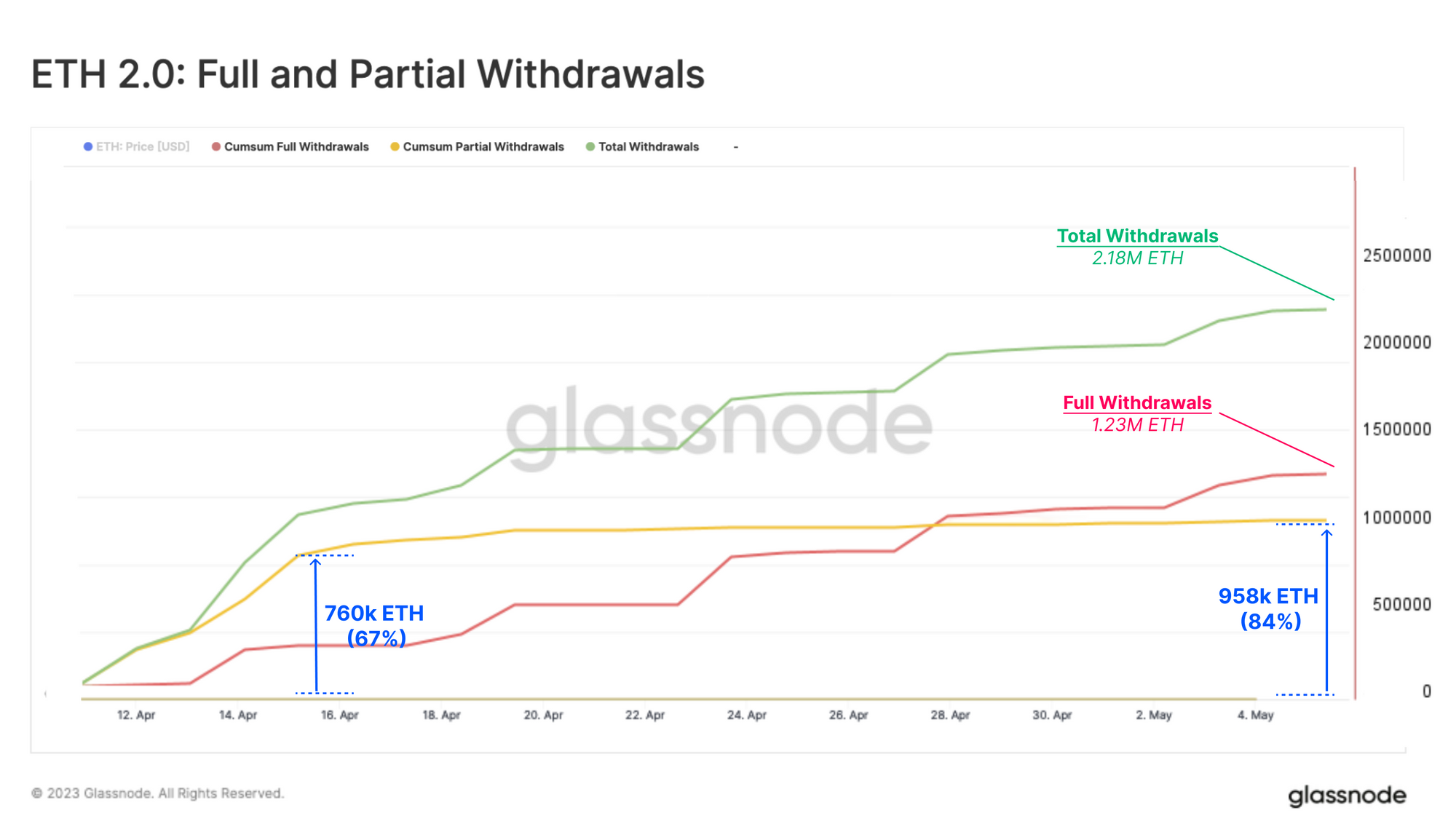

At first, the unstaked ETH consisted to a large degree of partial withdrawals, as all accumulated rewards were released all at once. To date, 84% of the accumulated staking rewards have been withdrawn, with the remaining 16% attributed to missing credential updates.

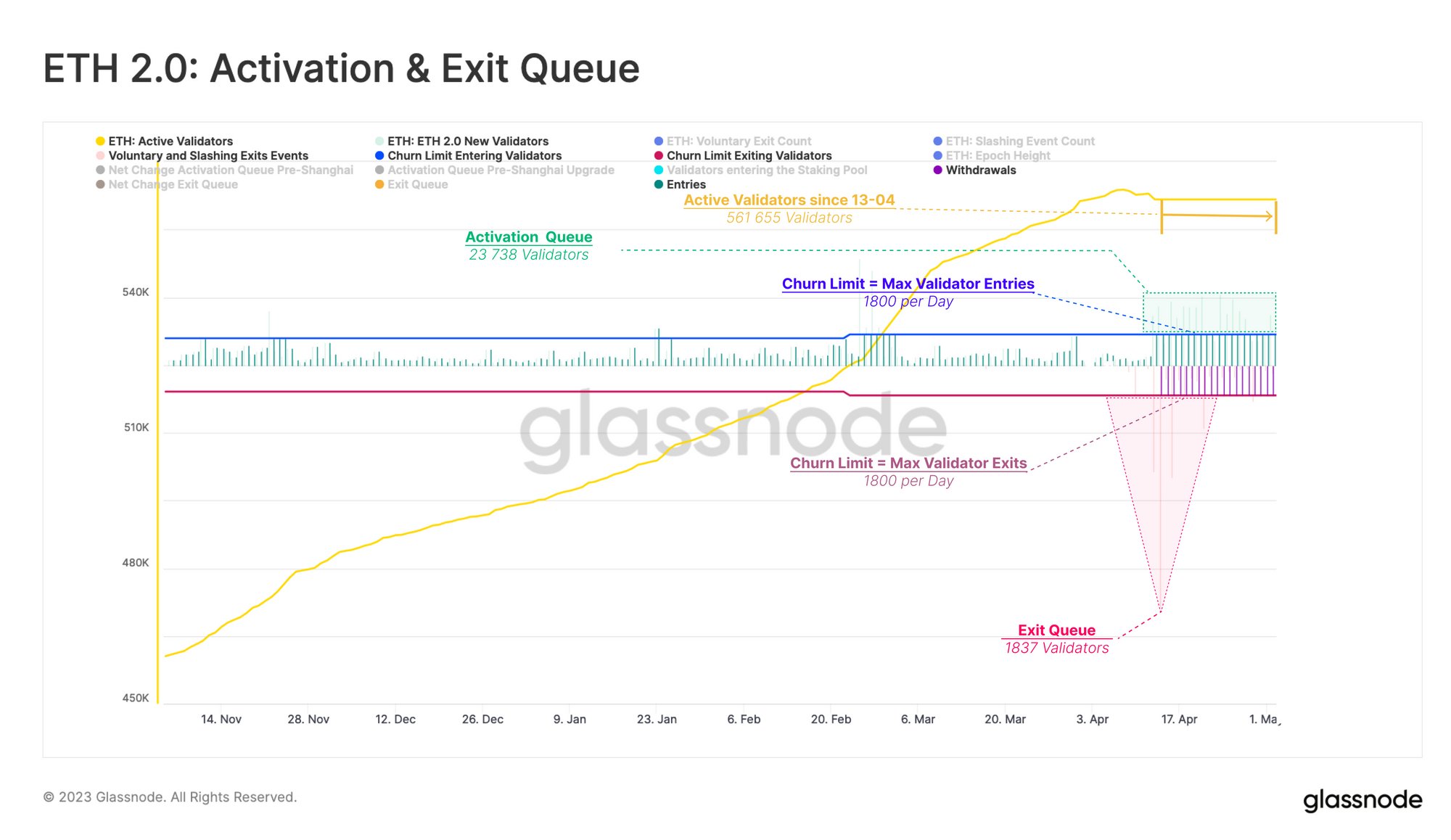

The number of full withdrawals is determined by the number of validators exiting, which is then constrained by the Churn Limit. This limit currently sits at 1800 validators (57,600 ETH), and is applicable to both entering, and exiting validators.

After the upgrade, the demand for exits immediately maxed out, with stake being withdrawn capped at 57,600 ETH. Since 28th April, the cumulative sum of exited stake has exceeded that of withdrawn rewards. This is an interesting development, as many analyses focused mainly on rewards as the main source of ETH sell-side pressure, however full withdrawals have overtaken partial in terms of unstaked volume.

Refinding Equilibrium

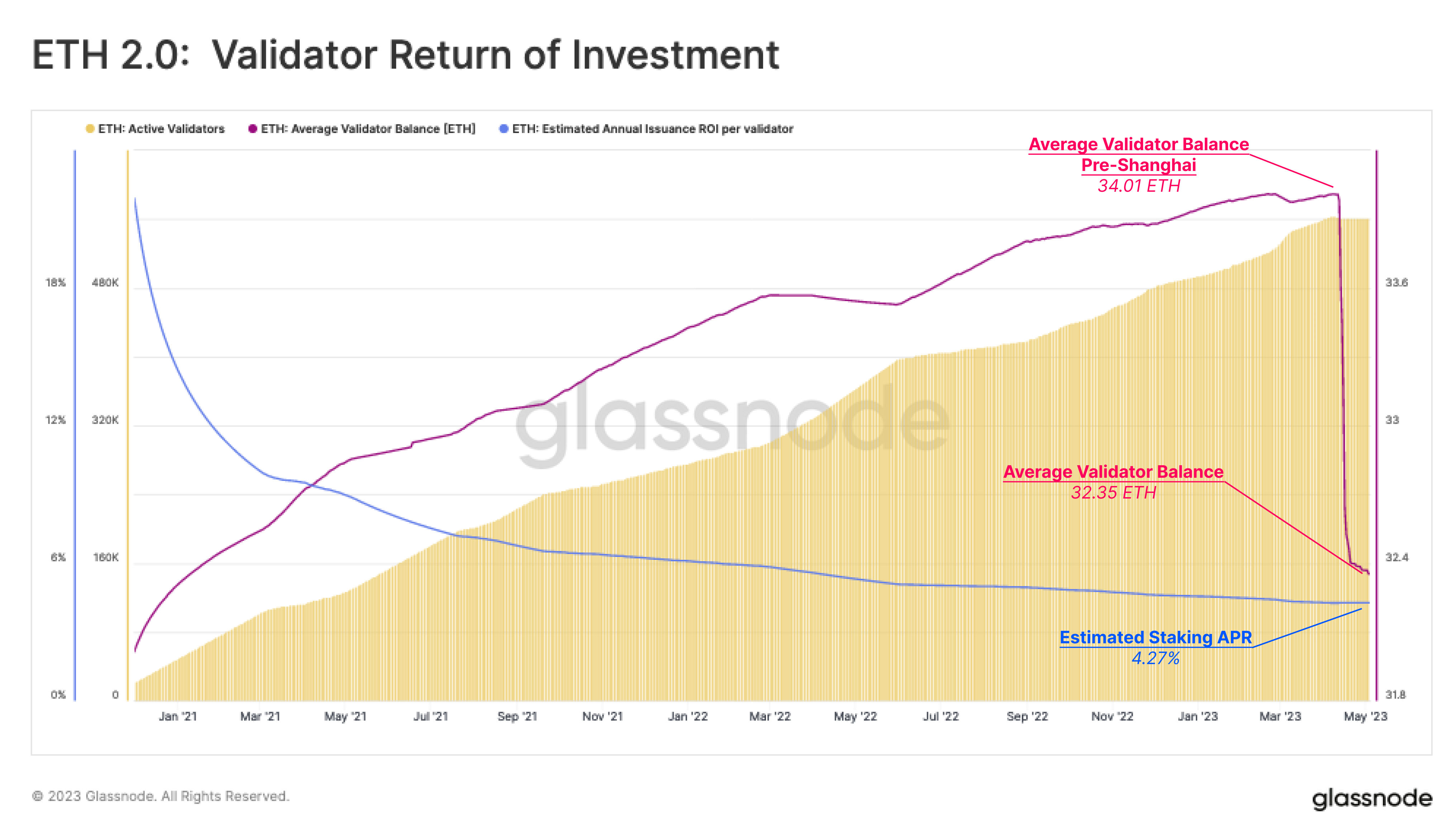

The estimated annual percentage rate (APR) for validators is negatively correlated with the number of active validators. With 561k validators currently in the staking pool, the estimated APR is 4.27%.

The staking protocol limits the maximum effective balance to 32 ETH, meaning that any rewards added to a validator’s balance and could not be redeployed until the upgrade. The average balance per validator before the upgrade had risen to 34 ETH as a result, with 2 ETH left effectively inactive.

Following the upgrade and the first round of automatic reward withdrawals, the average balance has now declined to 32.39 ETH, where we expect it to remain around from now on, as rewards are automatically transferred back to the staker.

Regularly skimming and transferring rewards back to the Ethereum mainnet will act to increase the effectiveness of stake. The ineffective balance has reduced from 1.12M ETH Pre-Shanghai to 223k ETH today, and as a result, we now see that 98.1% of the stake is efficiently used to secure the network.

The Path of Exited Stake

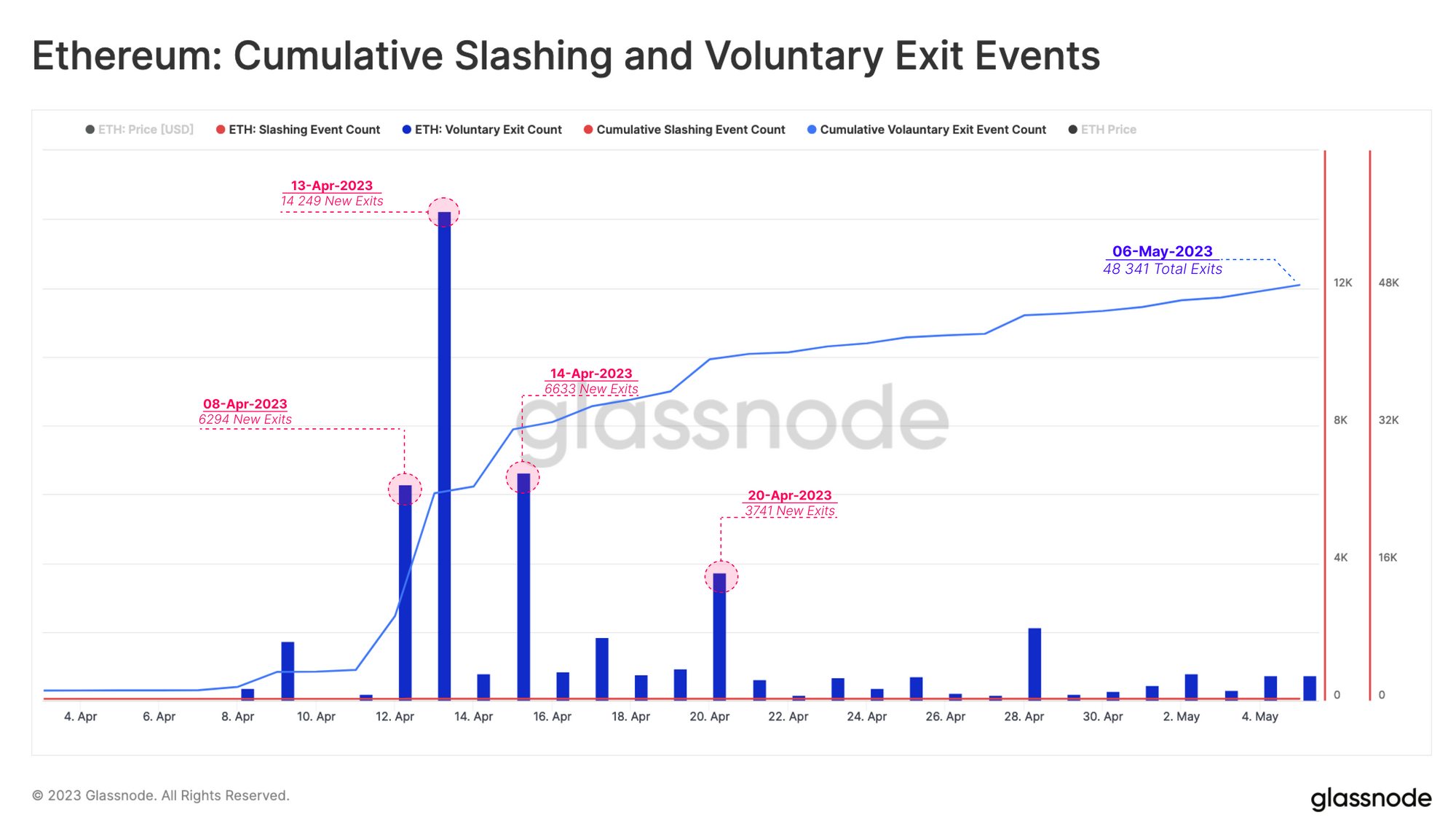

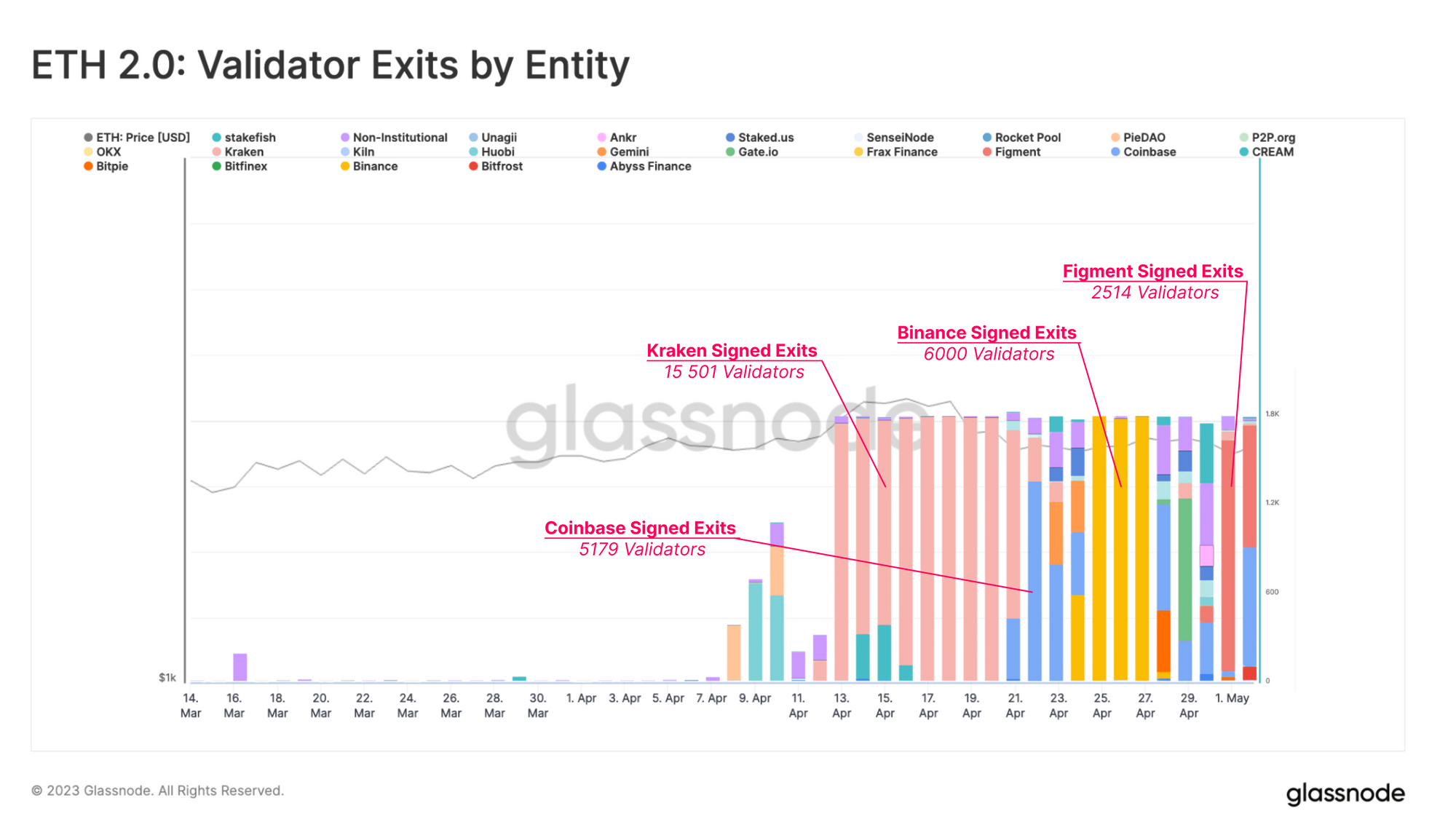

As of today, a total of 48,341 validators have exited, amounting to 1.55M ETH ($2.93B). Unsurprisingly, the day after the Shanghai/Capella upgrade 14,249 validators exiting, which remains the largest daily count. After this peak, exit events quickly tapered off, having levelled off to between 300 and 700 per day.

There was also an incident where 11 validators were slashed shortly after the update, which was attributed to human error by one of the node operators of the liquid staking provider, Lido.

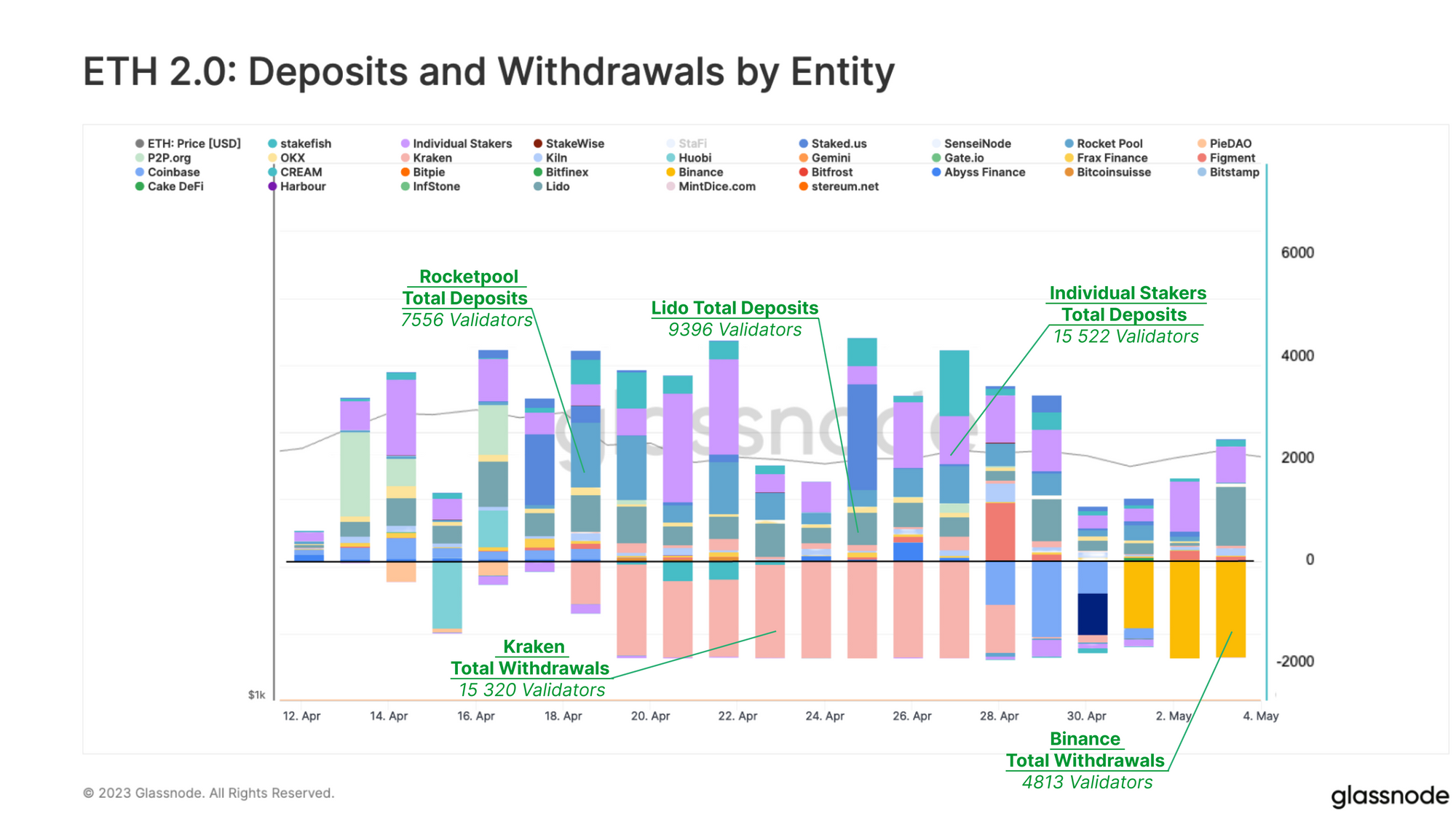

On the other side of the equation, we see over 23k validators are waiting in the entry activation queue, while the exit queue has shrunk down to just 1,837. Observing the two different queues, we see that exit events are offset by new deposits, resulting in zero net change in the active validator count.

However, given the tapering off of exits, and persistently high inflow of new staking entrants, we expect a net increase to validator counts in the near future. This high number of new deposits into the staking pool also provides another explanation for the absence of appreciable sell pressure.

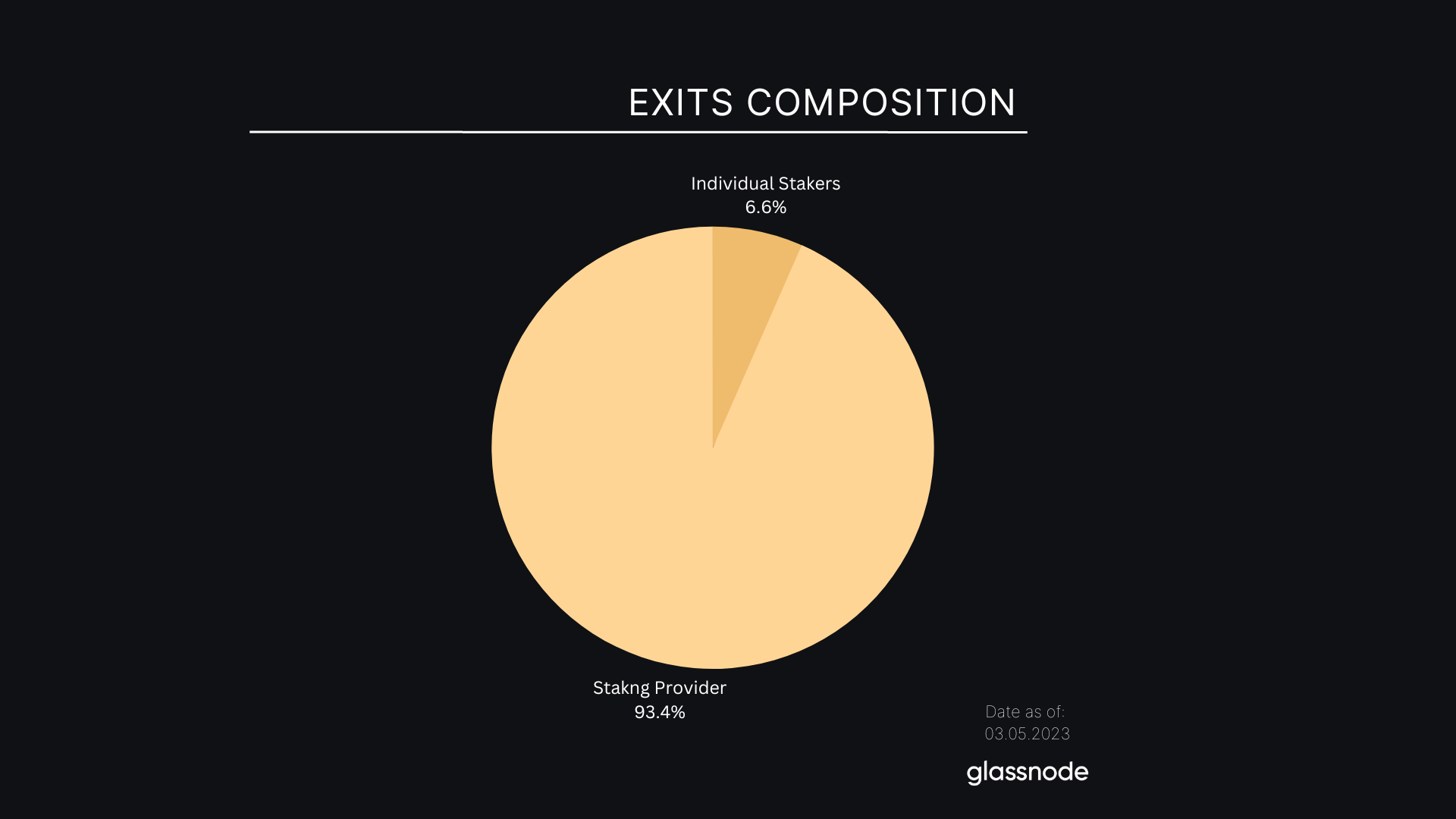

Upon analyzing the composition of exited stake, and excluding slashed exits, we can conclude that the majority of exits came from centralized exchanges that offer staking services.

Kraken alone has withdrawn 15,501 validators, representing 496k out of the 1.55M in total exited ETH (32%). Binance follows with 6,000 deactivated validators, Coinbase with 5,179, Figment with 2,514, and Gate.io with 1,000 validators. The remaining exchanges had fewer than 1,000 exits. It should be noted that Lido has not yet enabled withdrawals.

Out of the 48,341 voluntary exits, just 2,561 (6.6%) were initiated by stakers that are not associated with centralized staking service providers.

Surprisingly, a large number of deposits (15,522 validators) were made by individual stakers. This supports our previous findings that this group tends to become more active around major events. We also observe a continuous stream of deposits from Lido suggesting sustained demand for liquid staking derivative tokens.

(Note that withdrawals depicted in the chart below are time-shifted, based on our estimate of when the funds were received by mainnet wallets based on the duration of the exit queue, withdrawal period, and skimming process.)

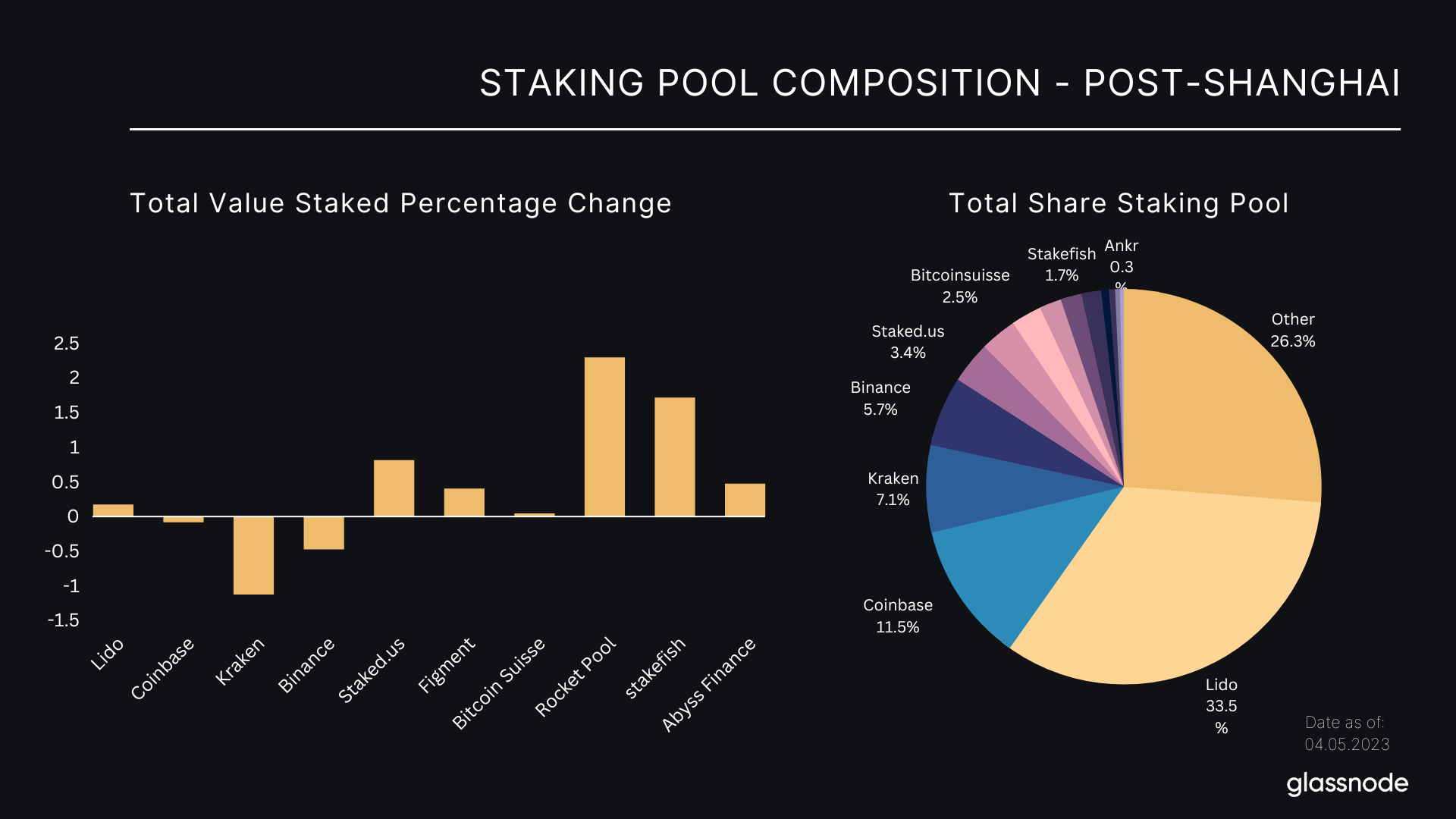

Despite the increased activity around newly exiting and deposited validators, the aggregate composition of the Staking Pool has remained almost unchanged. Kraken, the staking provider that saw the most exited validators, reduced its total stake by only 1.1%, while Binance reduced its stake by around 0.5%. Rocket Pool was the biggest gainer, with 2.3%, and stakefish gained 1.7%.

Liquid staking provider Lido still holds the largest market share, with 33.5% dominance, followed by the staking services of the centralized exchanges Coinbase with 11% and Kraken with 7.1%.

Summary and Conclusion

Since the Shanghai/Capella upgrade, a significant amount of stake has been withdrawn. Besides the one-time event of the accumulated rewards to be withdrawn at once, we saw over 48,000 validators leaving the Ethereum Staking Pool, resulting in 1.55 million ETH being withdrawn.

Despite the ability for stakers to withdraw their accumulated rewards and exit their staked positions from the staking pool, this does not seem to have had significant impact on market prices. This may be attributed, among other factors, to the high demand for deposits seen during this period, offsetting unstaked and distributed ETH. This trend is expected to continue in the near future, resulting in a net positive flow into the staking pool.

Despite increased activity around both exiting, and depositing validators, this has not significantly altered the aggregate distribution of stake dominance among staking providers.

Overall, the results of the analysis suggest that the mechanics of Proof-of-Stake for both incoming and exiting validators have played out as intended, with Ethereum’s consensus mechanism remaining stable throughout the process. This is likely to de-risk longstanding engineering challenges, with net positive effects for both the security of the network, and the economy built upon it.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Source: https://insights.glassnode.com/the-week-onchain-week-19-2023/