Once again, an acronym is all the rage in the crypto world. Don’t be misled. AA does not stand for anonymous alcoholics, even though crypto has a solid anon culture. It’s short for account abstraction and describes a concept that could remove some of the biggest friction points when using crypto.

What is all of that about? To understand the potential of AA, we need to first look at the fundamentals of Ethereum since this concept applies to the smart contract blockchain, not all of crypto.

Externally Owned vs. Contract Accounts

Blockchains have different ways of keeping track of who owns how much. While Bitcoin uses unspent transaction outputs (UTXOs) to figure out how much someone can still spend, Ethereum relies on an account model. This mirrors the way we all have bank accounts with a balance.

However, not all accounts are the same. Ethereum features two types of accounts. Externally owned and contract accounts.

Externally owned account (EOA)

If you have an Ethereum wallet for your precious JPEGs or LSDs, this is the account you’re using. EOAs can initiate transactions and send and receive assets. They are free to create – say again that nothing in life is free – and require private keys to sign for transactions.

Contract Accounts (CA)

Contract accounts are code written directly in the Ethereum Operating system (really wonder why they didn’t call it EOS), the EVM where they send transactions in response to inputs. They have no private keys because they are controlled by logic encoded. However, they also don’t have money. That’s why they still need an EOA to pay gas fees before they can do anything. Sus, as the young generation would say.

Enter Account Abstraction.

AA new dawn

Account abstraction unifies both account types to give you the best of both worlds, effectively turning every account into a smart contract wallet. This means enabling the contract accounts to start transacting with tokens without having to use another account. Adding smart capabilities to an account is pretty smart. It reduces complexity making developers’ lives easier and, ultimately, our all.

Why it matters

If you ask anyone in crypto what their biggest fear is losing the seed phrase. Making your life savings dependent on not losing a 12 – 24 phrase is daunting. And it’s also not much better than hoarding cash under your pillow if you wrote it down on a piece of paper.

However, with smart contract accounts, there is no need for a seed phrase. Keys could be stored on a phone’s hardware security module using your existing unlocking features. And if you ever lose access, worry not. AA enables social recovery whereby you could rely on a network of friends, family, or a provider to help unlock your account access.

In short, AA allows a more familiar experience, abstracting away a lot of what creates friction when entering crypto.

This leaves us with just one question: why is it hyped now?

That’s because at EthDenver – yes, the event that dumped the ETH price with a cringe song – it was announced that Account Abstraction is now live on Ethereum. This came as a surprise even for Ethereum enthusiasts used to countless delays.

Something shipping ahead of schedule was not on my 2023 bingo card.

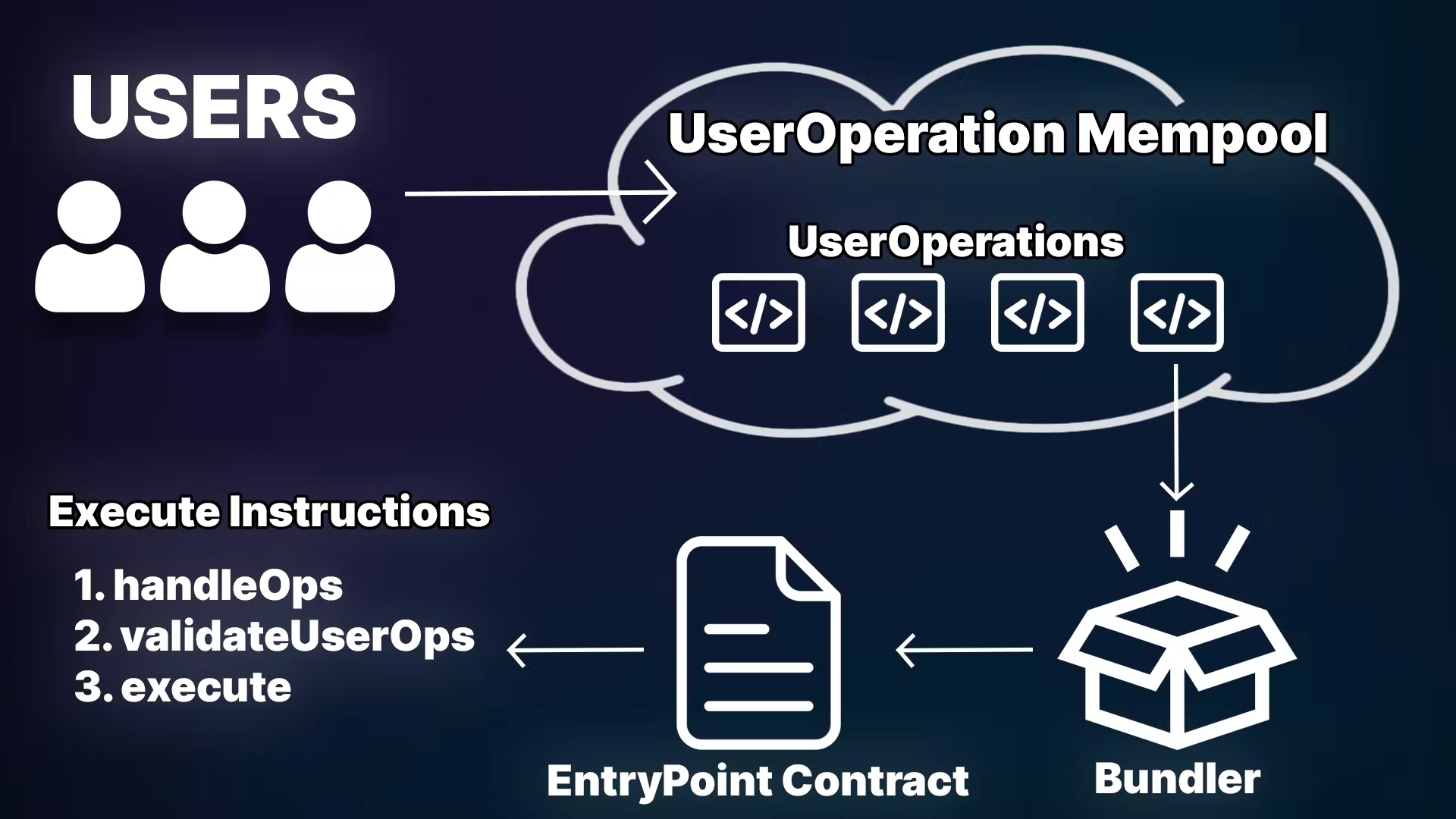

EIP-4337, the update bringing AA to Ethereum, eliminates the need for sending transactions and replaces it with a set of user operations. These are processed through Bundler nodes that eventually return something to the wallet.

The update was deployed as a smart contract. This means your current account remains not-smart. However, any EVM-compatible chain can now easily implement AA, so we can expect better onboarding experiences by the time Christmas comes, and we want to gift our family NFTs.

Personally, I like John’s take.

https://twitter.com/jadler0/status/1631090239077855232?s=20

Naomi from CoinJar

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767). Like all investments, cryptoassets carry risk. Due to the potential volatility of the cryptoasset markets, the value of your investments may fall significantly and lead to total loss. Cryptoassets are complex and are unregulated in the UK, and you are unable to access the UK Financial Service Compensation Scheme or the UK Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

Source: https://blog.coinjar.com/account-abstraction-or-making-crypto-user-friendly/