Automation tools are changing the business landscape and transforming how we work today. From manufacturing and retail to finance and accounting, automation is playing a critical role in optimizing business processes, improving efficiency, and reducing costs. In the field of accounting, automation is becoming increasingly popular, and for good reason. By automating accounting tasks, businesses can streamline their operations, improve accuracy, and reduce the risk of errors.

In this article, we will explore the benefits of accounting automation and how it can help businesses of all sizes. We also see how just implementing an accounting software like QuickBooks might not be enough, and how Nanonets can integrate with QuickBooks to provide your company with a competitive edge.

Benefits of Accounting Automation

Over the years, employing software to carry out conventional accounting duties has improved efficiency, accuracy, and adherence to regulations in these procedures. Given the current economic climate, businesses that are slow to implement accounting process automation in their finance and accounting processes are likely to experience decreased productivity and reduced efficiency. Some specific benefits to accounting automation are

- Improved Accuracy: Accounting errors can have a significant impact on businesses, ranging from financial loss to damage to reputation. Common accounting errors include data entry mistakes, improper classification of transactions, and errors in financial calculations. These mistakes can result in inaccurate financial statements, which can have severe consequences, including legal issues and loss of investor confidence. By automating accounting tasks such as data entry, invoicing, and reconciliation, businesses can reduce the risk of errors and ensure that financial information is accurate and up-to-date. This not only saves time but also helps businesses make informed decisions based on accurate financial data.

- Time-Saving: According to the TDWI Best Practices Report on Improving Data Preparation for Business Analytics, 28 percent of respondents spend between 41 to 60 percent of their time on data preparation. By automating accounting tasks, businesses can free up time that can be spent on more strategic activities, such as analyzing financial data and making informed decisions. Additionally, automation can help businesses reduce the time it takes to complete routine tasks such as data entry and reconciliation, allowing them to focus on more value-added activities.

- Increased Efficiency: By automating accounting tasks, businesses can eliminate manual processes, reduce the risk of errors, and streamline their operations. This not only saves time but also reduces costs and improves productivity. Additionally, automation can help businesses improve their cash flow by speeding up the invoicing and payment process. This, in turn, can help businesses improve their relationships with customers and suppliers and create a more efficient and effective supply chain.

- Reduced Costs: According to a report from Blue Hill Research, data analysts typically spend two hours per day exclusively on data preparation, representing around $22,000 of a typical data analyst’s annual salary. Manual accounting processes can be expensive, especially if they require a significant amount of staff time. By automating accounting tasks, businesses can reduce the time and resources required to complete routine tasks, thereby reducing costs.

- Improved Compliance: Automation can help businesses ensure that they are calculating and paying the correct amount of tax, keeping accurate financial records, and complying with data protection regulations. This not only reduces the risk of penalties and fines but also helps businesses maintain their reputation and build trust with customers and stakeholders.

- Improved Visibility: By automating accounting tasks, businesses can gain real-time insights into their financial performance and make informed decisions based on accurate and up-to-date financial data. This not only helps businesses identify areas of improvement but also allows them to respond quickly to changes in the market and make strategic decisions that can help them grow and succeed.

How to introduce accounting software into your business?

Integrating automation technology into your business may appear intimidating at first, but it can be done with ease. The software can be easily incorporated with your existing solutions, and there are a few things you can do to get started.

To begin the process of automation, it’s important to first identify inefficient tasks and processes that could be streamlined through automation. This could include manual data entry, repetitive tasks, or other time-consuming activities.

Once these tasks have been identified, it’s essential to train employees to operate the automation software. This ensures that the technology is used effectively and that employees feel comfortable with the new system. Utilizing skilled Citizen Automators within the company can also aid in the transition to automation by providing guidance and support to colleagues.

Developing determinants and markers for success with data entry automation is also critical. These metrics can help track progress and ensure that the automation is achieving its intended goals. Testing the automation software within the business accounting systems prior to client use is also important to ensure that it’s working effectively and to avoid any potential issues.

After testing and refining the automation processes within the business, it’s time to begin implementing automation in client accounts. Analyzing the results and metrics of initial use can help identify any areas for improvement and ensure that the automation is delivering the intended benefits. Once the initial rollout has been successful, it’s possible to scale automation processes within the business to further streamline operations and improve efficiency.

The QuickBooks-Nanonets Combination

QuickBooks is a popular accounting software that is increasingly being used to automate many accounting processes. With QuickBooks, businesses can automate tasks such as invoicing, bill payment, and financial reporting. Businesses can integrate QuickBooks with their POS systems, payroll software, and even their CRM systems to create a seamless flow of information between different departments. This not only saves time but also helps reduce the risk of errors.

However, a workflow in Quicckbooks is still completely manual – data entry. This involves teams of employees inputting large volumes of financial data, such as invoices, bills, and expenses, which can be time-consuming, cost intensive and prone to errors.

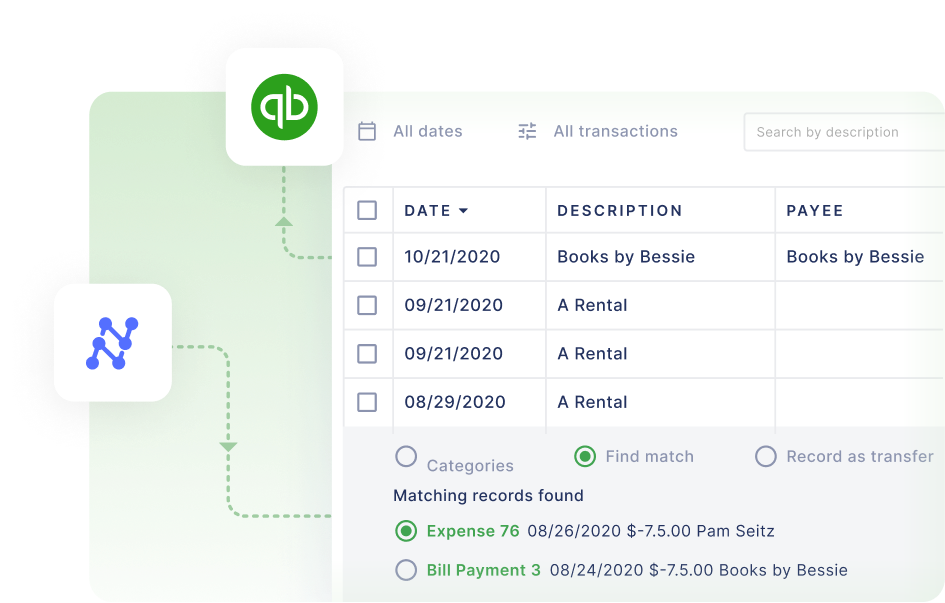

Integrating Nanonets with QuickBooks can help businesses automate their data entry processes and streamline their accounting workflows.

Nanonets can extract and consolidate accounts-related data from various sources such as email, digital files, scanned documents, cloud storage, ERP, and API. It captures and extracts data from invoices, receipts, and bills using intelligent technology, categorizes and codes transactions based on business rules, sets up automated approval workflows, and reconciles all transactions. The data extracted using Nanonets can be integrated with QuickBooks for Invoice Processing and other Accounts Payable activities.

Here’s how you can integrate Nanonets with QuickBooks:

- Sign into flow.nanonets.com

- Click on Integrations on the left-hand side menu

- Click on the QuickBooks card to sign in and connect your QuickBooks account

- Enter your QuickBooks credentials

- Back on the Flow QuickBooks card, enable Project/Class sync.

- Your GL codes and chart of accounts automatically gets imported into Flow.

- Set up notifications for your team members. Invoices are exported only once they are approved inside Flow.

- Click on “Done”

How to Test your QuickBooks Integration

- Go to the “Invoices” tab on the left-hand side panel

- Upload an invoice from your local storage or forward an email to the displayed email ID with an invoice attached

- Once the invoice has been read by Flow (in around 60 seconds), you can click on the invoice

- On the invoice review screen, you will be prompted to add an approver for the invoice. Add someone from your team and get them to approve the invoice

- Once the invoice has been approved, it will automatically be exported to Quickbooks

Takeaway

The combination of Nanonets and QuickBooks offers businesses an easy-to-use solution that seamlessly integrates with their existing systems, without the need for extensive training or a significant investment. By leveraging the power of automation, businesses can improve their accounting processes, leading to better decision-making and more successful outcomes. It is clear that accounting automation is the way forward for businesses that want to remain competitive and successful in today’s fast-paced and technology-driven world.

Source: https://nanonets.com/blog/how-to-select-the-best-accounting-software-for-your-business/