Reconciliation is a mandatory process for businesses of all sizes. Reconciliation helps businesses gain insight into business spending and their categories in real-time.

Account reconciliation takes a lot of time and effort. Also, the manual reconciliation method is error-prone. It involves matching records on multiple documents, which might lead to errors in reporting and, subsequently, put businesses at risk of making wrong decisions to limit their spending.

With intelligent automation, the reconciliation landscape is changing. Reconciliation software (a part of accounting automation software) like Nanonets helps businesses take control of their spending, keep books up to date and enhance financial reporting with accurate data.

Let’s look at the reconciliation processes and how reconciliation software simplifies reconciliation for your finance department.

How do reconciliation manually?

Here’s what the manual reconciliation process looks like:

- Collecting & comparing documents – You need to collect bank statements, cash registers, and proof of payments to match them. For every transaction registered in the bank statement, you should have the same entry in the cash register along with proof of payment.

- Extract data from the documents – To compare the data correctly, you should either manually enter data from the documents into an excel sheet, or use a bank statement to CSV converter.

- Check out the entries that match – Strike out the entries that match on all three documents.

- Check the entries that don’t match – Multiple entries will not match. You’ll have to find the reason and a proper expense category and adjust the balances properly.

- Check ending balance – Your general ledger balance ending balance should match your bank statement balance after all your adjustments.

The manual process involves

- Matching documents manually or using different excel sheets.

- Collecting proof of payments manually.

- Inconsistent processes, as every accountant, follow steps a little differently.

What can be done to remove manual elements from the entire process? You can use accounting automation software like Nanonets to introduce intelligent automation in your entire process. But let’s answer the following question first.

Can you automate the reconciliation process?

Yes. You can automate manual aspects of the bank statement reconciliation process with reconciliation software. Let’s look at one of the ways you can use accounting automation software like Nanonets to automate the reconciliation process.

Nanonets Reconciliaition Software for Reconciliation Automation

Nanonets is an intelligent document automation platform that leverages no-code workflow automation, OCR software, and global payments platform to automate reconciliation processes. Nanonets help organizations update their financial records, track spend categories, and improve financial visibility with advanced process automation.

Nanonets reconciliation software workflow

You can use Nanonets workflow automation and OCR models to automate the bank reconciliation process. Here’s your reconciliation process with Nanonets as your reconciliation software.

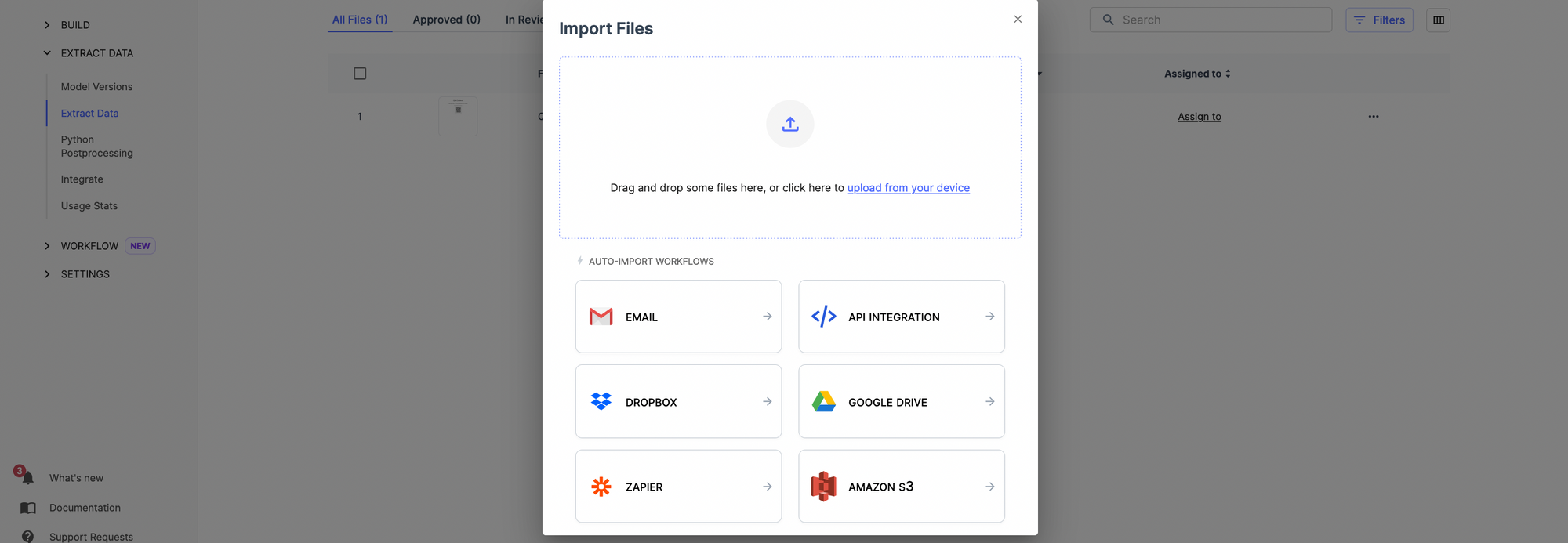

Document Input

Feed the bank statement, cash register, and proof of payments to Nanonets via email forwarding, Google Drive, or other direct integrations. Automate document upload to Nanonets models with easy options. No need to collect documents yourself.

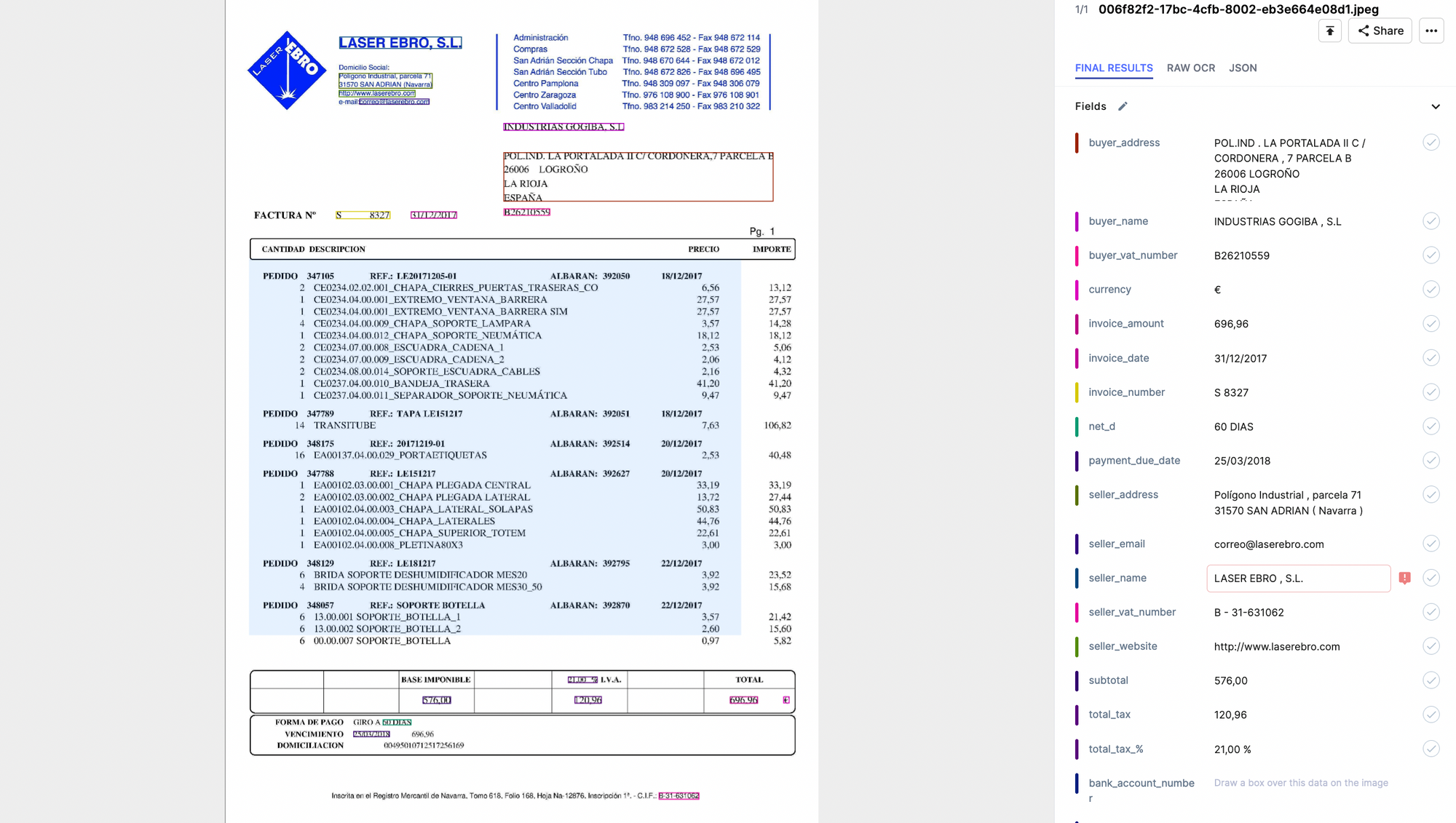

Document Data Extraction

Once uploaded, the documents will be automatically categorized with Nanonets document classifier. After that, Nanonets will extract all the relevant data from the documents, like

- Time period, currency, comments,

- Tables from bank statement & cash registers containing details about transactions

- Subtotals and Total amounts

And convert the data into a format of your choice like CSV. [See how it works with PDF to CSV tool]

Document Data Matching

Now that you have the data, you can use rule-based workflows to match the data. Once set, the workflows will match data in seconds.

Flagging & sending data for review

In this step, the amounts that don’t match will be reviewed using automated approval workflows. You can set up proper rules to route a query to the relevant reviewer. In this step, you’ll receive a notification to check the non-matching entries and suggest adjustments in order to match the ending balances.

Document Annotation

The reviewers can add their comments to the document itself. Every reviewer can see the comments from the other reviewer, which improves collaboration and reduces the chances of errors creeping into the final file.

Final Review

Once all the entries match, the reviewers receive the final file to double-check all the entries and approve the file with corrections.

Update Matching Entries

After the approval, all the entries are updated in the ERP or accounting software. You can also create a new file on Google Sheets or the database of your choice containing all the extracted data.

Why should you choose Nanonets?

Apart from the abovementioned simplified reconciliation workflow, there are additional benefits to using Nanonets as your reconciliation software.

- 24×7 Support

- Free Trial

- Free migration assistance

- Flexible Pricing Plans

- Customization Services – Customize the OCR models & workflows according to your use cases.

- 5000+ integrations – Custom integrations available

- Training Support

- No-code platform

- A dedicated customer success manager

- Cloud or on-premise hosting

We can help you solve all your reconciliation problems. Book a consultation call with our automation experts or start a free trial!

Benefits of using Nanonets as your Reconciliation Software

Enhance Financial Visibility

Monitor reconciliation processes with workflow status report. Understand the volume of transactions, their reconciliation steps, and details about the adjustment processes. Nanonets also maintains a proper audit log for third-party inspections so you don’t have to save documents physically.

Update your financial records on the go

Keep all your books up to date. Use rule-based workflows to update General ledger entries with proper codes as the bills/invoices come in. Import, categorize and update all your financial transactions in seconds.

Match Bills with Bank Transactions with 0 errors

Use Nanonets 3-way document matching to match any documents with the highest precision.

Powerful OCR software can extract data from incoming invoices, bills, receipts, bank statements and any other documents in a blink of an eye.

Get your entries reviewed on time

Automated approval workflows will ensure that all your documents are reviewed properly before your deadlines.

Alternative Reconciliation Software

Apart from Nanonets, there are other reconciliation software out there that can help you with account reconciliation automation. Here are three popular reconciliation software:

Xero

Xero is a powerful accounting software for small businesses, accountants, and bookkeepers. Xero has amazing features like capturing bank transactions daily, custom rules to match invoices & bank transactions, and group similar spends. Xero + Nanonets are a perfect match for mid to large-size businesses looking to combine the power of intelligent document processing and simple accounting software.

Blackline

Blackline specializes in financial close management with many reconciliation tools like templates, procedures, policies, and workflows. Blackline reconciliation software provides powerful reporting capabilities to monitor reconciliation processes.

You’ll still have to enter data into Blackline, which you can automate using Nanonets.

ReconArt

ReconArt provides an easy-to-use reconciliation software for bank reconciliation, credit card reconciliation, balance sheet reconciliation, financial close, accounts reconciliation, variance analysis, journal entry, and intercompany reconciliation. ReconArt doesn’t have a free version, and their monthly plans start from $1500.

Benefits of using Reconciliation software

- Standardized Reconciliation Processes with templatized rule-based workflows. Eliminate the need for manual data entry and manual document matching.

- Error-free processes – Use an intelligent automation platform to reduce manual mistakes, enhance internal controls & implement rules automatically.

- Automated Audit Trail – Maintain all reconciliation history for audit and compliance

- Improved Accountability with role-based user access on reconciliation software.

Conclusion

Real-time financial data helps you make proper business decisions. With reconciliation software, automate all your finance processes while reducing costs, saving time, and enhancing productivity. With so many benefits, it would be difficult not to try it.

Nanonets can automate reconciliation processes efficiently while seamlessly integrating with your existing tech stack. With a 14-day free trial, 24×7 support, and free migration assistance, it sounds like a deal you can’t let go of.

Get on a free consultation call or start a free trial.

Source: https://nanonets.com/blog/reconciliation-software-reconciliation-automation/