- Initial jobless claims in the US fell, pointing to a still-tight labor market.

- The SVB Financial Group will seek Chapter 11 bankruptcy protection.

- The banking crisis has clouded monetary policies in the US and the UK.

The GBP/USD weekly forecast is slightly bearish as banking sector worries might continue in the coming week, boosting the safe-haven dollar.

Ups and downs of GBP/USD

GBP/USD had a volatile week marred with economic releases and macroeconomic developments in the banking sector. There were releases from the UK and the US, but the banking crisis overshadowed them. The US released a mixed bag of data, with inflation rising while retail sales fell. Initial jobless claims in the US fell, pointing to a still-tight labor market.

-If you are interested in forex day trading then have a read of our guide to getting started-

However, a developing banking crisis and the looming storm clouds of a potential recession dominated the turbulent week.

The latest twist in an ongoing drama that started last week was the announcement by SVB Financial Group that it would seek Chapter 11 bankruptcy protection.

These issues have reached Europe, where Credit Suisse shares have fallen due to liquidity concerns, forcing regulators to rush to reassure the markets.

First Republic Bank experienced a 32.8% decline after announcing that it would suspend its dividend.

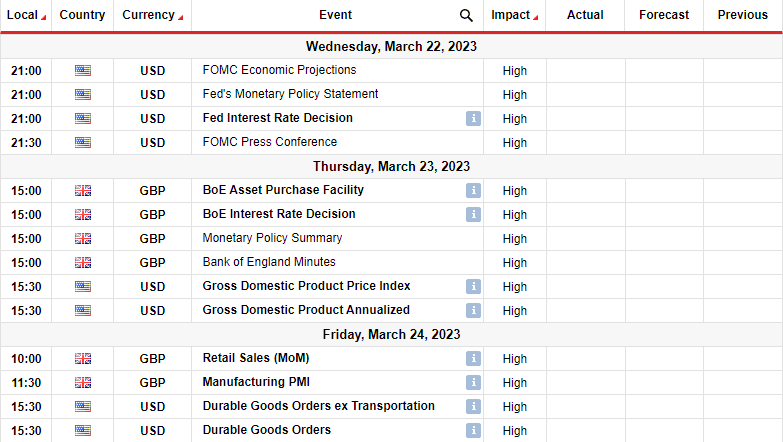

Next week’s key events for GBP/USD

Investors will focus on the Federal Reserve’s and BOE’s monetary policy meetings scheduled for next week.

Investors have revised their forecasts for the magnitude and duration of the interest rate hikes in the US and the UK in light of recent changes in the banking industry.

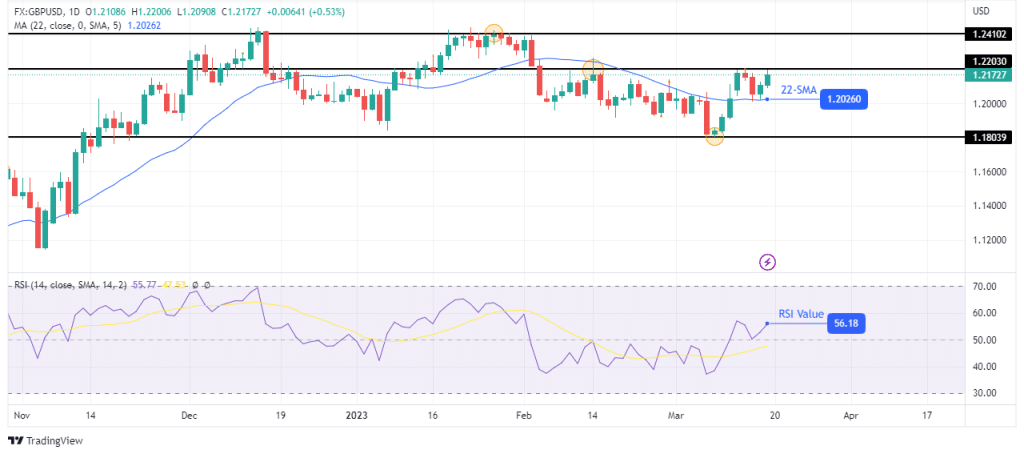

GBP/USD weekly technical forecast: A bounce higher from the 22-SMA support

The daily chart shows GBP/USD trading above the 22-SMA and the RSI above 50, indicating a bullish bias. Bulls took over from bears after a short and choppy downtrend as bears could not continue below the 1.1803 support.

-Are you looking for automated trading? Check our detailed guide-

The price broke above the 22-SMA, retested it, and is now looking to take out the previous high at 1.2203. In the coming week, there is a high chance that the price will break above the 1.2203 resistance and push higher to the 1.2410 resistance.

However, the price might fall below the SMA if the 1.2203 level holds firm. A break below the SMA would mean retesting the 1.1803 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/gbp-usd-weekly-forecast-deep-banking-crisis-to-halt-gains/