- Shares of Deutsche Bank dropped by about 9% on Friday amid banking sector worries.

- The British central bank increased its benchmark interest rate from 4% to 4.25%.

- Bailey reiterated that the central bank expected inflation to decline considerably this year.

Today’s GBP/USD forecast is bearish. Deutsche Bank shares dropped about 9% on Friday, resulting in poor risk sentiment that pushed the dollar index higher.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Bank of England Governor Andrew Bailey said British companies should consider official projections that inflation will decline this year when establishing prices.

Bailey continued by stating that he lacked proof that businesses were raising prices above what was necessary.

On Thursday, the British central bank increased its benchmark interest rate from 4% to 4.25%. This came a day after official data revealed an unexpected increase in the annual rate of consumer price inflation to 10.4% in February.

Bailey said he was “very relieved” that inflation has stabilized and reiterated that the central bank expected inflation to decline considerably this year. This is because the impact of last year’s strong increase in energy costs is fading from year-on-year price comparisons.

On Friday, financial markets forecasted one more BoE interest rate increase this year, bringing rates to their highest level of 4.5%.

The BoE officials updated their short-term economic outlook on Thursday, now predicting mild growth rather than a decrease in the three months leading up to the end of June.

According to Bailey, there is a fair probability that the British economy will escape sliding into recession.

GBP/USD key events today

Investors will pay attention to the Bank of England governor Bailey who is set to speak later in the day. His speech might contain clues on future policy moves.

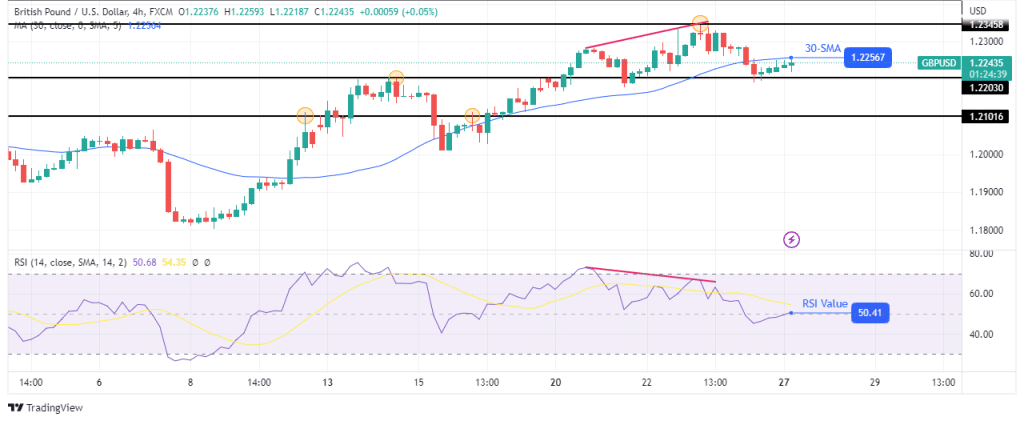

GBP/USD technical forecast: Bearish divergence

The 4-hour chart shows GBP/USD trading slightly below the 30-SMA after pausing at the 1.2203 support. This comes after a shift in sentiment that saw the price break below the 30-SMA and the RSI cross below the 50-level.

–Are you interested in learning more about forex robots? Check our detailed guide-

Bears took over after the RSI made a bearish divergence with the price. The price is retesting the recently broken SMA before a fall and breaking below the 1.2203 support. Now that bears are stronger, we might see a fall to the 1.2101 support if the price stays below the SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Source: https://www.forexcrunch.com/gbp-usd-forecast-bailey-claims-inflation-to-decline-in-2023/