- Inflation in the Eurozone increased last month.

- The Eurozone experienced a surprise slowing in underlying price growth.

- Eurozone credit demand declined significantly.

Today’s EUR/USD price analysis is bearish. Inflation in the Eurozone increased last month. However, there was a surprise slowdown in underlying price growth. This slowdown strengthens the case for a lower interest rate increase at Thursday’s European Central Bank meeting.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

Even though inflation has decreased significantly from double-digit readings at the end of last year, it is still far too high. The high inflation necessitates another rate increase, the size of which is still up for debate. Policymakers at the ECB cannot decide between a move of 25 and 50 basis points.

The overall price growth across the 20 countries that use the euro currency increased to 7.0% in April from 6.9% a month earlier. This value was in line with what economists predicted. However, the focus has been on core or underlying inflation in recent months.

Inflation fell to 7.3% from 7.5% when volatile fuel and food costs were excluded. An even more restricted gauge that excludes alcohol and tobacco slowed to 5.6% from 5.7%. It fell short of estimates for 5.7%, marking the first decline since last June.

At the same time, the ECB’s quarterly bank lending survey revealed an unusually big decline in credit demand. This report supported the argument for a smaller rate hike.

The ECB increased interest rates by at least 50 basis points at its previous six meetings. Investors expect the ECB’s current 3% deposit rate to reach approximately 3.75% by the end of summer.

EUR/USD key events today

Investors will focus on the US, which will release a jobs report. The report will show the number of open positions for employment in the country.

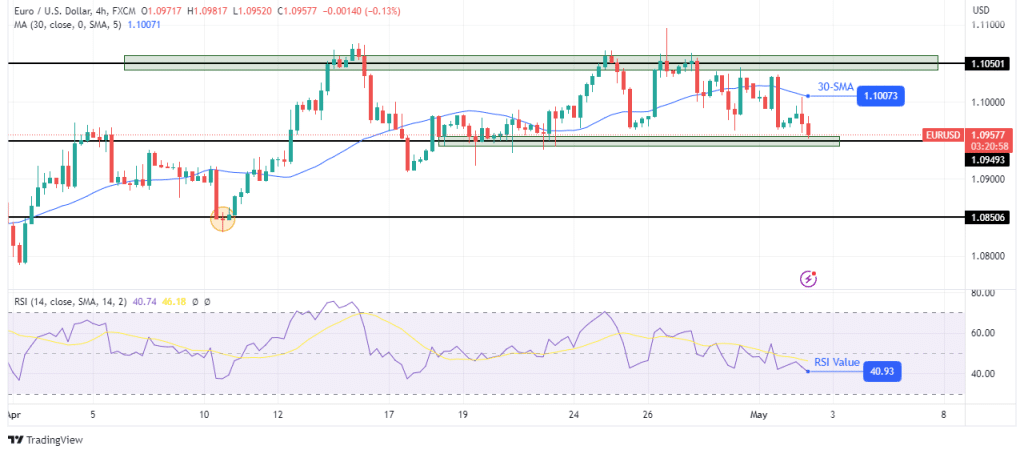

EUR/USD technical price analysis: Bears challenging the 1.0949 support level

The EUR/USD is falling in the 4-hour chart after failing to break above the 1.1050 resistance level. The price was strongly rejected above this level, allowing bears to take over by breaking below the 30-SMA. The RSI also crossed below 50, indicating a shift in sentiment.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

After the shift in sentiment, bears took the lead. The price is now approaching the 1.0949 key support level. We might see it pause or pull back at this level. However, we might also see a break below since bears show strength.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/eur-usd-price-analysis-eu-inflation-rises-core-inflation-falls/