- Trader bets on a significant ECB interest rate increase quickly fell.

- Credit Suisse shares dropped to a new record low.

- The euro experienced its greatest one-day decline since the peak of COVID.

Today’s EUR/USD outlook is slightly bullish. On Thursday, Credit Suisse stated it would borrow nearly $54 billion from the Swiss central bank to support liquidity and market confidence. This helped stem the recent selloff in global markets.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Policymakers at the European Central Bank are gathering on Thursday amidst extraordinary market volatility. This may push them to abandon plans for another significant interest rate hike even though inflation is still too high.

On Wednesday, trader bets on a significant ECB interest rate increase this week quickly fell apart. A collapse stoked panic over the European banking system in Credit Suisse shares.

According to money market pricing, less than 20% of traders expect the ECB to raise rates by 50 basis points on Thursday. This is a decrease from the previous 90% probability.

Following the abrupt failure of Silicon Valley Bank in the United States, days of market volatility were extended when Credit Suisse shares fell to a new record low.

According to market pricing, a smaller, more cautious 25 bps advance is now anticipated.

The euro experienced its greatest one-day decline yesterday since the peak of the COVID-induced market volatility in March 2020. It fell 1.8% against the dollar as anxiety spread.

EUR/USD key events today

All focus will be on the ECB meeting later in the day. Investors have significantly lowered their expectations for a 50bps rate hike. There will also be releases from the US, including building permits and the initial jobless claims report.

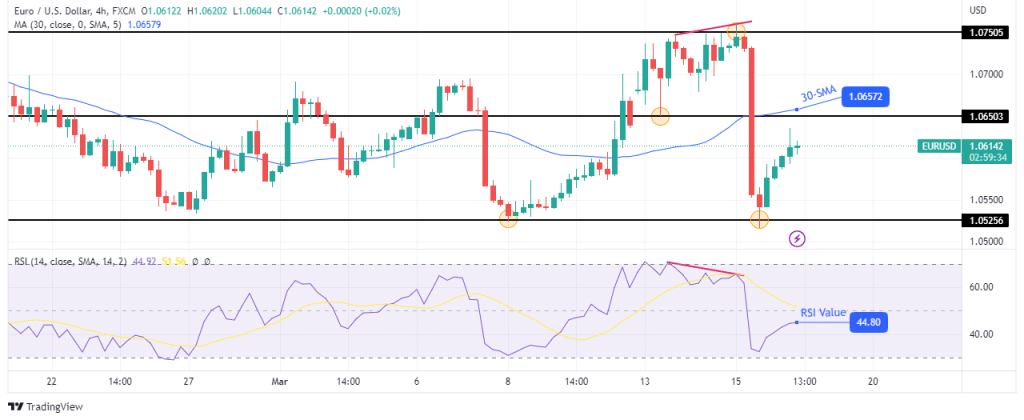

EUR/USD technical outlook: Pullback after a sharp collapse to 1.0525

The 4-hour chart shows EUR/USD trading below the 30-SMA with the RSI below 50, showing control lies with the bears. The price fell from the 1.0750 resistance to the 1.0525 support, making a very strong bearish candle. The candle also broke below the 30-SMA and the 1.0650 support level.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The RSI crossed below 50, a clear sign of a shift in sentiment. Currently, the price is pulling back and might go up to retest the 1.0650 level. However, the bearish bias will remain if the price stays below the 30-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Source: https://www.forexcrunch.com/eur-usd-outlook-lower-bets-on-ecb-hike-amid-credit-suisse/