Executive summary: Despite China’s ban on crypto operations, Hong Kong is positioning itself as a regional crypto and Web3 hub, attracting blockchain firms and legalizing retail cryptocurrency trading. With a robust regulatory framework in place, Hong Kong has already received expressions of interest from over 80 companies providing crypto-related services.

Bitcoin (BTC) and Ethereum (ETH) are expected to be the chief beneficiaries, but emerging Web3 services also warrant attention. Investors should monitor the evolving regulatory landscape and follow mainland China’s moves, as loosening crypto restrictions could cause the market to surge.

China’s Evolving Stance on Crypto

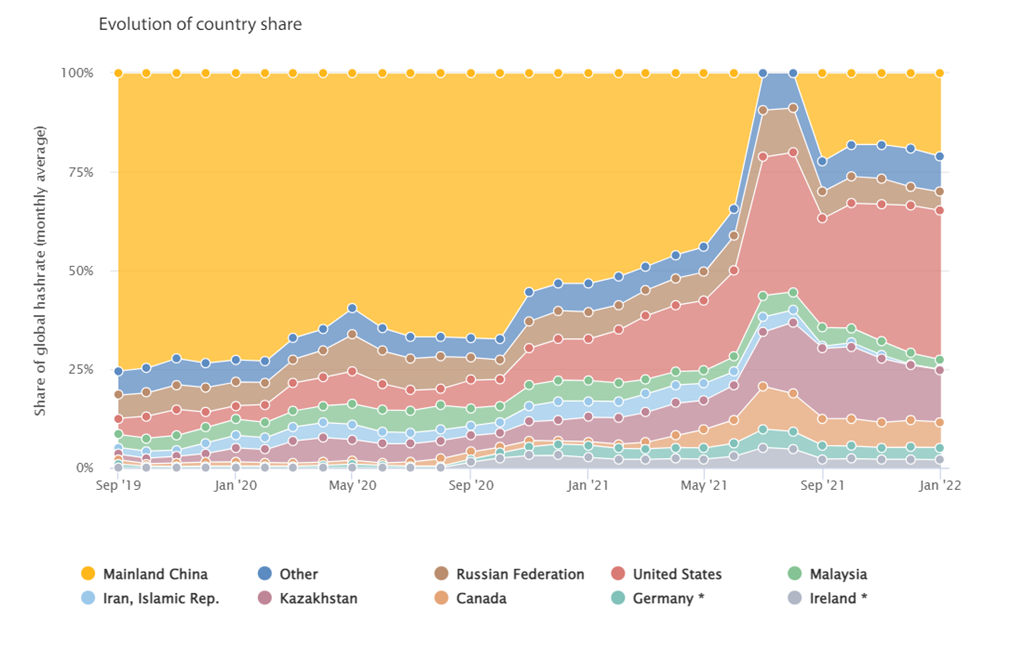

During the initial years of bitcoin’s existence, China was one of the most important countries for the crypto industry, as it hosted many companies operating exchange platforms, wallets, and other services. Moreover, China alone accounted for about two-thirds of all bitcoin mining in 2019-2020.

However, the Chinese government subsequently decided bitcoin and other cryptocurrencies pose many risks that outweigh the potential benefits. The result was Chinese authorities gradually cracking down on all retail crypto operations.

In 2017, it started with initial coin offerings (ICOs). The government shut down all ICO platforms and operations when they were at their peak. If a local exchange sold ICO tokens, they had to return the funds to investors.

During that time, China cracked down on many crypto exchanges, but the countrywide ban came in 2021. As bitcoin skyrocketed to fresh records, China banned crypto mining and prohibited all crypto transactions altogether, forcing mining and exchange companies to relocate.

Hong Kong as an Experiment

Even though Hong Kong is officially part of China, it remains somewhat separate due to its status as a special administrative region (SAR). This status gives the city more freedom; thus it might choose not to enforce Beijing’s crypto rules. Due to the proximity to the mainland territory, many crypto companies might relocate to Hong Kong in search of better conditions.

The good news is that Hong Kong plans to become a regional crypto and Web3 hub and even compete with Singapore to attract blockchain firms, especially after Singapore moved to a tough stance on crypto businesses last year. Crucially, Hong Kong has reportedly obtained the nod from Beijing.

At the end of 2022, Hong Kong said during its government-backed fintech week event that it planned to legalize cryptocurrency retail trading and develop a licensing system for crypto exchanges and other blockchain companies.

Some believe that China will closely monitor Hong Kong’s crypto story before returning to the crypto question itself.

Deng Chao, CEO of digital asset manager Hashkey Capital, commented on Hong Kong’s crypto initiative:

“In the future, it may serve as a model for policy formulation in other regions [in China] if it proves successful.”

Strong Regulation Expected

As Hong Kong prepares to become crypto-friendly, it is creating an extensive regulatory framework for digital assets and blockchain operations. In February 2023, the city’s Securities and Futures Commission (SFC) released draft rules enabling investors to trade certain major cryptocurrencies starting June 1, 2023. However, it didn’t mention which coins would be supported.

The financial regulator plans to introduce a new licensing regime to take effect on June 1. The new rules will require all centralized crypto exchanges doing business in Hong Kong to be licensed by the SFC. The regulatory requirements are expected to be similar to those for licensed securities brokers and automated trading venues.

SFC CEO Julia Leung stated:

“In light of the recent turmoil and the collapse of some leading crypto trading platforms around the world, there is clear consensus among regulators globally for regulation in the virtual asset space to ensure investors are adequately protected and key risks are effectively managed.”

Who is Interested?

In February, the city’s Department for Foreign Direct Investment received “expressions of interest” from more than 80 companies offering crypto-related services. The companies, located in mainland China and abroad, include crypto exchanges, blockchain infrastructure firms, blockchain network security firms, crypto wallets and payment operators, and other Web3 companies.

KuCoin, one of the largest crypto exchanges by trading volume, stated last year that it would open an office in Hong Kong. Other major companies planning to expand their presence in the city are Huobi, OKX, and Gate.io.

Interestingly, crypto firms have found an unexpected ally: Chinese state-owned banks. Bloomberg cited people familiar with the matter saying that Chinese banks, including Shanghai Pudong Development Bank (600000:CH), the Bank of Communications Co. (BKFCF:US), and Bank of China Ltd. (3988:HK), have either started providing banking services to crypto companies in Hong Kong or made inquiries with crypto firms.

Institutional investors are also monitoring Hong Kong’s transformation into a potential crypto hub, looking to become early beneficiaries in the competition to win market share.

Which Tokens Might Benefit Most?

Hong Kong is about to shortlist the cryptocurrencies to be accepted for trading starting on June 1. While it hasn’t indicated which digital assets would be accepted, the list will likely include bitcoin (BTC) and Ethereum (ETH), which will probably remain the primary beneficiaries.

Ethereum can be a major winner as Hong Kong has suggested it plans to become a Web3 hub. The majority of decentralized applications (dapps), non-fungible tokens (NFTs), and other Web3 elements rely on Ethereum as their underlying infrastructure.

In terms of currently popular dapps in the Asian region, the decentralized exchange 1inch (INCH) continues to see great interest. In terms of centralized exchanges, leaders include Binance (BNB) and Kucoin (KCS), along with OKX.

Another potential winning blockchain will be Polygon (MATIC). This ties into the popularity of gaming in Asia in general and in China specifically. According to a DappRadar study, Polygon is the favored blockchain for game development, with 30.8% of web studio game developers choosing Polygon. This is important, because Asia has 55% of the total global gamers, representing some 1.7 billion users.

In China gaming is dominated by Tencent (TCEHY:US), and while the company isn’t currently developing blockchain games, it has recently announced a number of partnerships that indicate it may be moving into the blockchain space in response to the news. Tencent will jointly develop a suite of blockchain API services with Web3 infrastructure provider Ankr (ANKR), and is also partnering with several Web3 infrastructure builders, including Avalanche (AVAX), Scroll, a Layer-2 scaling solution for Ethereum; and Sui (SUI), a relatively young Layer-1 blockchain created by ex-Meta employees.

Can Hong Kong Become a Crypto Hub?

Despite the strict regulations anticipated, the Hong Kong crypto hub plan has all prerequisites to become a reality. The city’s initiative is becoming even more relevant today as the US, until recently one of the best jurisdictions for crypto businesses, has been cracking down on crypto operations in reaction to the collapse of FTX.

Coinbase, the largest crypto exchange in the US, is considering relocating due to “regulatory uncertainty.” As we can see, the lack of clear regulation can be a problem. It remains to be seen how restrictive Hong Kong is going to be.

Investor Takeaway

As Hong Kong takes steps to become a crypto and Web3 hub, investors should keep a close eye on the evolving regulatory landscape and the potential impact on the crypto space. It makes sense to monitor the list of approved tokens when it becomes public and the level of support from mainland China. If the latter starts loosening its crypto ban, the market will likely explode.

Bitcoin (BTC) and Ethereum (ETH) are expected to be the major beneficiaries, but emerging Web3 services deserve attention as well.

Over 50,000 crypto investors get our Bitcoin Market Journal newsletter. Click to subscribe and join the tribe.

Source: https://www.bitcoinmarketjournal.com/hong-kong-as-a-crypto-hub/