- Markets are betting that the RBA’s 10-month tightening campaign is largely done.

- The Federal Reserve raised rates for the ninth time in a row.

- A decrease in US unemployment claims indicated the tight labor market.

The AUD/USD weekly forecast is slightly bearish as markets are not expecting another rate hike from the RBA.

Ups and downs of AUD/USD

On Monday, Assistant Governor of the Reserve Bank of Australia (RBA), Christopher Kent, stated that financial conditions would be one of several variables taken into consideration by the Board at its next policy meeting in April.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Markets are betting, however, that the RBA’s 10-month tightening campaign is largely done due to the stresses in the global banking industry. This contributed to the pair’s bearish close to the week.

The Federal Reserve raised rates on Wednesday for the ninth time in a row, this time by a quarter of a percentage point.

As they gathered this week to debate policy, Federal Reserve officials said on Friday that there was little evidence that financial stress was worsening. This enabled them to keep trying to lower inflation by raising interest rates.

On the statistical front, a decrease in US unemployment claims was another indication of the tight labor market. While core durable goods orders decreased, the housing sector’s data were generally positive.

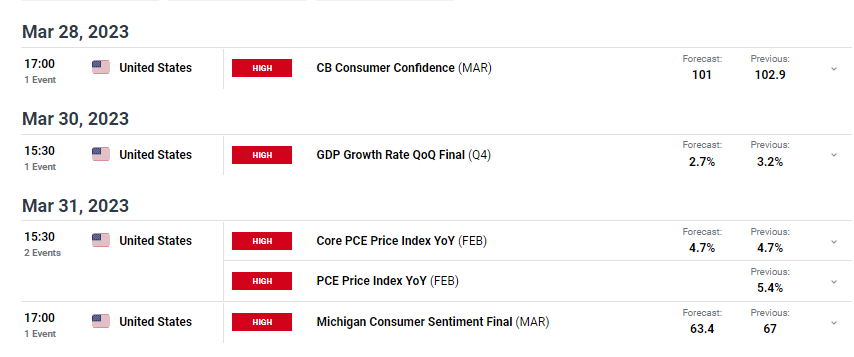

Next week’s key events for AUD/USD

Inflation data from the US next week will likely influence the Fed’s next policy move. Investors will also pay attention to the GDP report expected to show slower growth in US economic activity in Q4.

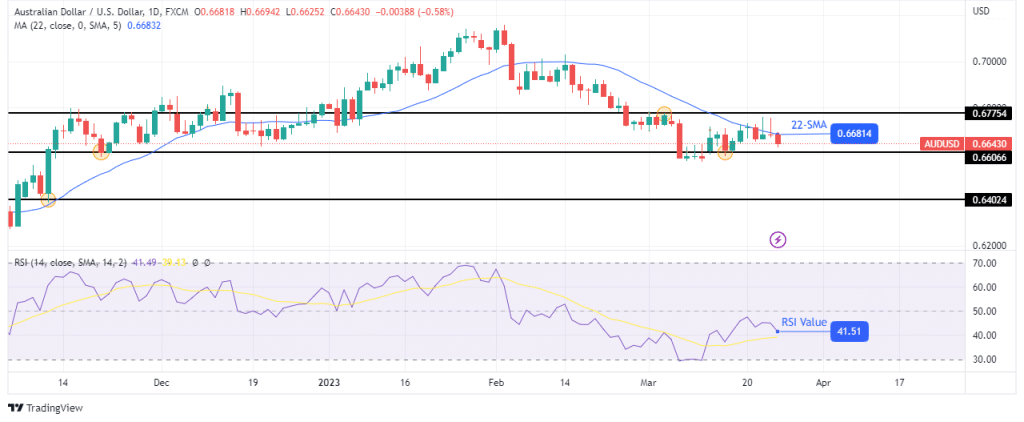

AUD/USD weekly technical forecast: Price respecting the 22-SMA resistance

The daily chart shows AUD/USD in a downtrend, with the price trading below the 22-SMA and the RSI below 50. The bearish move found support at the 0.6606 level, where bulls returned for a retracement.

–Are you interested in learning more about forex robots? Check our detailed guide-

The price pulled back to retest the 22-SMA and found strong resistance. This is yet another sign that the bearish trend is strong. The price is bouncing lower from the SMA and will likely take out the 0.6606 support in the coming week.

A break below this support would see the price fall to the next support at 0.6402. However, if the price breaks above the 22-SMA in the coming week, we could see a shift in sentiment that would likely lead to a break above the 0.6775 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Source: https://www.forexcrunch.com/aud-usd-weekly-forecast-rbas-tightening-cycle-to-end/