- China’s GDP expanded by 4.5% yearly in Q1.

- China’s retail sales growth exceeded forecasts and nearly reached a two-year high.

- Australia’s central bank is prepared to tighten further if inflation and demand do not decline.

Today’s AUD/USD outlook is bullish. Aussie rose on Tuesday as China’s economy showed signs of a faster-than-expected rebound from the harsh pandemic lockdowns that caused a significant slowdown last year.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

For the first quarter, China’s GDP expanded by 4.5% yearly, exceeding most economists’ forecasts.

Following the release of the GDP figures, the currency of Australia, whose exports are dependent on Chinese demand, surged higher.

Separate information on March activity was also issued on Tuesday. It revealed that retail sales growth exceeded forecasts and nearly reached a two-year high, while factory output growth accelerated.

After failing to meet its goal for 2022, the Chinese government has set a 5% growth target for this year.

The Reserve Bank of Australia’s April meeting minutes revealed that Australia’s central bank was prepared to tighten further if inflation and demand did not decline. However, it ultimately decided against raising rates.

The Empire State Survey was among two significant business surveys from the United States released on Monday. The surveys revealed that business conditions and confidence remained strong despite the banking sector crisis and tighter monetary policy conditions.

Strong US economic data boosted the chances that the Federal Reserve will lift interest rates again in May. However, the dollar weakened on Tuesday after rising overnight.

According to the CME FedWatch tool, markets are pricing in a 91% chance that the Fed will increase interest rates by 25bps at its next meeting in May.

AUD/USD key events today

A report on building permits from the US will show the state of the housing sector and, by extension, the economy.

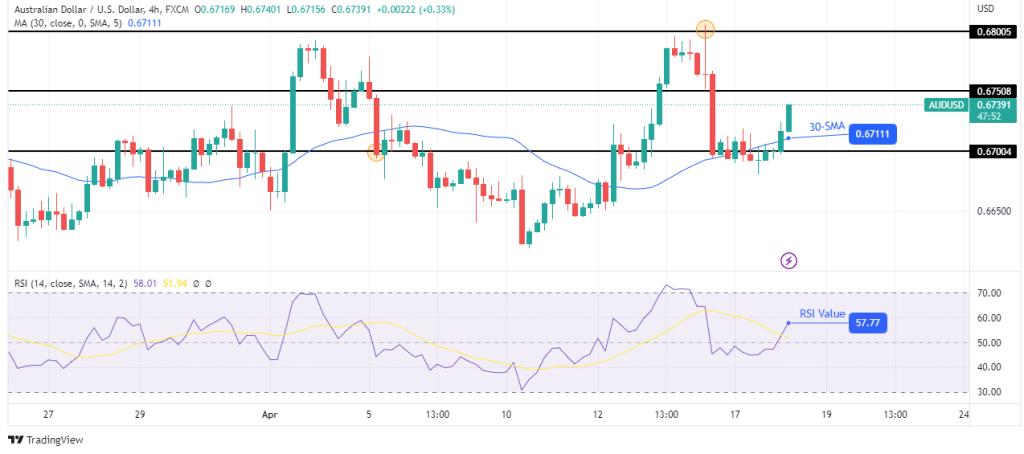

AUD/USD technical outlook: Supported by 0.6700 level

AUD/USD is bouncing higher after respecting support from the 30-SMA and the 0.6700 level. The RSI has also gone above 50, a sign that bulls are in control. With this bullish bias, the price will soon retest the next resistance level at 0.6750.

–Are you interested to learn more about South African forex brokers? Check our detailed guide-

The bullish bias will get stronger if the price can take out the 0.6750 and 0.6800 resistance levels to make a higher high. However, if it fails to go above these resistance levels, we might get into an area of consolidation.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source: https://www.forexcrunch.com/aud-usd-outlook-aussie-gains-on-the-back-of-chinese-data/